Stock Market Today: Rate Fears Send Tech Tumbling

Treasury Secretary Janet Yellen put a little fear of future Fed rate hikes into investors, sparking an exodus Tuesday in the FAANGs and other tech names.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The stock market flinched on Tuesday, spooked by comments from Treasury Secretary Janet Yellen, but the damage was uneven. The "rotation trade" out of growth continued to unwind, hurting shares of large technology stocks, while a number of healthcare names and telecoms held up well.

In taped remarks to The Atlantic aired today, Yellen said that "it may be that interest rates will have to rise somewhat to make sure that our economy doesn't overheat" – a statement that runs counter to the Federal Reserve's message that rate hikes are a long way away.

But you might also blame valuations that made the market ripe for profit-taking at the first sign of trouble.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"According to data from Bloomberg Analytics, the S&P 500 is trading at a higher multiple than at any other time in history, including the 1982-2000 secular bull cycle," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. "Historical data shows the trailing-12 month P/E ratio currently trading just under 31, after hitting a recent high of 32.38 in March this year."

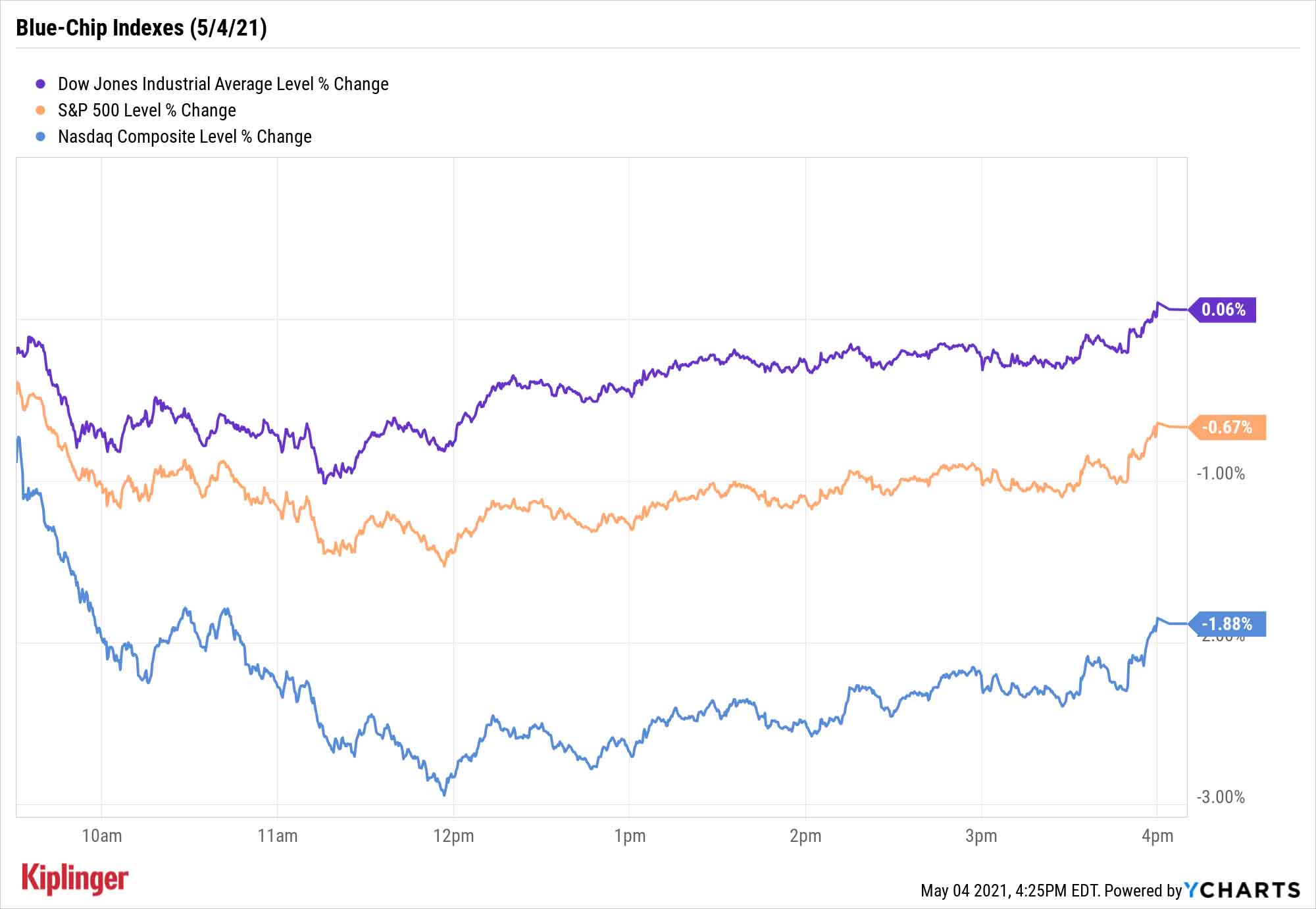

The deepest cuts to lofty valuations were found in the Nasdaq Composite (-1.9% to 13,633) and its many tech and tech-esque stocks. The "FAANGs" – Facebook (FB, -1.3%), Apple (AAPL, -3.5%), Amazon.com (AMZN, -2.2%), Netflix (NFLX, -1.2%) and Google parent Alphabet (GOOGL, -1.6%) – were all solidly lower, which also weighed on the S&P 500, down 0.7% to 4,164.

The Dow Jones Industrial Average, however, managed to escape with a marginal gain to 34,133, bolstered by Dow (DOW, +2.6%) and Caterpillar (CAT, +2.3%).

Other action in the stock market today:

- CVS Health (CVS, +4.3%) had a solid session after the pharmacy chain reported stronger-than-expected earnings and revenue in its first quarter, with COVID-19 vaccinations and testing boosting its top line. CVS also raised its full-year profit guidance.

- Alcoa (AA) spinoff Arconic (ARNC, +19.2%) was also a post-earnings winner. The company recorded first-quarter profit and revenue above what analysts were projecting, thanks to higher aluminum prices. Arconic also upped its 2021 revenue forecast and authorized a $300 million share repurchase program.

- The small-cap Russell 2000 declined by 1.3% to 2,248.

- U.S. crude oil futures gained 1.9% to end at $65.69 per barrel.

- Gold futures slipped 0.9% to settle at $1,776.00 an ounce.

- The CBOE Volatility Index (VIX) popped 6.4% to 19.48.

- Bitcoin prices sank 5.0% to $54,643.66. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Stay Cool as Ice With Cash

How can investors go about protecting themselves from yet another potential bout of volatility?

Fund providers always seem to have a trick or two up their sleeves – and one such trick you might want to check out are "buffeted" ETFs, which are designed to absorb stock market losses – though at the cost of capping some gains.

If you prefer to simply buy and hold your way through most market noise, you know that the key to tamping down turbulence is a steady stream of income. How much income is another story altogether, and one that comes down to your own personal risk tolerance and needs … but regardless of what that number is, we can show you how to get it.

We've recently outlined 35 ways to earn yields of up 10%, and it spans the spectrum – from short-term cash investments to bonds to stocks to high-yield classes. Check out the full list, which can help determine what's best for you.

Kyle Woodley was long AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.