Buffered ETFs Can Limit Your Losses

The catch: You'll give up some gains in return.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

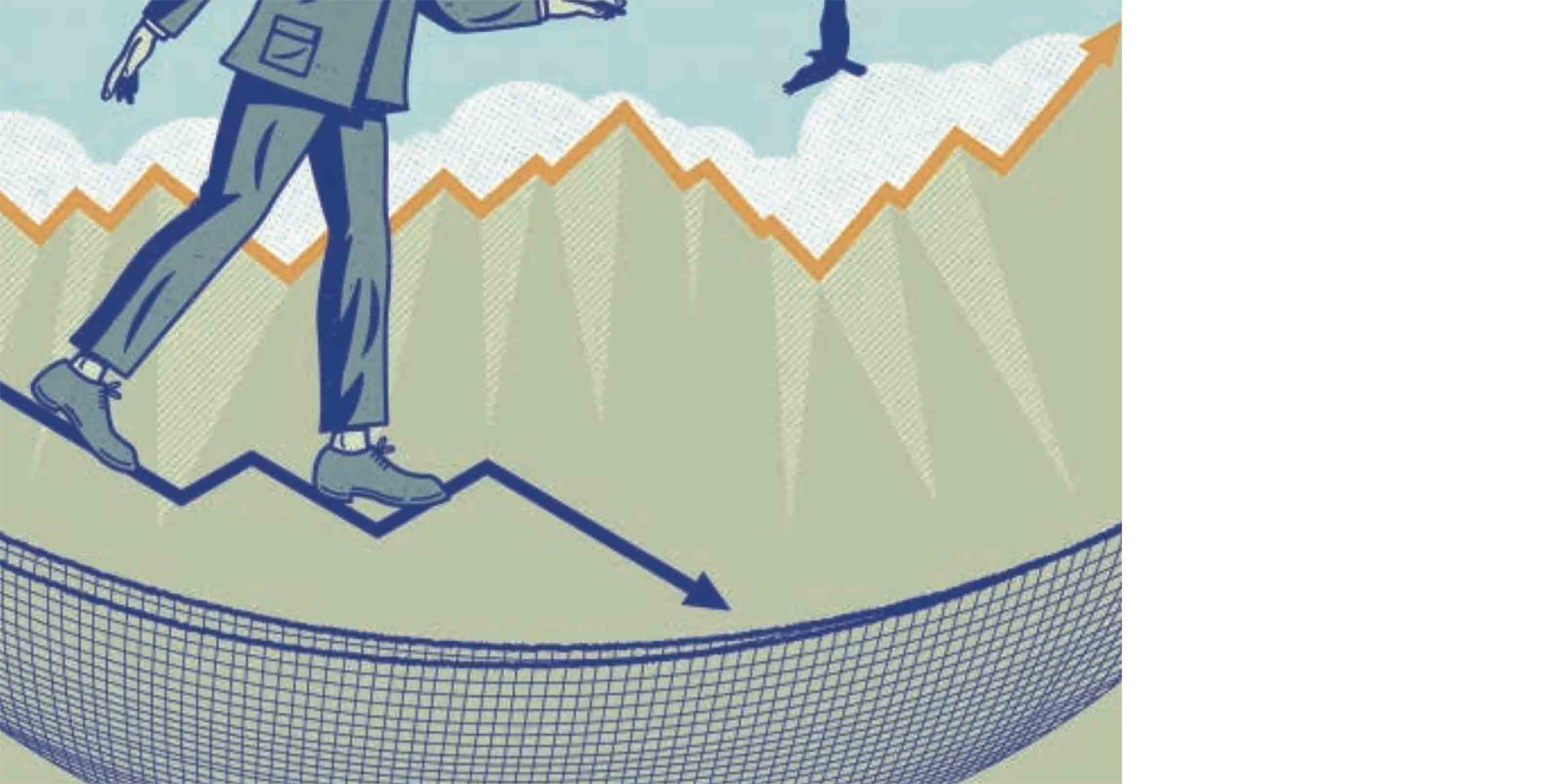

Investing in stocks can seem like walking a tightrope without a safety net. A new breed of exchange-traded funds aims to change that. These funds, called buffered or defined-outcome ETFs, absorb a portion of stock market losses in exchange for capping some of the gains.

"This is a solution for investors who want to protect on the downside," says Ryan Issakainen, head of ETF products at First Trust Advisers.

Other investments, such as low-volatility stock funds, also promise to cushion against market gyrations. But buffered ETFs, by investing in one-year options linked to a broad benchmark, differ in that they set exactly how much in losses – 9%, 10%, 15%, 20% or 30% before fees, depending on the fund – shareholders are protected from over a 12-month period.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How much you give up in returns depends in part on the amount of protection the fund offers. The greater the cushion, the smaller the potential gain. "These strategies provide risk mitigation first," says Johan Grahn, head of ETF products at Allianz Investment Management. "They are not built to hit home runs."

The first buffered ETFs launched in August 2018. Since then, another 70-odd defined-outcome funds have opened. Innovator and First Trust are the largest providers; AllianzIM and TrueShares entered the market in 2020. Because the funds rely on one-year options, the names of buffered ETFs include a month of the year, signaling the start of the 12-month period.

How Buffered ETFs Work

Most buffered ETFs are linked to the S&P 500 Index. Innovator S&P 500 Buffer ETF February (BFEB), for example, tracks the SPDR S&P 500 ETF Trust (SPY). Investors who bought shares in BFEB at the start of February 2021 have a 9% buffer against losses.

That means SPY can drop by up to 9% over the 12-month period from February 1, 2021, to January 31, 2022, and shareholders will lose nothing. But losses beyond the 9% buffer are not shielded. So if SPY declines, say, 15% over the 12-month period, BFEB shareholders (who bought in early February) will suffer a 6% loss.

On the flip side, BFEB’s potential return tops out at 18%, before fees, over the 12-month period. Any gains beyond that are forfeited. At the end of the one-year period, the fund resets by buying new options, which will define the parameters over the next 12-month period.

Buffered ETFs, all actively managed, carry an expense ratio of roughly 0.80%; the most common buffer is about 10%. Innovator and First Trust have funds that offer bigger cushions that work a little differently. You absorb the first 5% drop, and the fund absorbs up to the next 30 percentage points in losses. Allianz offers a series of funds with a 20% cushion.

TrueShares' funds differ on the upside. Instead of accepting a percentage-point limit on potential returns, investors in TrueShares defined-outcome ETFs can expect to reap roughly 83% of the S&P 500's price returns over any given 12-month period. That's a plus, because gains could be less curtailed relative to other buffered ETFs as long as the S&P 500 keeps rising.

Buy shares in a defined-outcome ETF within a week of the start of its 12-month stretch to take advantage of the fund's full downside buffer. In late May or early June, for example, buy a June-dated ETF. And plan to hold the ETF for at least the full year. For investors who don't buy at the start of the period, note that the buffer and cap shift a bit depending on the fund’s net asset value each day.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.