Stock Market Today: Dow Bounces Back as Earnings Beats Roll On

Everything from the blue-chip Dow to the small-cap Russell 2000 both benefited from a broad recovery day as Q1 earnings continued to impress.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wednesday maintained the same light-news, heavy-earnings pace of the past couple of days, but with a much better result that saw the major indexes close in the black.

Netflix (NFLX) was the primary focus of today's earnings slate. Its stock tanked by 7.4% after it reported disappointing subscriber growth in Q1 and predicted much of the same for Q2.

However, Michael Reinking, NYSE senior market strategist (and, get this, celebrant of National Big Word Day today), points out that "earnings remain the cynosure of investors, and, while there has been a disproportionable amount of coverage of the Netflix subs disappointment, earnings have been quite strong over the past few days."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Indeed, Verizon (VZ, -0.4%), Halliburton (HAL, -3.6%) and Edwards Lifesciences (EW, +6.3%) were among a few dozen companies to announce Street-beating earnings over the past 24 hours alone.

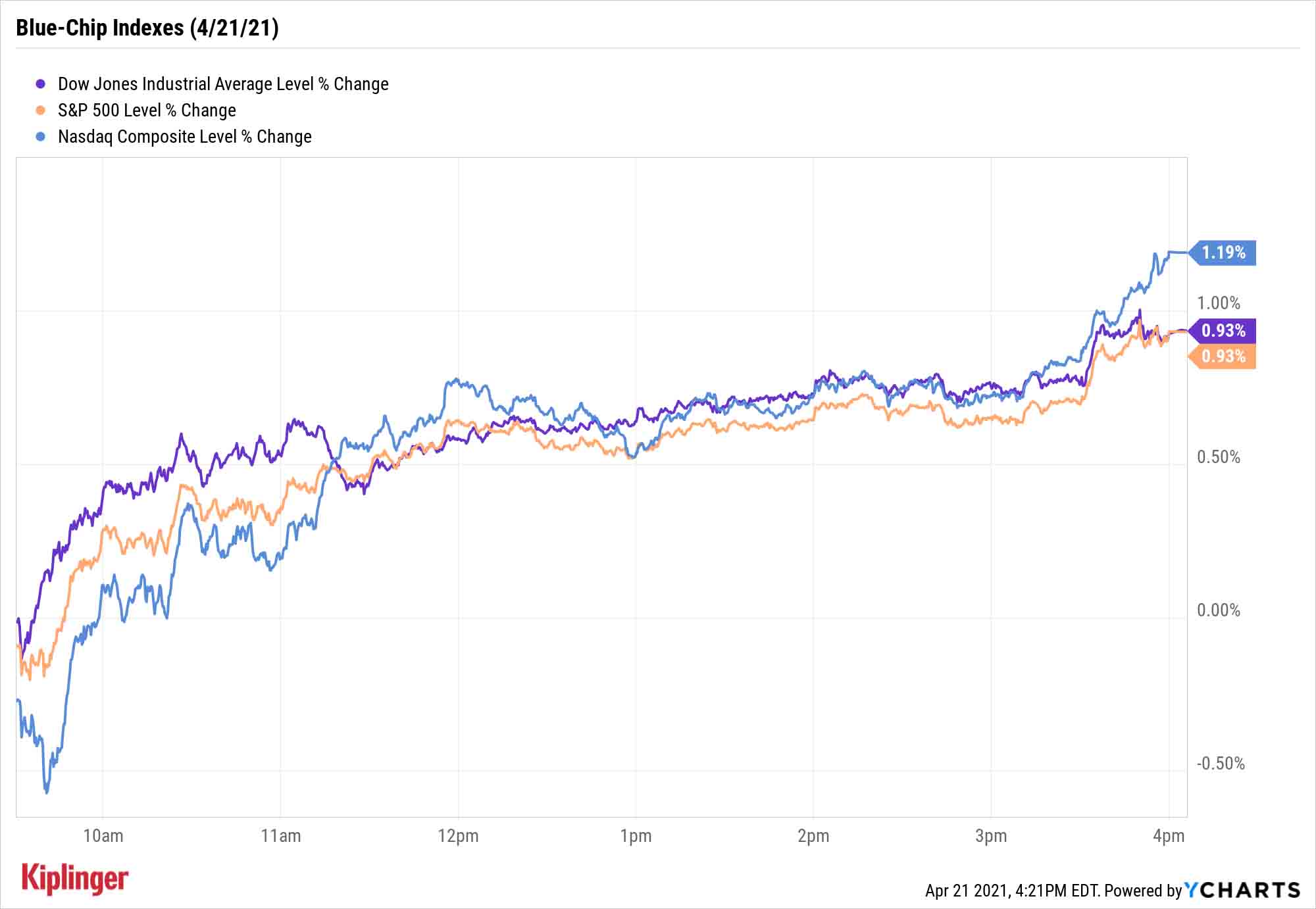

Investor reactions to each of those reports varied widely, but the direction of the broader markets was unanimously up: The Dow Jones Industrial Average gained 0.9% to 34,137, the S&P 500 finished 0.9% higher to 4,173, the Nasdaq Composite closed up 1.2% to 13,950 and the small-cap Russell 2000 jumped 2.4% to 2,239.

"After the defensive posturing we’ve seen in the market over the last week, some of that is reversing today," Reinking adds.

Other action in the stock market today:

- Cruise line stocks were sharply higher on Wednesday, including gains from Carnival (CCL, +X%) and Royal Caribbean (RCL, +X%). But leading the way was Norwegian Cruise Line Holdings (NCLH, +X%) after Goldman Sachs analyst Stephen Grambling upgraded it to Buy. "The bottom-line is NCLH is poised to see fundamentals inflect once sailings resume," he writes, "with pent-up leisure demand driving a recovery in net yields beyond pre-pandemic levels at the same time that net cruise costs ex-fuel will be slower to bounce back."

- U.S. crude oil futures slumped 2.1% to $61.35 per barrel.

- Gold futures improved by 0.8% to $1,793.10 per ounce.

- The CBOE Volatility Index (VIX) retreated by 8.1% to 17.16.

- Bitcoin prices declined 1.8% to $55.615. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

ESG Investments for Earth Day

Tomorrow marks the nation's 51st celebration of Earth Day, and never before has the concept behind it been so important to investors.

Environmental stewardship has become a crucial value to a swelling number of investors – it goes beyond buying shares of companies directly in the business of doing better by the environment, but ensuring that firms of all types are contributing where they can.

That's just part of a wider trend favoring investments based on ESG (environmental, social and corporate governance) factors. And it's more than merely a feel-good strategy; many good ESG practices go hand in hand with stronger operations.

If you want to harness these factors but don't feel like doing heavy research across hundreds of stocks, funds that select their holdings based on these criteria are abundant – we've recently explored a number of ESG ETFs that fit the bill, and this wider list of values-based funds includes picks for ETF and mutual fund investors alike.

That said, some people are most comfortable with individual companies they've come to learn and understand, like the ubiquitous blue chips of the Dow 30 – and you'll be glad to know that several of them are solid ESG citizens. According to index and analytics specialist MSCI, 10 Dow stocks are considered leaders in environmental, social and governance practices, and most of them also pass muster with Wall Street's top analysts. Check them out.

Kyle Woodley was long NCLH as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.

-

Stocks Slip to Start Fed Week: Stock Market Today

Stocks Slip to Start Fed Week: Stock Market TodayWhile a rate cut is widely expected this week, uncertainty is building around the Fed's future plans for monetary policy.