Stock Market Today: Dow Clears 34K, Nasdaq Tops 14K as Recovery Accelerates

A steep decline in unemployment claims and better-than-expected retail sales provided fresh evidence of an economic recovery and triggered a broad rally Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you're a fan of big, round numbers, you probably enjoyed Thursday's market activity, which saw the major stock indexes flirt with a pair of them amidst a wide, robust rally.

Fueling today's fire? For one, the lowest reading for initial unemployment claims so far in the COVID recovery: 576,000 for the week ended April 10, a sharp decline of 193,000 from the week before.

"The drop in initial claims hints that job separation rates are starting to normalize as the economy picks up steam, after having remained elevated throughout the recovery," says Jonathan Millar, deputy chief U.S. economist at Barclays Investment Bank. "Sustained progress on this front would be a very positive development for the labor market recovery, which has lagged well behind the recovery in activity."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also inspiring optimism was a massive 9.8% month-over-month leap in March retail sales that easily cleared consensus views for a 5.8% improvement.

"There is plenty of pent-up demand in the economy, as Thursday's retail sales report showed," says Vanessa Martinez, managing director and partner for wealth management firm The Lerner Group. "Consumer savings rates have surged over the past year, and we expect consumer spending to remain elevated for the remainder of 2021, which should bode very well for 2021 GDP figures."

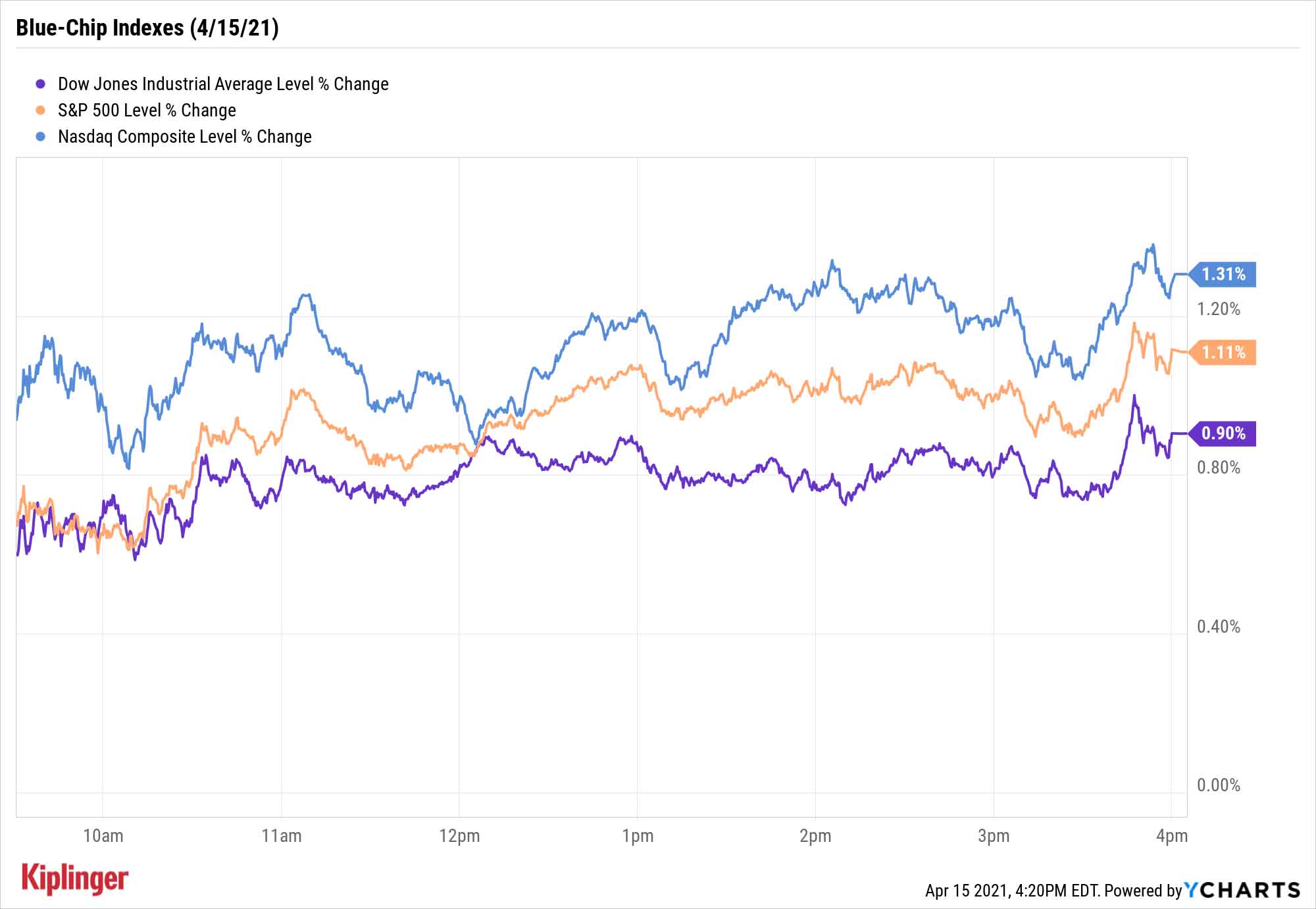

Earnings reports added to the exuberance, too. UnitedHealth Group (UNH, +3.8%) reported a nearly 43% year-over-year pop in profits to $5.31 per share that easily hurdled analysts' expectations. That helped spark a strong day in the healthcare sector (+1.7%), and pushed the Dow Jones Industrial Average past the 34,000 mark, an 0.9% gain to a record 34,035.

Semiconductor stocks such as Nvidia (NVDA, +5.6%) and Advanced Micro Devices (AMD, +5.7%) powered the Nasdaq Composite (+1.3% to 14,038) through the 14,000 level. And the S&P 500 climbed 1.1% to a record close of 4,170.

Other action in the stock market today:

- The Russell 2000 rose 0.4% to close at 2,257.

- U.S. crude oil futures improved by 0.5% to $63.46 per barrel.

- Gold futures punched 1.8% higher to $1,766.80 per ounce.

- The CBOE Volatility Index (VIX) declined 2.9% to settle at 16.50.

- Bitcoin prices rebounded 2.4% to $63,489. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Dow 34K: Just the Beginning?

Thursday had a celebratory feel to it, but investors shouldn't blow through all of their confetti. Several analysts who weighed in on the Dow's ascent to 34K believe there's more to come.

"The Dow's push through 34,000 is a signal that investor appetite for future growth prospects is spilling over into more value-oriented names," says Peter Essele, head of portfolio management for Commonwealth Financial Network. "The demand for industrials and more cyclically oriented areas should continue as the vaccines take hold and earnings potentially come in higher than originally expected."

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, adds that "a re-opening economy, with better weather and decreasing consumer caution, will drive markets higher this year, with double-digit returns possible in 2021."

Those are certainly encouraging remarks for holders of any of the Dow's 30 stocks, not to mention the numerous other stocks counting on the recovery to continue reversing their fortunes.

They also bode well for many of the cyclical names found among the potential beneficiaries of President Joe Biden's recently unveiled "American Jobs Plan." Generally speaking, a brisk economic expansion would light a fire under many of these stocks – and they could really heat up if Biden's plan manages to gain traction in the months ahead. Check out these 15 infrastructure plays that could get a boost from the American Jobs Plan.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.