Stock Market Today: Jobs Jubilee Drives Fresh Highs in Dow, S&P 500

The new week kicked off with a gleeful reaction to the March jobs report that sent the major indexes flying higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street had a full three days to digest the March jobs report, and it's clear investors liked what they saw.

The Labor Department reported Friday, a stock-market holiday, that the U.S. added 916,000 jobs last month – a massive beat of economists' expectations for 647,000 additions. It also was a significant jump from February's 468,000 new jobs – a number that itself was revised upward by nearly 100,000.

The report "emphasizes the strong recovery that is beginning to take shape in the service sector of the economy," says Charlie Ripley, senior investment strategist for Allianz Investment Management. "With 280k jobs in the leisure and hospitality sector added, it is a clear signal that pockets of the economy that have been hit by pandemic restrictions are starting to come back to life."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Further bolstering that case was the Institute for Supply Management's March service reading, which rose to 63.7 from 55.3 in February, shattering expectations for a 59.0 reading.

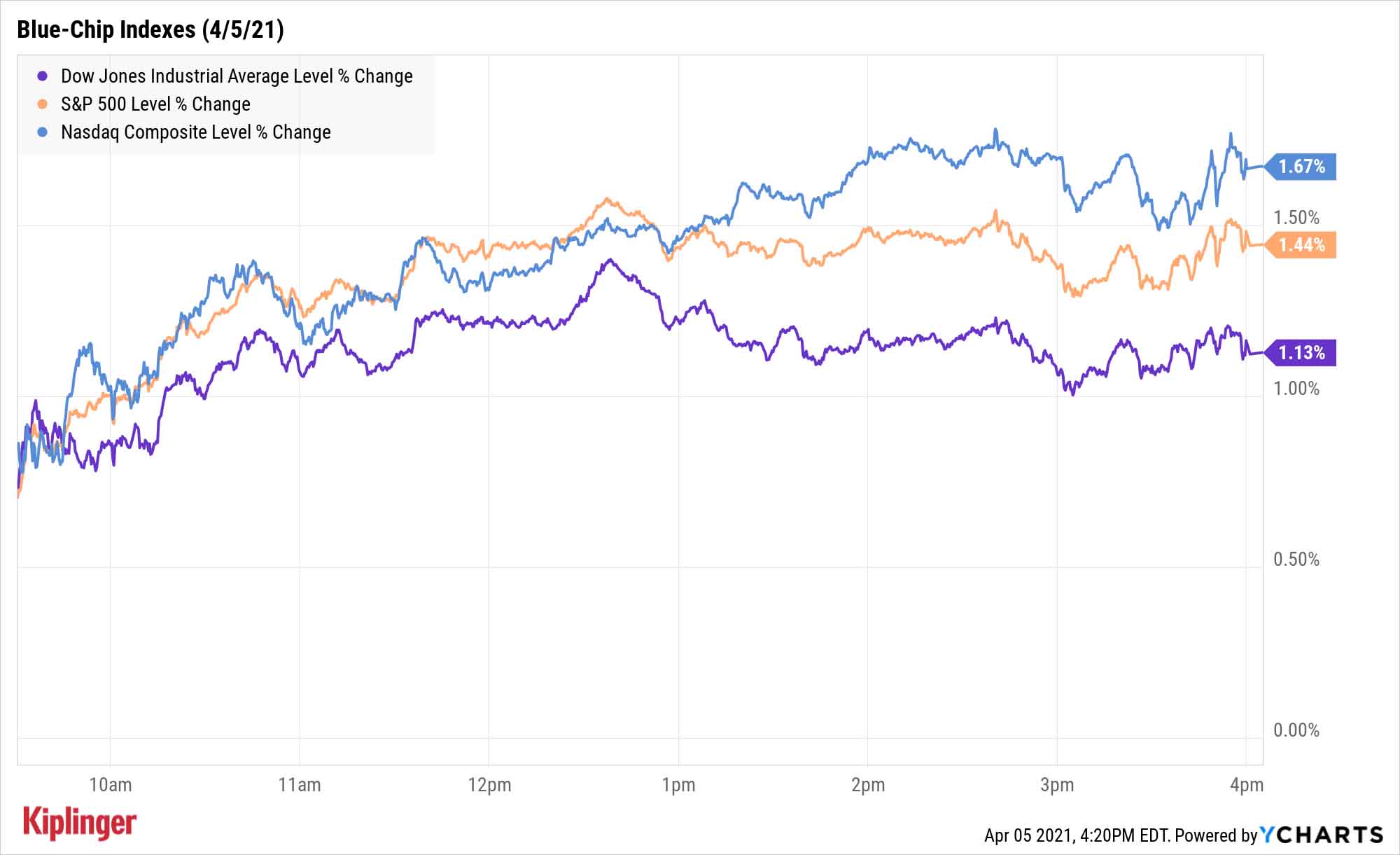

The Dow Jones Industrial Average (+1.1%) hit a record high of 33,527, led by gains in Walgreens (WBA, +3.7%), Intel (INTC, +3.1%) and Walmart (WMT, +2.8%). The S&P 500 also recorded a new high-water mark, up 1.4% to 4,077.

Other action in the stock market today:

- The small-cap Russell 2000 improved by 0.5% to 2,264.

- Global COVID outbreaks and an OPEC+ vote to increase production sent U.S. crude oil futures 4.5% lower to $58.69 per barrel.

- Gold futures were marginally higher to $1,728.80 per ounce.

- Bitcoin prices finished 0.2% higher on Monday to reach $59,006. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

FAANGs Start to Look Sharper, Too

The Nasdaq Composite remains a few hundred points shy of its February highs, but it still had itself a day, climbing 1.7% to 13,705.

The tech-heavy index was propelled in part by Tesla (TSLA), which jumped 4.4% along with several other electric vehicle stocks Monday. Wedbush technology analyst Dan Ives upgraded Tesla to "Outperform" and raised his price target to $1,000 amid several drivers, including EV-friendly initiatives in President Joe Biden's $2.3 trillion infrastructure plan.

Also heading higher were all of the "FAANGs," best among them Google parent Alphabet (GOOGL, +4.2%) and Facebook (FB, +3.4%) – welcome news for the group of mega-cap tech and tech-adjacent stocks that easily outstripped the major indices in 2020 but have collectively simmered this year, underperforming the S&P 500 on average.

Most of the analyst community remains bullish on the group, though each of these large companies has a more difficult row to hoe in 2021. Should you buy the FAANGs now? Consider the challenges faced by each of these five widely held stocks in the months ahead – and what, if anything, they're doing to fight back.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.