Stock Market Today: Dow Climbs Again, Nasdaq Yo-Yo Continues

Wall Street closed out the week with a renewed surge in Treasury yields, which weighed on growth but helped the value-oriented Dow rise again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The week ended just as it started for investors, with the "reflation trade" lifting the likes of financial stocks and industrials while growthier sectors such as technology and communications lagged.

Inflation worries firmly gripped the wheel once again, with the 10-year Treasury yield crossing 1.6% again following the finalization of the Biden administration's $1.9 trillion stimulus package, which will see $1,400 stimulus payments sent out in days.

But the threat of economic overheating isn't just about stimulus checks, or even the reopening of the economy on its own – it's about a "massive surge in excess savings and liquid assets" being spent when the economy reopens, says Ethan Harris, head of global economics research at BofA Global Research.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"We expect the glut of excess savings to help support exceptional growth this year in addition to the tailwinds from fiscal stimulus and an improving virus picture," he says.

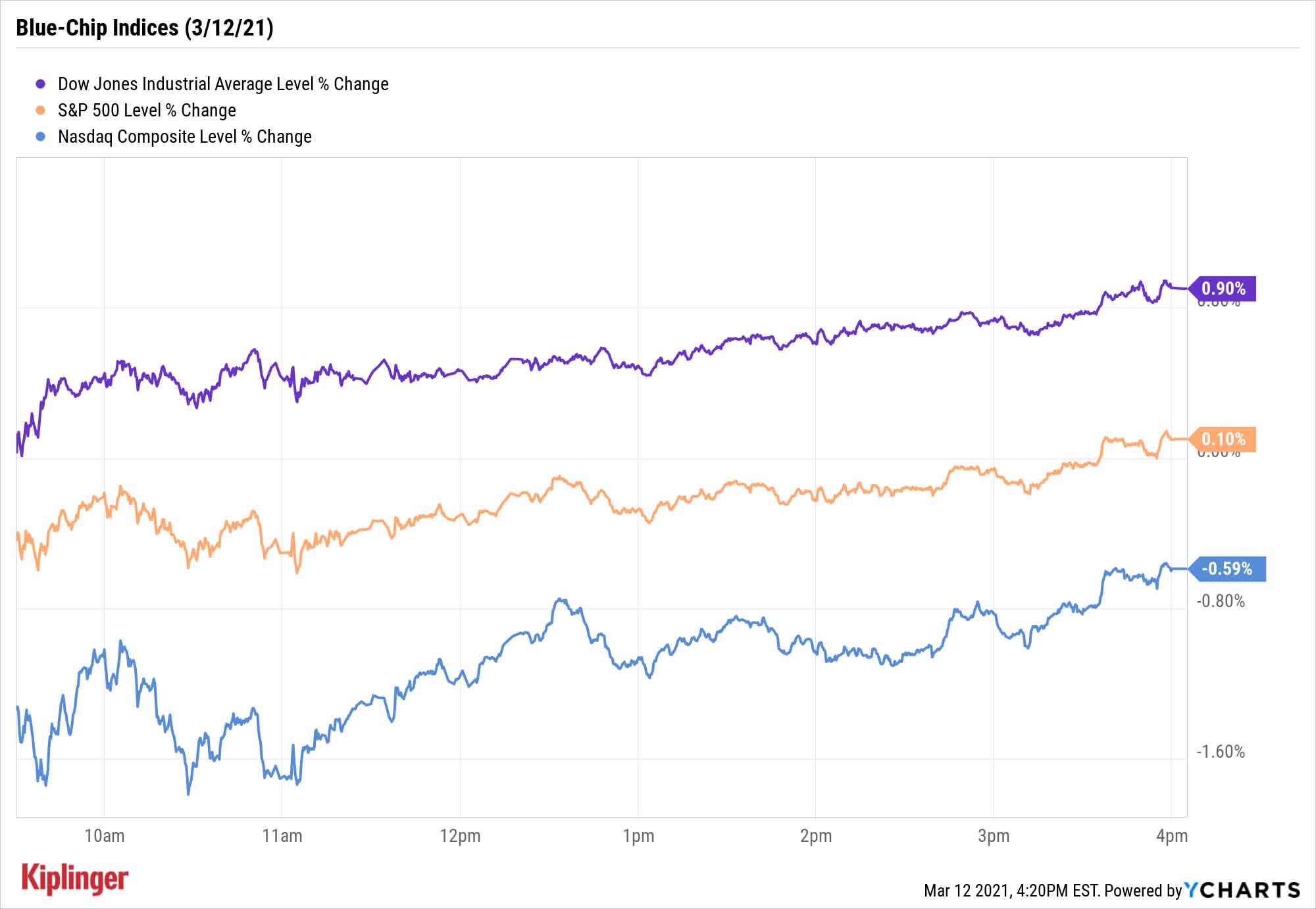

Boeing (BA, +6.8%), which confirmed a deal to produce 24 737 Max aircraft (with an option for 60 more) for private investment firm 777 Partners, led the Dow Jones Industrial Average 0.9% higher to a record 32,778. The S&P 500 also eked out a modest 0.1% gain to a new high of 3,943. The tech-heavy Nasdaq Composite declined 0.6% to 13,319, weighed down by Alphabet (GOOGL, -2.4%) and Facebook (FB, -2.0%), among others.

Other action in the stock market today:

- The Russell 2000 gained 0.6% to 2,352.

- U.S. crude oil futures declined 0.6% to $65.61 per barrel.

- Gold futures finished with a small 0.2% loss to $1,719 per ounce.

- Bitcoin prices broke a winning streak with a 1.3% decline to $56,764. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Invest in the Recovery

The Dow continues to flip the script from 2020, when it significantly lagged its major-index peers. The industrial average closed Friday up 7.1% for the year, versus 5.0% for the S&P 500 and 3.3% for the Nasdaq.

"Many of the Dow's top performers this year have been financial and industrial stocks – two 'reopening sectors' that could continue to benefit from the pandemic's end," says Lindsey Bell, chief investment strategist for Ally Invest. "When stocks break rank from the rest of the market, we pay attention.

"The Dow should be getting its day in the sun as the COVID market recovery reaches cyclical and value stocks. That's a good sign for where the economy and markets are heading."

But while you indeed can find many great plays for the current market environment within the Dow's 30 components, that's not the only place to dig them up.

We recently searched the much broader Russell 1000 in search of "recovery plays" – stocks that could enjoy a one-two punch of additional spending in the months to come, as well as additional interest from investors who have said they plan on putting some of their stimulus money back into the stock market.

We narrowed our list down to 11 such recovery stocks that still have ample upside and plenty of bullish pros willing to vouch for them.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.