Stock Market Today: Tech Roller Coaster Leaves Investors Thrilled

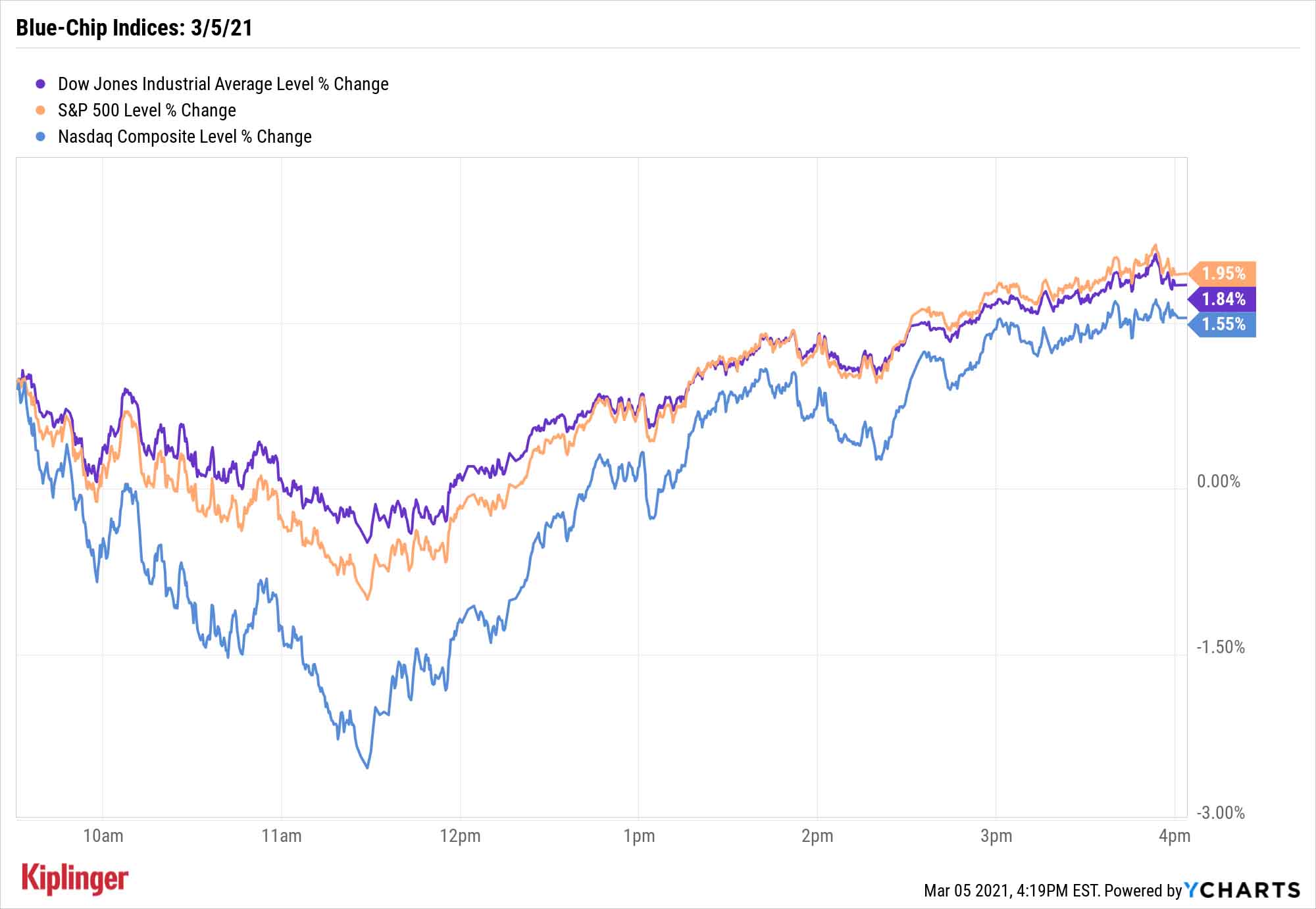

Stocks, especially tech, appeared poised for yet another bloodletting on Friday despite a stellar February jobs report. Then came the turn.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

My oh my, what a head fake that was.

What was shaping up to be another potential setback for the technology sector and the rest of the stock market today turned into a roaring rebound into the weekend.

On Friday, the Labor Department reported that February nonfarm payrolls improved by 379,000 – robustly better than estimates for 200,000 jobs – and that unemployment had ticked lower, from 6.3% to 6.2%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The much better-than-expected payroll report continues the narrative that the economy is in recovery, and a resurgence in the services side of the economy is helping to drive it," Gene Goldman, chief investment officer at Cetera Investment Management, said earlier in the day. "Also, in a reversal to recent market dynamics, good news is good news as equity markets are poised to rally today."

It didn't seem like it at first, though.

The Nasdaq Composite declined by as much as 2.6% before midday, with the other major indices also spilling red ink. An afternoon recovery, led by the likes of Microsoft (MSFT, +2.2%) and Alphabet (GOOGL, +3.1%), flipped the tech-heavy index 1.6% in the green to 12,920.

The Dow Jones Industrial Average closed 1.9% higher to 31,496, led by Intel (INTC, +4.1%) and UnitedHealth Group (UNH, +3.9%).

Other action in the stock market today:

- The S&P 500 charged ahead by 2.0% to 3,841.

- The small-cap Russell 2000 improved by 2.1% to 2,192.

- U.S. crude oil futures popped yet again, by 3.5% to $66.09 per barrel – their highest prices since 2019.

- Gold futures slipped below the $1,700 mark, declining 0.1% to $1,698.50 per ounce.

- Bitcoin prices, like the rest of the market, took a dive but finished up, improving 1.7% to $49,169. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Achieve a Smoother Ride

It's unlikely to be the end of recent volatility, but it's a glorious way to end a difficult week.

Given that the market has been largely living and dying by the direction of interest rates, "markets will be very tuned into the next FOMC meeting on March 17, and Chair Powell, for any guidance over the evolution of FOMC communications," says Rick Rieder, BlackRock's chief investment officer of Global Fixed Income. "They have said that they will communicate well in advance before shifting policy toward tapering and then ultimately raising rates, and we expect further clarification to emerge in the coming months."

"We would expect more clarification on the path of policy from the Fed in the coming weeks and months. Until then, though, expect more volatility, since markets hate uncertainty, as amply displayed over the past week."

But not everyone has been sweating the past week: Investors who know they're getting an ample portion of their returns from regular dividend payments can watch stocks zig and zag with a little less stress.

We often share sources of substantial income, whether it's these 21 "retirement-ready" picks or these 11 monthly dividend payers, most of whom offer both high and frequent payouts. But you should also be aware of the wide variety of income strategies you can execute with exchange-traded funds (ETFs).

This list of 10 high-yield ETFs, paying out between 3.5% and 10.2%, tackles not just a wide variety of asset classes, but also several flavor-of-the-day sectors including financials and energy. Take a look!

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.