Stock Market Today: Tech Gets Respite From Recent Selling

Treasury yields cooled off Friday, and so did the Dow and S&P 500, while the recently maligned Nasdaq and several of its tech components enjoyed a modest rebound.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wall Street flipped the week's script on Friday, with a cooling-off in interest rates stunting value-oriented stocks while providing much-needed relief for "growthier" names.

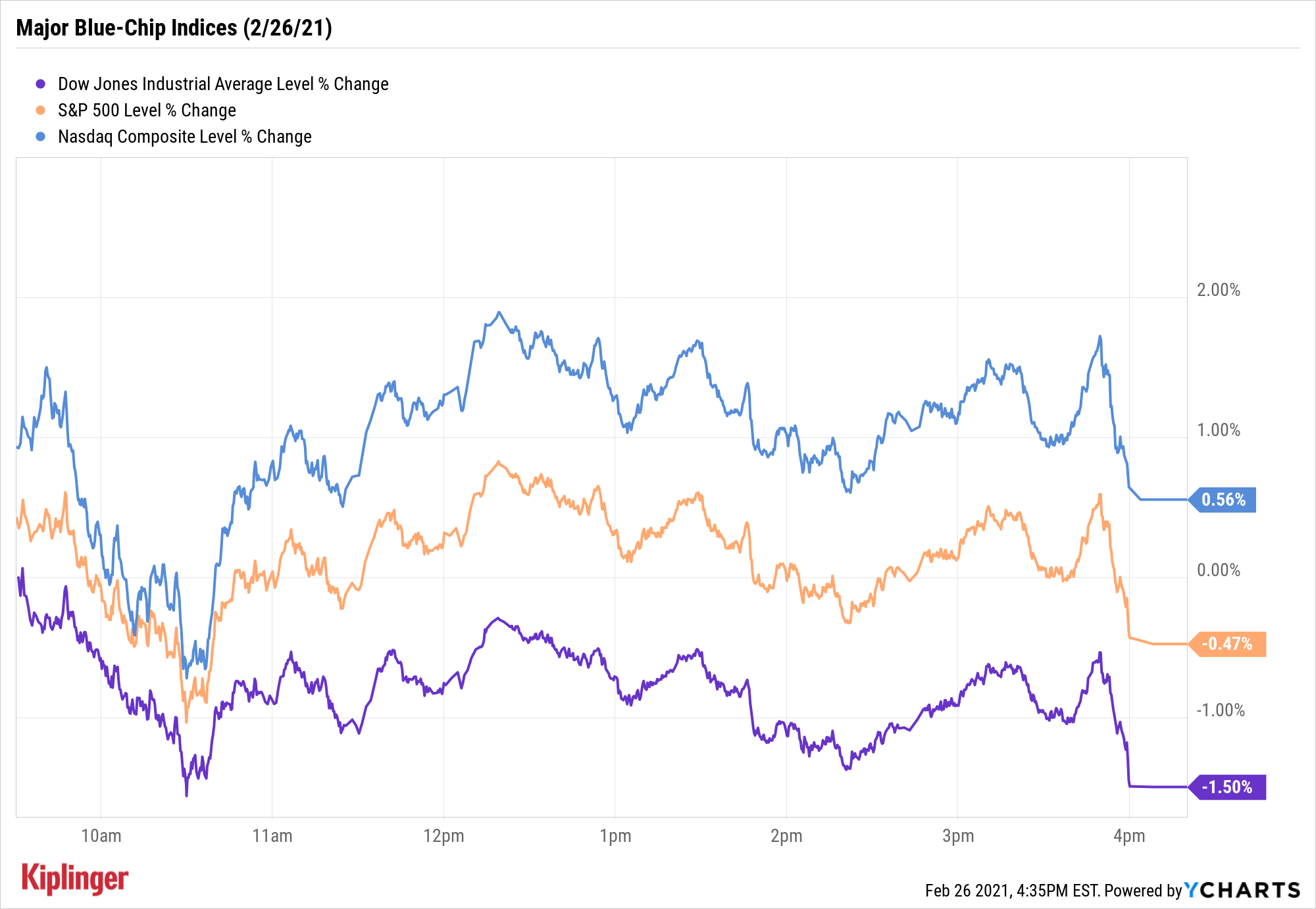

The Dow Jones Industrial Average lagged the broader indices with a 1.5% decline to 30,932, while the S&P 500 declined 0.5% to 3,811. The Nasdaq Composite, meanwhile, got a lift from the recently sold-off technology and communications sectors; stocks such as Facebook (FB, +1.2%), Nvidia (NVDA, +3.1%) and Microsoft (MSFT, +1.5%) helped lead a modest 0.6% rebound in the tech-heavy index.

Despite the rebound, the Nasdaq remained down 4.9% for the week, the result of interest-rate fears, versus 1.8% and 2.4% losses for the Dow and S&P 500, respectively.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Many market participants have referenced the infamous 'Taper Tantrum' in 2013 as a similar playbook to today as a reason why we're seeing equity market weakness," says Brian Price, head of investment management for Commonwealth Financial Network. But he also points out that "the notable difference today ... is that the Fed seems very committed to letting the economy run a little hotter than normal and will tolerate higher inflation."

Other action in the stock market today:

- The small-cap Russell 2000 eked out a marginal gain to 2,201.

- U.S. crude oil futures sank 3.2% to $61.50 per barrel, but still finished February up 18%.

- Gold futures sank, too, dropping 2.6% to $1,728.80 per ounce, plumbing nine-month lows.

- Bitcoin prices, at $48,870 on Thursday, dropped 5.1% to $46,381. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Earnings Estimates Are Looking Up!

Whatever the market faces in the short term, analysts see better times further on in the year.

Economic expectations are improving as more Americans are inoculated against COVID-19; nearly 14% of the population has received at least one dose, according to the Centers for Disease Control and Prevention.

That has analysts quickly scaling up their earnings estimates. Current-quarter profit expectations have improved by 5% over the first two months of Q1. According to FactSet Senior Earnings Analyst John Butters, that's "the second-highest increase in the bottom-up EPS estimate during the first two months of a quarter since FactSet began tracking this metric in Q2 2002," trailing only Q1 2018's 5.7% increase.

That augurs well for much of the market – including a number of dividend-rich sectors and industries. Many real estate investment trusts (REITs), especially in the retail and hospitality industries, are poised for better results as foot traffic picks up. And an economic recovery bodes well for business development companies (BDCs), as well as the small and midsized businesses in which they invest.

Investors will find plenty of attractive income opportunities across the equity board – though if you're looking for somewhere to start, we suggest you begin with our list of 21 high-quality (and high-yielding) stocks that are suitable for those looking to retirement (or even in it). These names offer an appealing blend of payout potential and income stability that just about any long-term buy-and-holder can appreciate.

Kyle Woodley was long NVDA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.