Stock Market Today: Winter Storm Boosts Energy Sector, But Stocks Finish Mixed

Oil and natural gas prices surged Tuesday as Winter Storm Uri pounded the nation, sending power demand higher and impacting energy supplies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

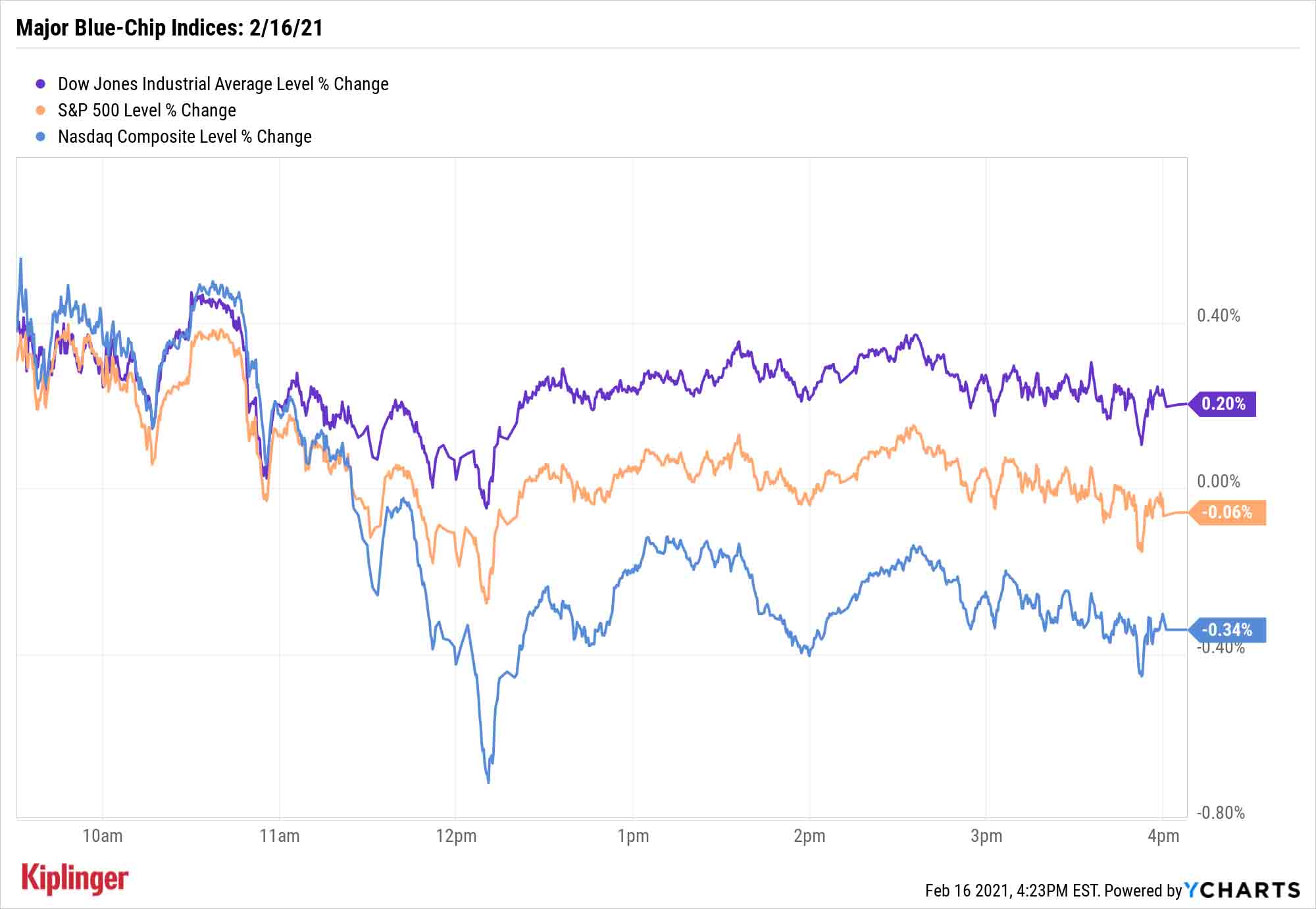

The major indices looked like they were ready to go after the long holiday weekend, and they did at the open. Unfortunately, many stocks couldn’t sustain that buzz all day.

A massive winter storm has wreaked havoc on Texas's power grid, leaving millions without electricity, and impacting the state's pipelines and refineries. The resultant spike in demand as well as the disturbance in supplies sent oil and natural gas prices higher; U.S. crude oil futures jumped a full 1% to $60.05 per barrel. Energy names such as Exxon Mobil (XOM, +3.0%) and ConocoPhillips (COP, +3.6%) helped lead the sector forward.

The rest of the stock market was a much more mixed affair.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average (+0.2% to a record 31,522) managed to finish in the black, albeit off its highs for the day, thanks to strong performances from Salesforce.com (CRM, +3.4%) and JPMorgan Chase (JPM, +2.4%). But the S&P 500 weakened throughout the day and closed with a marginal loss to 3,932, and the Nasdaq Composite also went green-to-red, finishing 0.3% lower to 14,047.

Other action in the stock market today:

- The small-cap Russell 2000 drooped 0.7% to 2,272.

- Gold futures settled 1.3% lower to $1,799.00 per ounce.

- Bitcoin prices briefly surpassed the $50,000 mark on Tuesday before dipping back to $48,783. That was still 2.4% better than its price of $47,622 on Friday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Turn Short-Term Pain Into Long-Term Gain

The market very well could be running out of gas. Tony Dwyer, analyst at Canaccord Genuity, says "We still believe the market is ripe for a pullback" amid high valuations, overbought chart indicators and historically sky-high sentiment (which incidentally can be a bearish signal).

Fortunately, these are mostly short-term concerns in what appears to be a favorable longer-term setup.

"The Fed is focused on obtaining sustainably higher inflation, money availability remains historic, the economy is just in the beginning of a long-duration recovery, consensus EPS forecasts are too conservative, and like 2010, any valuation contraction should be a result of a sharp EPS ramp rather than something more onerous," Dwyer adds.

The prevailing wisdom in such an environment is to buy dips, as they're expected to be temporary. But what dips should investors buy?

These S&P 500 stocks would have more appeal with a major reduction in price. But in the event that we don't get drastic pullbacks, simply look for slightly better prices for the highest-quality stocks on your wishlist. Perhaps that's the picks espoused by Warren Buffett, whose latest changes to the Berkshire Hathaway (BRK.B) portfolio will be revealed this evening (check back here later tonight for full updates).

Or it might be the 21 picks hand-selected by several of us here at Kiplinger, as well as some of Wall Street's top fund managers. Most of these picks appear to have plenty more room to run in 2021 – and a quick market dip would make them all the more attractive.

Kyle Woodley was long CRM and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.