Stock Market Today: Blue-Chip Indices Close Out the Week on Top

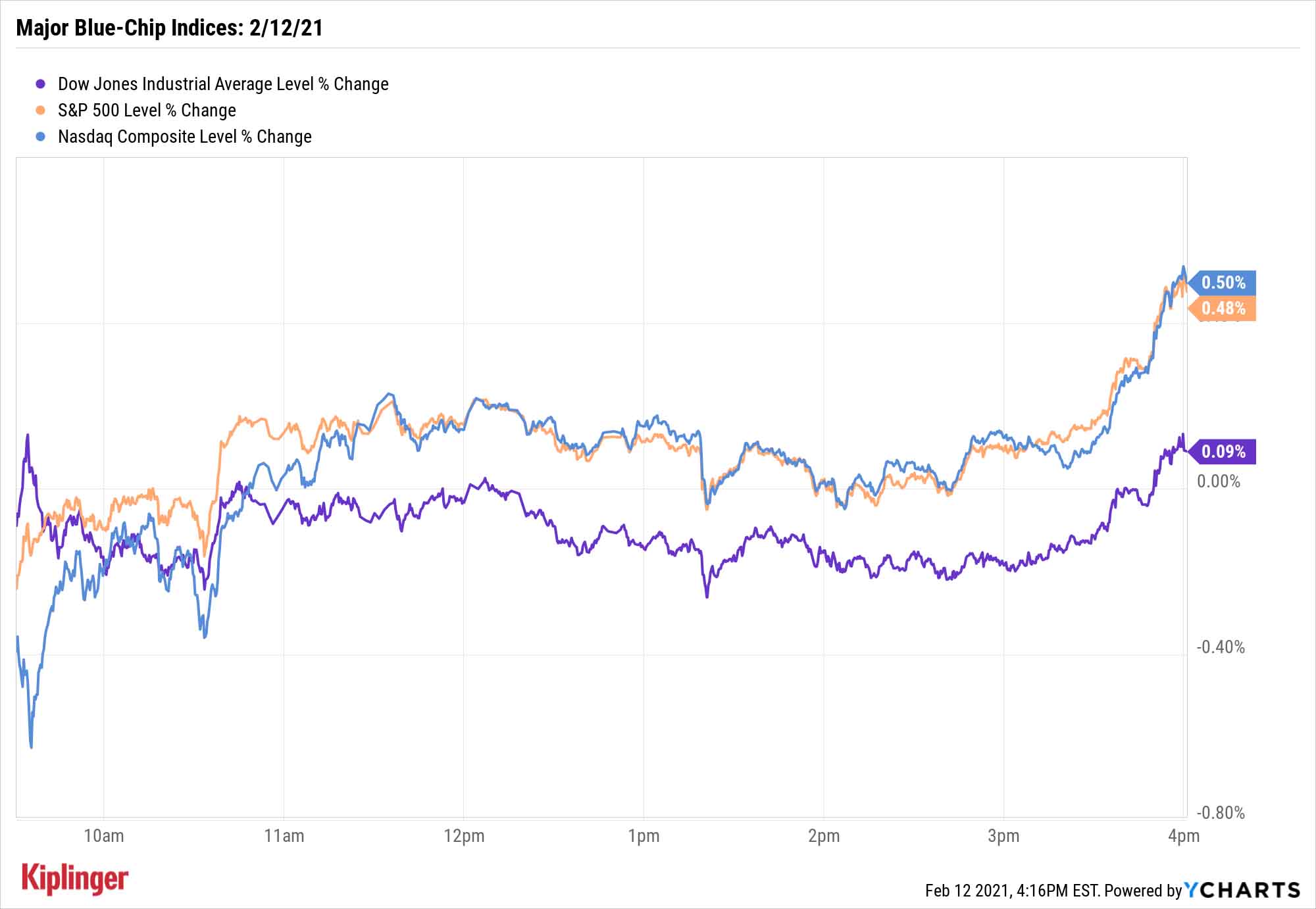

The Dow and other major indices managed to scratch out new all-time highs with modest gains in a quiet Friday session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The stock market was less escalator, more airport people-mover for much of the week, but the major indices managed to end the week on a (modestly) positive note, and at fresh highs.

President Joe Biden said Thursday that "we're now on track to have enough [vaccine] supply for 300 million Americans by the end of July," and The Associated Press reports that his administration is "on pace to exceed Biden's goal of administering 100 million vaccine doses in his first 100 days in office."

However, on Friday, the preliminary February estimate for the University of Michigan's consumer sentiment index slipped to 76.2, from 79.0 in January.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The loss was entirely driven by a drop in the expectations index as households turned less optimistic about their income prospects," says Pooja Sriram, Vice President, U.S. Economist, at Barclays. "The press release notes that the lower optimism was seen mainly among households with incomes below $75,000 and more so for those in the bottom one-third of the income scale."

The S&P 500 (+0.5% to 3,934) and Nasdaq Composite (+0.5% to 14,095) managed yet again to eke out new record closes. The Dow Jones Industrial Average did, too, though its 0.1% uptick to 31,458 was hampered by a 1.7% decline in Disney (DIS), which beat earnings expectations but had analysts questioning its valuation.

Also, take note: Monday is Presidents' Day, which is a stock market holiday.

Other action in the stock market today:

- The small-cap Russell 2000 scratched out a 0.2% gain to 2,289.

- U.S. crude oil futures recovered from yesterday's losses, gaining 2.1% to hit $59.47 per barrel.

- Gold futures slid again, off 0.2% to $1,823.30 per ounce.

- Bitcoin prices, at $48,379 on Thursday, slipped 1.5% to $47,662 on Friday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Fear a Dip; Get Ready to Buy It

While many observers have warned of a potential market downturn, Ally Invest chief investment strategist Lindsey Bell reminds investors that selloffs aren't always something to fear.

"If there is a pullback, have your wish list ready," she suggests, noting that consumer staples stocks are perhaps being overlooked despite their strong earnings performance.

She also reminds investors to have cash ready.

"When the drop happens, you’ll need some cash," Bell says. "Even though low-yielding cash gets a bad rap, it is an important part of any portfolio because without it you could miss the chance to take action when opportunity arises."

You can learn more about raising cash here, but typically this means selling off various stocks. In some cases, that means trimming losers, but in other cases it means taking profits on stocks that have run fast and far, but might be running out of gas.

This list of 10 widely held S&P 500 stocks is an interesting blend of both ideas here. They currently trade at nosebleed prices, making them a prime starting point for locking in profits. But they're also attractive long-term plays that might make for better buys amid a broader-market downturn.

Read on as we examine each of these extravagantly priced plays, and why they're possibly flying a little too close to the sun (for now).

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.