Stock Market Today: Market Simmers, But Marijuana Stocks Blaze On

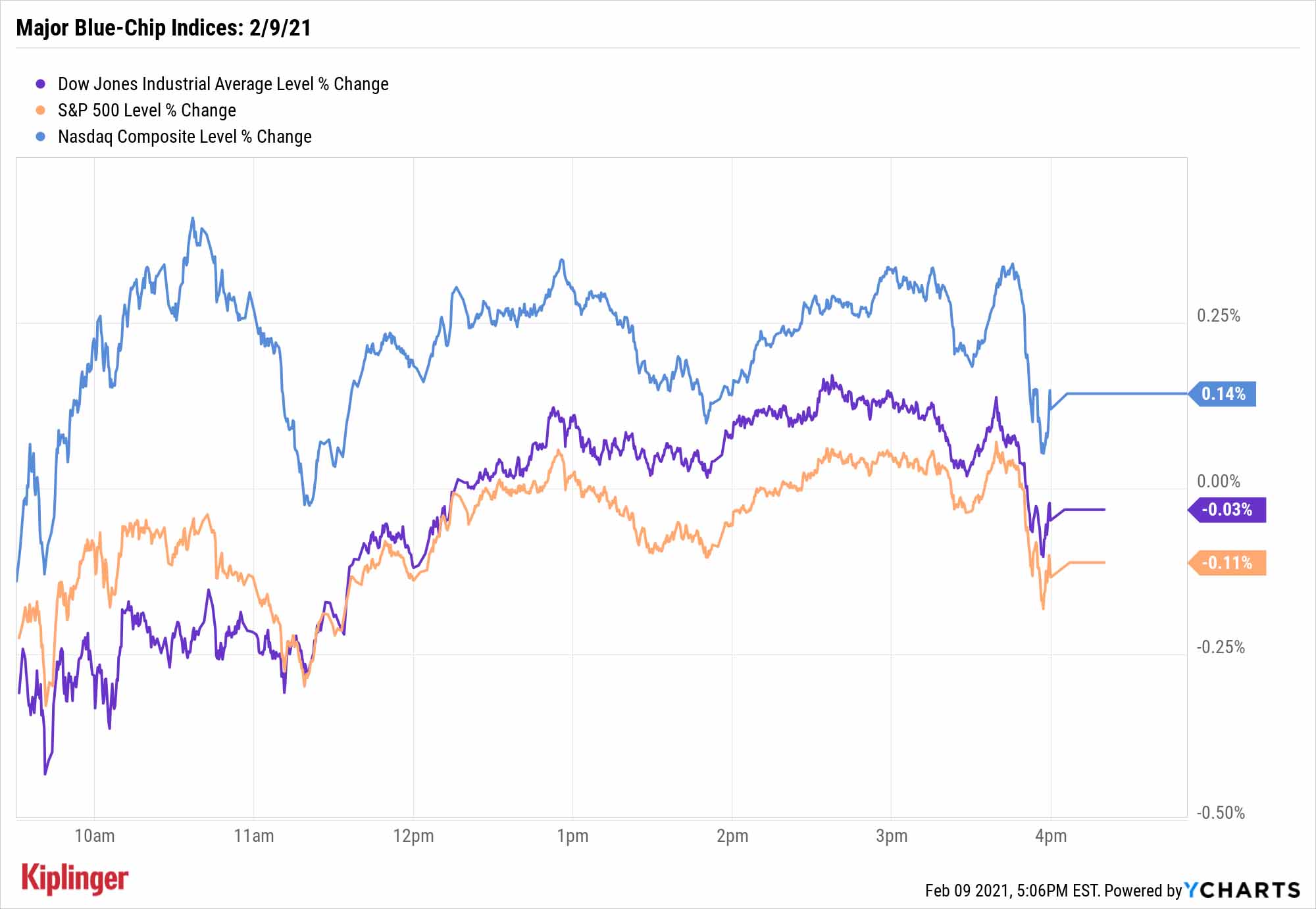

The major indices finished with mixed results on Tuesday as the stimulus picture starts to crystalize. Cannabis-related stocks were another story.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Tuesday's trading session was a mostly mixed affair from the start, albeit one that still managed to push (some of?) the major indices even further into record territory, if only marginally.

A proposed $1.9 billion stimulus plan came further into focus, with President Joe Biden saying he agreed with a Democratic proposal setting thresholds for the $1,400 direct payments: Individuals earning up to $75,000 (and households earning up to $150,000) would be eligible for the full amount.

The NFIB Small Business Optimism Index took a surprising tumble in January, however, declining to 95.0, which is three points below its 47-year average of 98.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The COVID-19 pandemic continues to dictate how small businesses operate and owners are worried about future business conditions and sales," says NFIB Chief Economist Bill Dunkelberg.

Despite that, the small-cap Russell 2000 was the best of the major indices, improving 0.4% to a new high of 2,299. The Nasdaq Composite (+0.1% to 14,007) also finished with a record close.

Other action in the stock market today:

- The Dow Jones Industrial Average finished marginally lower to 31,375.

- The S&P 500 slipped 0.1% to 3,911.

- U.S. crude oil futures improved by 0.7% to $58.36 per barrel.

- Gold futures extended their winning streak to three sessions, gaining 0.2% to $1,837.50 per ounce.

- Bitcoin prices, at $44,134 on Monday, surged another 6.9% to $47,200. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

In the Spotlight: Marijuana Stocks

The market might have been tepid Tuesday, but one budding industry continues to be white-hot.

Marijuana stocks delivered another day of spectacular gains, with the ETFMG Alternative Harvest ETF (MJ) of cannabis-related companies surging 13.4%, bringing its year-to-date gains to 101.3%.

While much of 2021's gains can be chalked up to enthusiasm for the Biden administration's seemingly friendly eye toward marijuana, Tuesday's excitement was tethered to something more concrete: the earnings calendar. Producer Canopy Growth (CGC, +11.9%) reported yet another large quarterly net loss, but a better-than-expected 33% jump in revenues, and it's predicting it will turn a profit in 2022.

"Operating expenses declined, and Canopy Growth remains very well positioned with C$1.6 billion of cash and a strong partner in Constellation Brands to help Canopy expand its global distribution," adds Jason Wilson, cannabis research and banking expert with ETFMG.

Marijuana remains a very "Wild West" industry that's chock full of risk – but rising asset values show investor interest is strong and increasing. Those considering dipping in a foot, or maybe even just a toe, are likely better served in MJ or similar funds, such as our 2021 ETF suggestion.

But for those with the risk appetite and the desire to make a splash, these 10 marijuana stocks are among the most attractive entryways into this industry.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.