Stock Market Today: Electric E-Commerce Earnings Send Nasdaq to New High

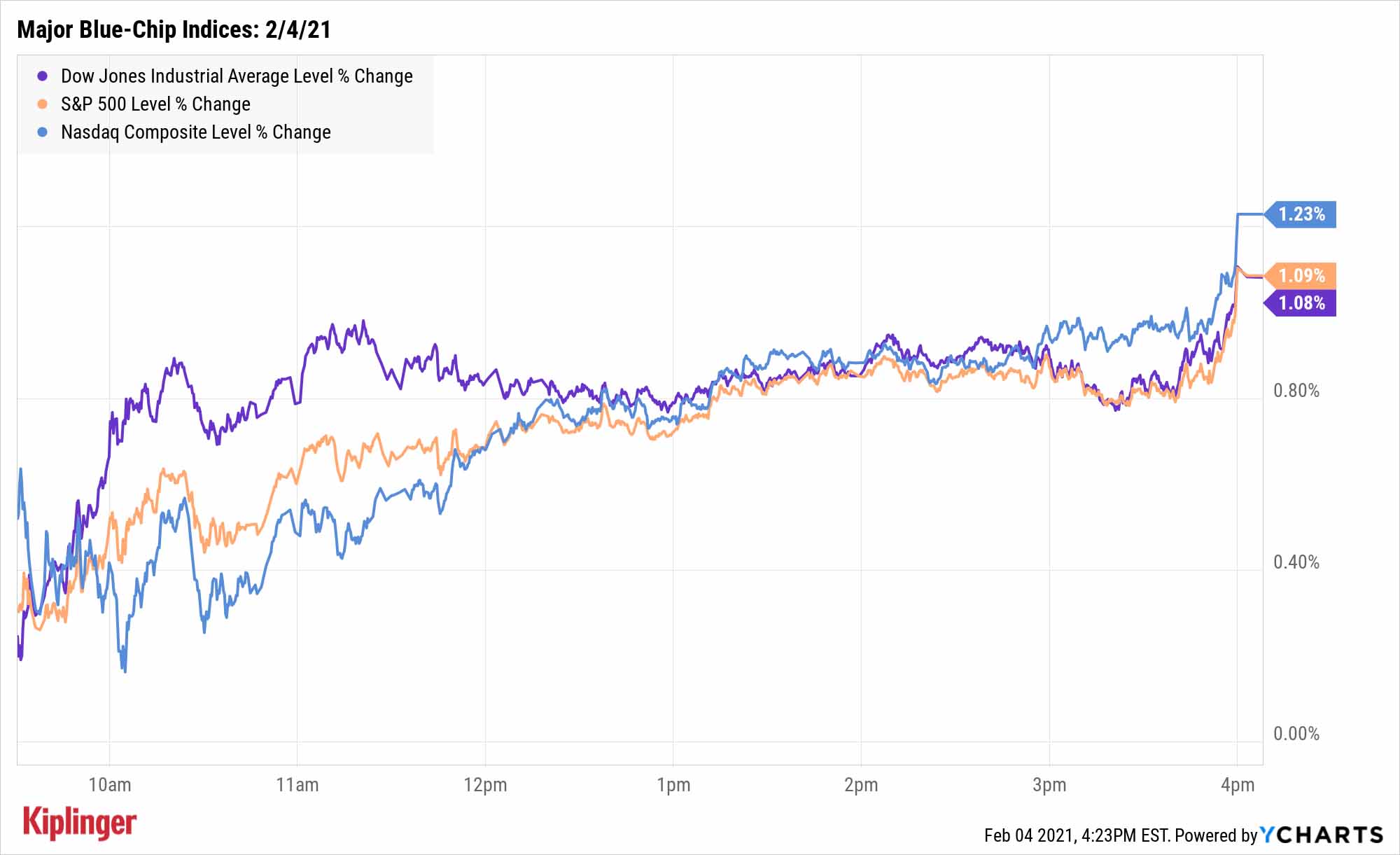

All the major indices took off running again Thursday on the back of brighter employment data and encouraging earnings. Several finished with record closes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

An improving economic backdrop and a few standout earnings reports helped send some of the major indices back into record territory Thursday.

Initial jobless claims for the week ending Jan. 30 came in at 779,000 – lower than expected, and 33,000 fewer than the prior week's claims, which were sharply revised downward to 812,000.

"Altogether, the signal from this week's claims data is one of modest further improvement following recent deterioration," write Barclays' Michael Gapen and Pooja Sriram. "Trends in initial claims in early 2021 point to some improvement in the rate of job separations in January, though this week's readings will be reflected in February employment conditions given the timing of the survey week for employment conditions (the week that includes the 12th of the month)."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also noteworthy were factory orders, which improved by 1% month-over-month in December, exceeding expectations.

On the earnings front, PayPal Holdings (PYPL, +7.4%) took off after reporting Wednesday night that fourth-quarter profits tripled amid continued pandemic-driven adoption of digital payments.

"We continue to appreciate PYPL's growth and positioning for a post-Covid world, which is accelerating the secular trends of e-commerce and digitization of cash and payments," writes Chris Kuiper, analyst at CFRA, adding that "we are particularly interested in PYPL's foray into crypto assets, which we think could become a much bigger opportunity."

"However, shares continue to embed very high growth expectations, therefore we remain neutral."

Interestingly, eBay (EBAY, +5.3%), which PayPal split from in 2015, also had itself a day after robust holiday sales fueled a Q4 earnings beat. Those and other strong tech performances led the Nasdaq Composite (+1.2% to 13,777) and S&P 500 (+1.1% to 3,871) to new closing highs. The Dow Jones Industrial Average finished with a strong 1.1% gain to 31,055.

Other action in the stock market today:

- U.S. crude oil futures continued their ascent, finishing a full 1.0% higher to $56.23 per barrel.

- Gold futures tumbled 2.4%, settling at $1,791.20 per ounce.

- Bitcoin prices, at $37,068 on Wednesday, advanced 1.2% to $37,528. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Small Caps Keep Punching Above Their Weight

But the stars of Thursday's show – and 2021, for that matter – were small-cap stocks.

The Russell 2000 also clinched a new high, advancing 2.0% to 2,202, which puts the index up 11.5% for the year-to-date. A couple days ago, we pointed out that January was a tough one for the broader market, but Bank of America reminds investors that the Russell 2000 was the only segment that gained in January (+5.0%), and its analysts remain bullish for several reasons.

"Small cap profits should bounce back stronger than their decline, and guidance trends are strongest here of the three size segments," they say, also pointing to stimulus, sentiment and support for smaller businesses as other catalysts for further gains.

Investors can harness some of these effects in mid-cap stocks, which boast advantages such as more diversified revenue streams and better financial stability. But if you're willing to roll with the volatility punches the small-cap space can throw, these 11 smaller firms could fit the bill.

Because of their size, they don't get as much media attention, so they fly under a lot of investors' radar, but they boast the potential for an electrifying year ahead.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.