Stock Market Today: Earnings, Stimulus Drive Another Big Push for Stocks

Major indices enjoy a second day of strong gains Tuesday; after the bell, Amazon.com announces Jeff Bezos will transition out of CEO role.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street finally stuck to the same tune for more than one session at a time, in this case posting a second consecutive day of rip-roaring gains on Tuesday. That action was followed up by the sudden news that one of corporate America's most successful CEOs would be stepping down.

Despite the growing prevalence of more-contagious COVID-19 strains, hospitalizations and deaths are, for the moment, heading lower. Financial relief for the coronavirus-battered economy looks a little likelier too, as Sen. Joe Manchin (D-W.Va.) signaled support for an important step forward in approving a new relief package.

Strong earnings reports from United Parcel Service (UPS, +2.6%) and Exxon Mobil (XOM, +1.6%) also whipped up some optimism.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Since multiple expansion – higher equity prices due to falling interest rates or rising liquidity – is unlikely to be an equity market driver this year, the 2021 bull thesis depends on earnings improvement to remain intact," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

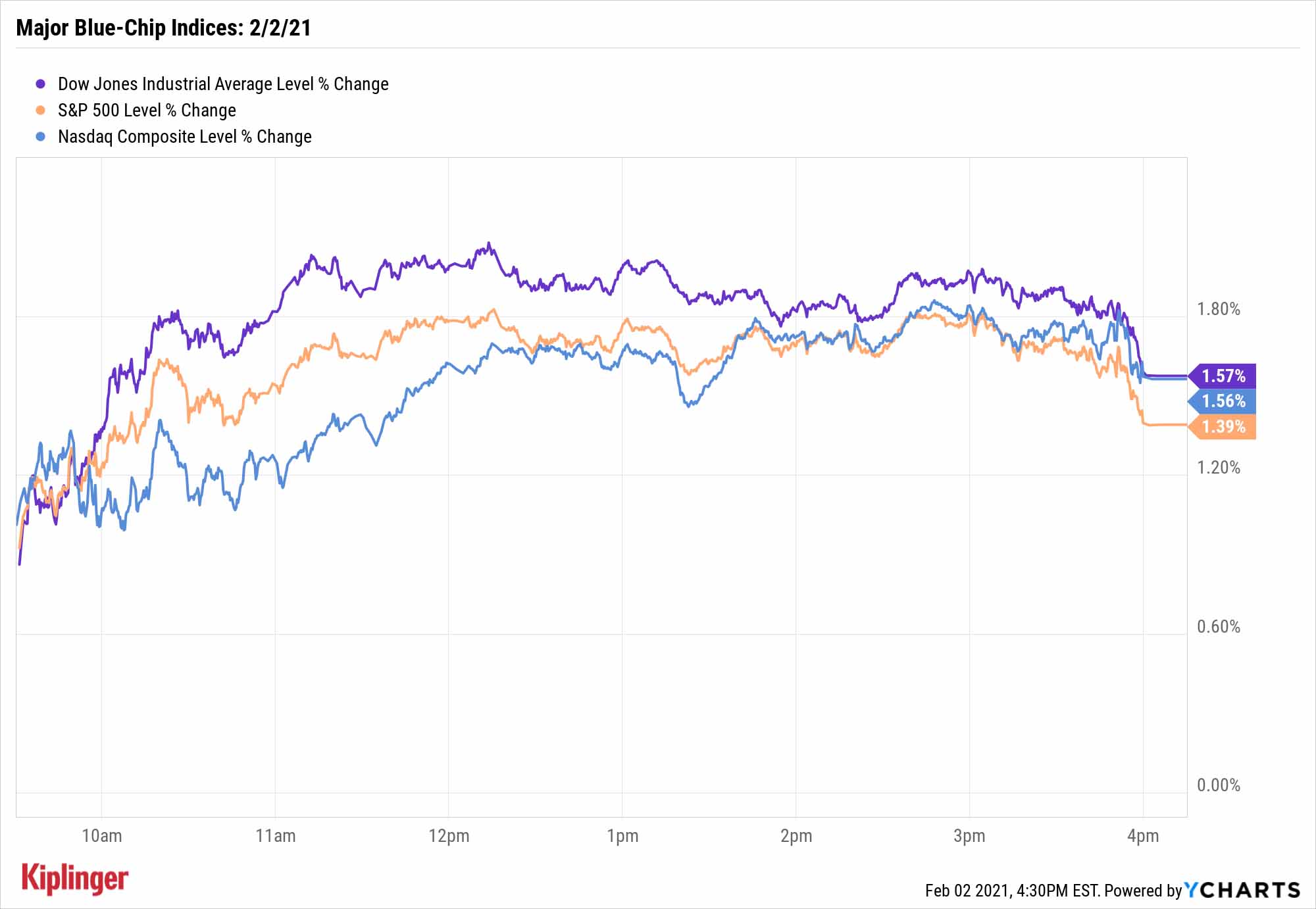

The Dow Jones Industrial Average (30,687) and Nasdaq Composite (13,612) each jumped 1.6%, while the S&P 500 enjoyed a robust gain of 1.4% to 3,826.

Investors in some of the "short squeeze" stocks espoused by the WallStreetBets Reddit community weren't so lucky. GameStop (GME) plunged a flat 60% after an 31% decline on Monday, AMC Entertainment (AMC) dropped 41.2% and BlackBerry (BB) lost 21.1%.

- The Russell 2000 jumped 1.2% to 2,151.

- Gold futures slid 1.9% to 1,833.40 per ounce.

- U.S. crude oil futures had another great day, improving by 2.3% to settle at $54.76 per barrel.

- Bitcoin prices, at $33,849 on Monday, popped by 5.9% to $35,842. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- After the closing bell, Amazon.com (AMZN) announced that Jeff Bezos would step down as CEO, to be replaced by Amazon Web Services (AWS) chief Andy Jassy. Bezos will shift to the role of Executive Chair in the third quarter of 2021.

History Says 2021 Could Be a Slog

Third stimulus or not, earnings rebound or not, 2021 could still be tough. Vaccines might be on the way, but COVID is largely unchecked, unemployment remains high, and – despite all that – stocks as a whole are sitting at sky-high valuations.

History isn't on our side either.

Remember the old adage, "As goes January, so goes the year"? Ryan Detrick, chief market strategist for LPL Financial, points out there's some statistical validity to that.

"When the S&P 500 has been green in January, the index has been up 11.9% on average over the rest of the year (final 11 months) and higher 86% of the time," he says. "However, when that first month was red, stocks rose only 1.7% on average over the final 11 months and were higher barely 60% of the time."

In other words, investors might need more than just stocks that ebb and flow with the market's tide – they'll need companies postured for standout results. If you ask the pros, many will point you to these 25 stocks that they've endorsed with high confidence. That's admittedly a growth-centric group, and some of us prefer value and dividends.

Fortunately, the analyst community has no shortage of love for a number of high-yield names, too, including these 25 stocks that yield at least 3%.

Kyle Woodley was long AMZN and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.