Stock Market Today: Nasdaq Scratches Out Another Record Finish

The Nasdaq came out of a mixed day with yet another fresh high. More interesting were Friday's moves by IBM, Intel and GameStop.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A muted Friday for the broader stock market was much more interesting under the microscope.

The market received some good news in the form of readings from IHS Markit showing a decade-high level of manufacturing activity and expansion of services activity. That news was blunted by the nation's top infectious diseases expert, Dr. Anthony Fauci, who highlighted data showing that current COVID vaccines might not be as effective in curbing some mutated strains.

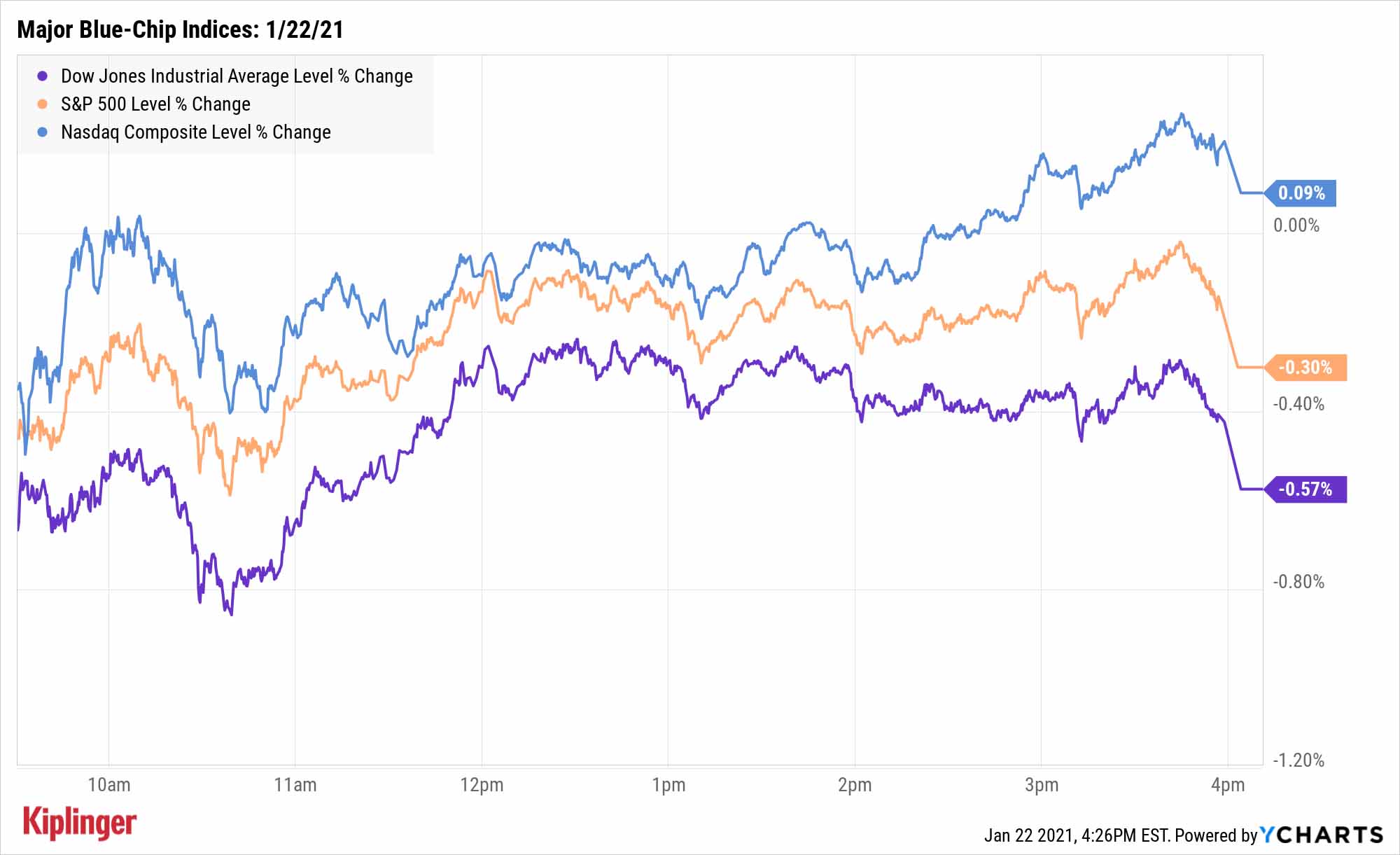

The Nasdaq Composite finished a modest 0.1% higher, good enough for a record close at 13,543. The Dow was clipped by 0.6% to 30,996, driven lower by International Business Machines (IBM, -9.9%), which reported disappointing quarterly revenues, and Intel (INTC, -9.3%), which popped yesterday after accidentally releasing its earnings before the closing bell, but yielded ground today.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Capturing much of Wall Street's attention, however, was GameStop (GME, +50.5%), which has rallied a wild 2,419% since April thanks to a mix of strong earnings, a transformative investor stake and the unraveling of bets against the stock. That helped the small-cap Russell 2000 violently rebound, with a 1.3% gain to a record 2,168.

Other action in the stock market today:

- The S&P 500 slipped 0.3% to 3,841.

- Gold futures dropped 0.6% to $1,855.70 per ounce.

- U.S. crude oil futures settled at $52.42 per barrel, a 1.3% decline.

- Bitcoin prices, at $31,902 on Thursday, rebounded 5.3% to $33,606. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Pros' Picks for 2021

The view from 10,000 feet is awfully different from the view on the ground.

The analyst community's broad-stroke convictions about what will work in 2021 are fairly uniform. Value stocks will finally have their day in the sun, they say, even if COVID lingers longer than hoped. Value-priced sectors, then, are also the rage: Financial stocks should win out, goes the logic. So too should oil and gas names.

But when you zoom in to the single-stock level, you'll find that many of the pros' favorite stocks for the year aren't all found in those favored niches.

We've highlighted 21 stock picks that stand out because of their high concentration of recent bullish 12-month calls, and our list is a mishmash of just about everything the market has to offer – large-cap health insurers, mid-cap tech plays, tiny health innovators and everything in between. Check them out!

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.