Why GameStop Stock Has Gone on an Epic Tear

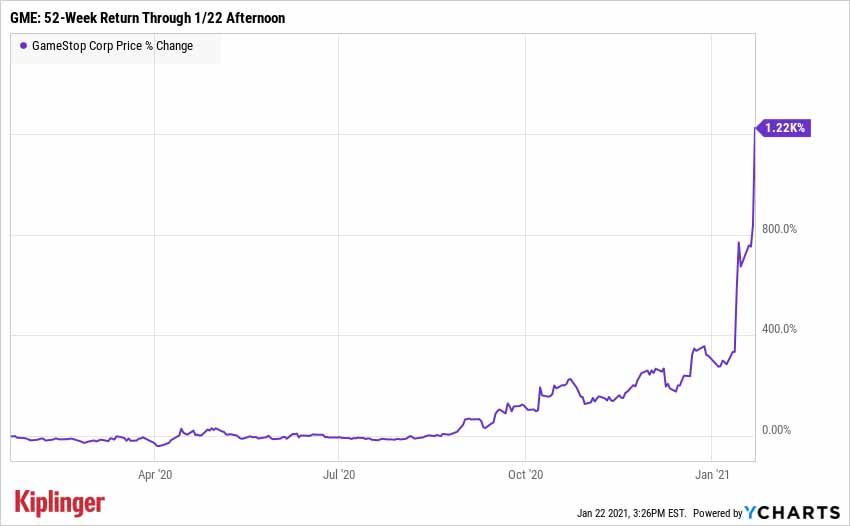

GameStop has rocketed 2,419% since April. However, recent heat under GME shares has been fueled not just by good news, but also doubters calling it quits.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Shares in GameStop (GME, $64.75) briefly soared almost 75% at one point in Friday trading, causing a quick trading halt, after a well-known short seller canceled a planned livestream critique of the video game retailer.

But that's just one ingredient in what has been a nearly perfect scenario fueling a massive run-up in GME stock.

Friday's gains extended a rally in GameStop, whose battered shares sold for as little as $2.57 per share in April, but have since exploded by 2,419%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The proximate cause for Friday's pop in GameStop shares, which finished the day up 50.5%, was a canceled presentation by Citron Research, which was to outline five reasons to sell GME stock. Citron said Thursday that too many hacking attempts on its Twitter account forced it to postpone its livestream.

But the larger takeaway for retail investors is that a two-week short squeeze in GameStop continues to push shares to what many analysts say are unsustainable highs, even if some fundamental changes to the business are encouraging.

The rally in GME stock began in earnest in August after Chewy (CHWY) co-founder Ryan Cohen took a 9% stake. A big part of the bear case on GameStop stems from the fact that it operates brick-and-mortar stores in an age when gamers download content and play online. So the involvement of someone pivotal to a successful e-commerce operation has led many investors to believe in a potential, meaningful turnaround.

The gains have accelerated over the past month or so after Cohen upped his stake to nearly 13%, and more recently after Cohen struck a deal to get three people on GameStop's board of directors.

Baird equity research, which rates GME at Neutral (equivalent of Hold), said the addition of former Chewy executives suggests GameStop is accelerating its digitalization strategy.

The Short Squeeze

Cohen's investment, nor the board news, doesn't explain why GameStop stock has nearly tripled since Jan. 12, however.

Another crucial reason for the stock's remarkable run is its enormous number of shares sold short. Short sellers expect a stock's price to fall. A sudden spike in demand for a stock forces short sellers to buy shares to cover their pessimistic bets.

It's known as a short squeeze, and it could take a while to burn out given the massive number of bets against GME. Indeed, recent data shows that short interest in GME exceeds the number of shares outstanding.

If the board news or Citron's canceled presentation were sparks, the short interest was the gasoline.

Citron maintains that GME is "going to $20," and that's actually optimistic compared to Wall Street's consensus. Of the eight analysts covering GME tracked by S&P Global Market Intelligence, one rates it at Buy, four say it's a Hold, two call it a Sell and one says Strong Sell. Their average price target of $11.01 gives GME implied downside of about 80% from current levels.

CFRA Research, which rates the stock at Sell, sums up the longer-term bear case on GME quite nicely:

"We hold concerns over GME's ability to maintain competitive positioning, namely due to high dependence on brick-and-mortar and secular shift away from physical gaming and toward digital and mobile."

But the past couple of weeks of GME stock trading are just another illustration of how, in the short term, fundamentals don't always steer the ship.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.