Stock Market Today: Investors Cheer Yellen Remarks on Stimulus, Taxes

President-Elect Joe Biden's pick for Treasury secretary sets a market-friendly tone in congressional hearing, lifting investor spirits Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sitting before Congress for her confirmation hearing, Janet Yellen, President-elect Joe Biden's pick for Treasury secretary, caught the eye of Wall Street as well.

The former Federal Reserve chair urged listeners there to act swiftly and strongly on additional COVID-19 aid, saying "The smartest thing we can do is act big."

"President-Elect Biden's nomination of Janet Yellen as Secretary of Treasury was largely seen as a positive by investors," says the Wells Fargo Investment Institute. "Yellen has been a proponent of fiscal stimulus, which benefits the (financial) sector, and she is viewed as being a more moderate choice from a regulation perspective."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That helped investors look past a new low point on the coronavirus front – Johns Hopkins reported that America's COVID death toll has surpassed 400,000 – as well as another mixed earnings report from a Big Four bank, this time Bank of America (BAC, -0.7%), which beat profit expectations but came up short on revenues.

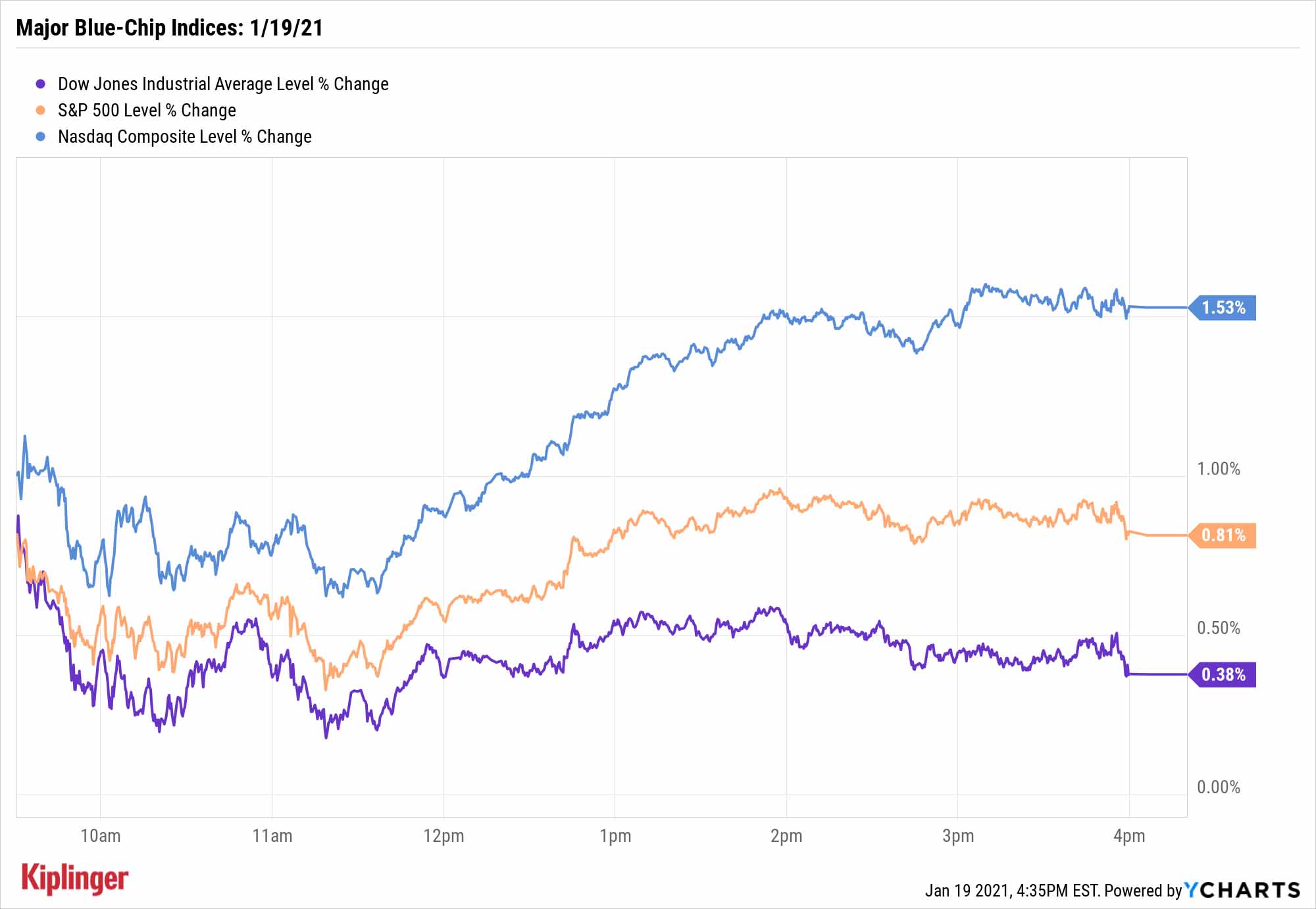

The Dow Jones Industrial Average closed 0.4% higher to 30,930, led by American Express (AXP, +3.8%) and Boeing (BA, +3.1%).

Other action in the stock market today:

- The S&P 500 gained 0.8% to 3,798.

- The Russell 2000 rebounded 1.3% to 2,151.

- Gold futures improved by 0.6% to $1,840.20 per ounce.

- U.S. crude oil futures bounced back from a rough Friday, jumping 1.2% to settle at $52.98 per barrel.

- Bitcoin prices, at $36,274 on Monday, improved by 0.4% to $36,433. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

And a reminder: The stock market is open for Inauguration Day.

Setting the Political Stage

Biden administration policy could set the market's tone early on. The Nasdaq Composite also surged Tuesday, rising 1.5% to 13,197 after Yellen also suggested that Biden was looking to change some aspects of Trump's tax cuts, but not a full repeal.

That's good news for many corporations, but particularly bullish for tech stocks like these 15 picks, and a large number of funds tied to the tech-heavy Nasdaq.

John Vail, chief global strategist at Nikko Asset Management, says to keep an eye on Biden's executive orders, too.

"The aggressiveness of (Biden's EOs) will indicate how much Biden wishes to compromise with Republicans in the Senate on the first stimulus bill," he says. "It is possible that if the Orders are not radical and the negotiations are without blame-game rancor, he could get enough Republicans to pass about half of his fiscal requests, which would be positive for the markets."

While value stocks are expected to be a prime beneficiary of stimulus progress, don't count out growth completely. Yes, the investing style could continue to cool after more than a decade of outperforming value, but the pros still see oodles of potential in a number of rapidly expanding companies.

Here, we look at 11 growth stocks that could shine in 2021, even if the market finally does continue a much anticipated rotation into value.

Kyle Woodley was long BA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.