Stock Market Today: Major Indices Reach New Peaks as Washington Simmers

Thursday's confirmation of Joe Biden as America's next president, as well as improving economic indicators, helped stocks regain their momentum from yesterday morning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A day after being shaken by an attack on the U.S. Capitol, American stock markets found their composure, and fresh highs, amid a little normalcy in Washington and some encouraging economic data.

Very early Thursday, Congress confirmed Democrat Joe Biden as the nation's 46th president, putting an end to any legal challenges. Initial jobless claims for last week declined for the third consecutive week, to 787,000.

"Altogether, the signal from this week's claims data is one of stabilization following prior loss of momentum," say Barclays' Michael Gapen and Pooja Sriram.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, the firm's outlook for Friday's December jobs report is a payrolls decline of 50,000, which would mark the first drop in seven months.

"Our forecast incorporates a modest 10k decline in total government payrolls, given BEA estimates of a 3k decline in Census employment on the month and prior establishment surveys that suggest that declines in payroll employment at the state and local levels have eased somewhat in recent months," Barclays says. "This would imply a 40k decline in private payroll, where we suspect the bulk of the weakness would come from services employment."

Also Thursday, an Institute for Supply Management reading for December showed better-than-expected growth in services activity since November.

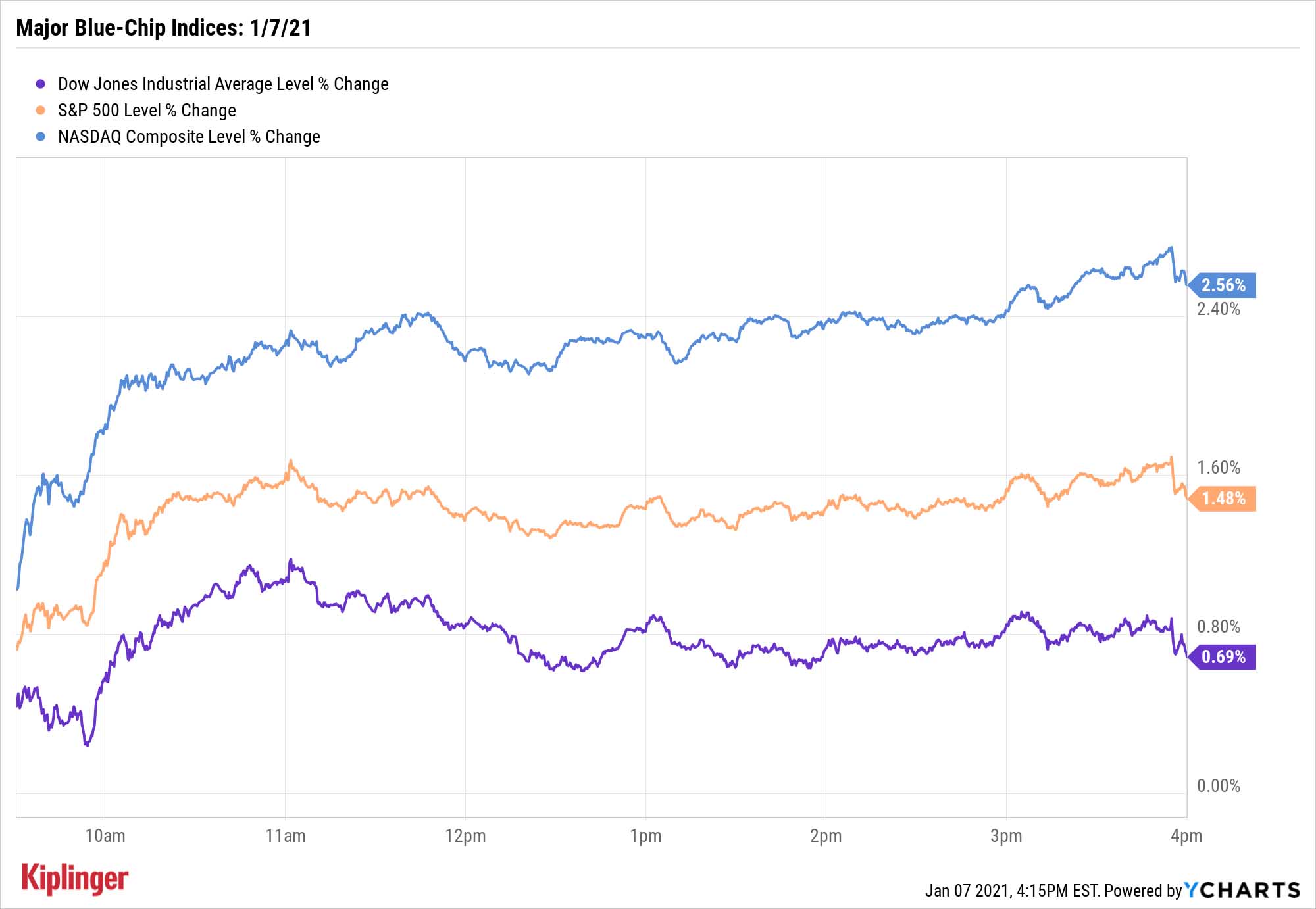

Massive days for Apple (AAPL, +3.4%) and Microsoft (MSFT, +2.9%) led each of the major blue-chip indices to new record highs, including the Dow Jones Industrial Average, which climbed 0.7% to 31,041.

Tesla (TSLA, +7.9%) finished the day at a $773 billion market capitalization to surpass Facebook (FB, +2.1%), and CEO Elon Musk surpassed Amazon.com's (AMZN, +0.8%) Jeff Bezos as the world's richest man. That helped lift the S&P 500 1.5% to 3,803, and the Nasdaq Composite 2.6% to 13,067.

The small-cap Russell 2000 chimed in with its own 1.9% gain to a record 2,096.

Other action in the stock market today:

- U.S. crude oil futures climbed for the third straight day, settling 0.4% higher to $50.83 per barrel.

- Gold futures eked out a 0.3% gain to $1,913.60 per ounce.

- Bitcoin prices, at roughly $36,000 yesterday, neared $39,000 on Thursday. (Bitcoin prices reported here are as of 4 p.m. each trading day.)

A Dirt-Cheap Way to Plan for 2021

Rightfully overlooked yesterday was the conundrum of the market's positive response to Georgia's election results.

After all, in November, investors seemed to cheer the possibility of Congressional gridlock. So why did they then celebrate yesterday the news of a unified Democratic government to come?

"In markets, there was only one relevant question for both elections," says Scott Knapp, chief market strategist at CUNA Mutual Group. "Will there be, in order of importance, more monetary and fiscal stimulus? The answer was a resounding yes after both elections, so the response was the same."

Investors trying to lock into positions for 2021 have myriad options at their disposal -- we've recently examined 21 high-potential stock picks for the year to come, as well as a basket of 21 ETFs that provide core, growth and defensive options alike.

But you can also build a gameplan for this year using a number of the ultra-low-cost products from low-cost pioneer Vanguard. We've compiled a list of 11 Vanguard mutual funds that appear tailor-made to tackle the new year's possibilities, but you could hold on to several of these options well past 2021 for long-term success. Check them out.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.