Stock Market Today: Stocks Fight to Extend Rally Despite Disappointing Payrolls

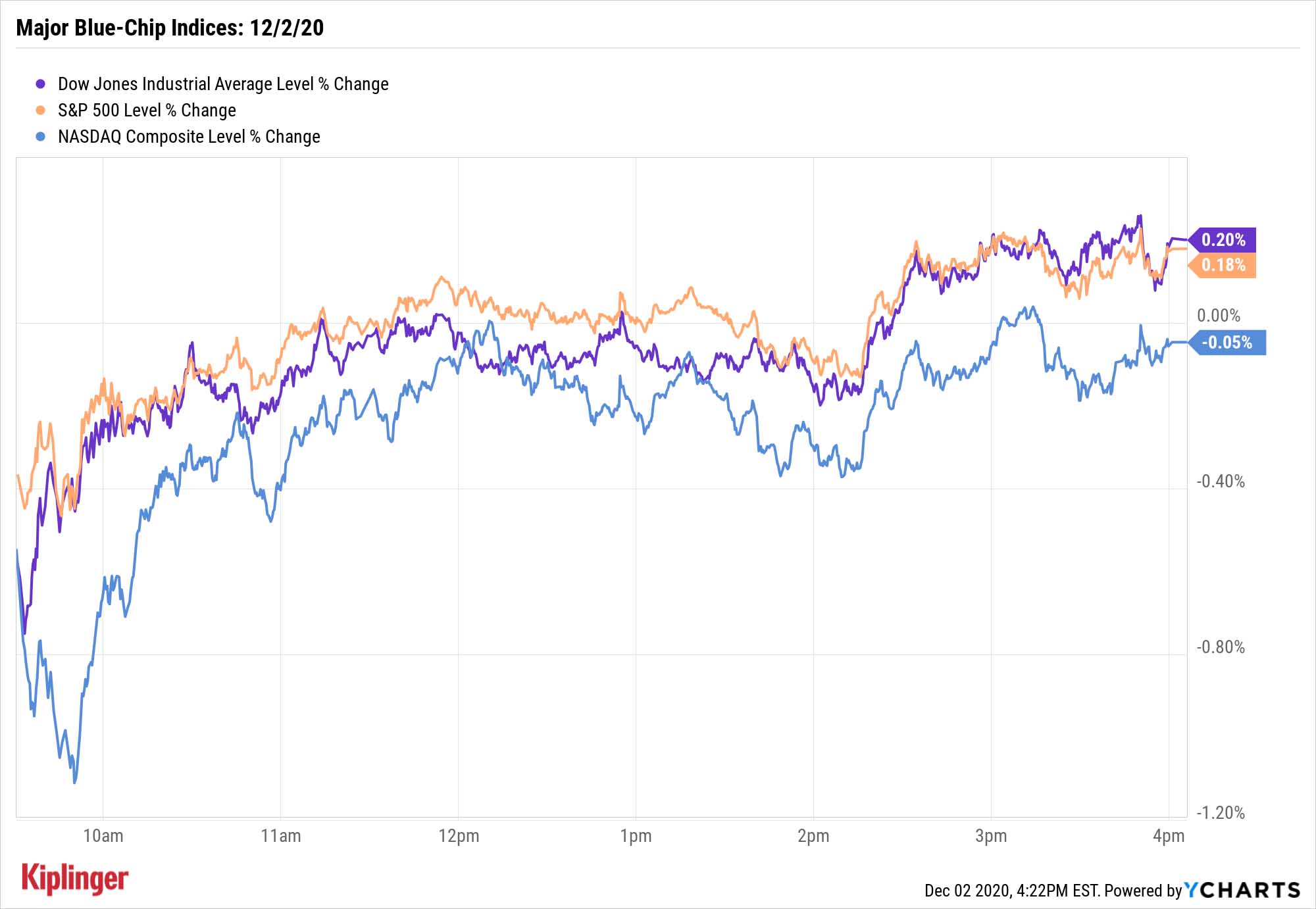

A weak ADP payrolls print took the life out of stocks Wednesday, but continued stimulus talks nudged a few major indices into the black by day's end.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market spent most of Wednesday trying to dig itself out of a hole as investors continued to chew on renewed stimulus discussions in Washington.

Earlier in the day, payroll services firm ADP reported that the U.S. added just 307,000 private-sector jobs in November – a firm decline from October's 404,000 jobs created and well below most economists' estimates.

"We see ~400-500k job additions contributing to lower unemployment – in the 6.8% range," say Credit Suisse analysts in a look-ahead to Friday's November nonfarm payrolls report. "We believe the level of employment likely remains below pre-COVID peaks into 2021 – pending further stimulus."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, Democratic congressional leaders Nancy Pelosi and Chuck Schumer endorsed a $908 billion bipartisan plan as a starting point for a new coronavirus relief deal before the year is out, while No. 2 House Democrat Steny Hoyer said he was meeting with Senate Majority Leader Mitch McConnell today about some sort of COVID relief measure.

Despite being weighed down by Salesforce.com (CRM, -8.5%), which sagged after officially announcing it would buy workplace communications firm Slack Technologies (WORK, -2.6%), the Dow managed to put up a modest 0.2% gain to 29,883. Boeing (BA, +5.1%) and Walgreens Boots Alliance (WBA, +3.6%) were among the biggest contributors to that effort.

Other action in the stock market today:

- The S&P 500 advanced 0.2% to set yet another all-time high at 3,669.

- The small-cap Russell 2000 edged 0.1% higher to 1,838.

- The Nasdaq Composite actually declined marginally, by less than six points to 12,349.

- Gold futures rose again, by 0.6% to $1,830.20 per ounce.

- U.S. crude oil futures rebounded from Tuesday's declines, improving by 1.5% to $45.21 per barrel.

Bond Investors: How Are You Approaching 2021?

As you start to think about how you'll rebalance your portfolio for 2021, a once-helpful rule of thumb continues to fall into obscurity.

The ol' 60-40 portfolio – 60% in stocks, 40% in bonds – has come under increasing fire for years as interest rates have tumbled, and its critics have only become more vocal in 2020 as rates have hit the floor.

Even then, many calls are for less bond exposure, not no bond exposure. And depending on your financial goals, you still might need a heavy weighting toward fixed income. But how should you go about investing in bonds?

Generally speaking, individual bonds are impractical for most retail investors, so they tend to turn to bond funds like this wide-ranging array of fixed-income products.

But if you're looking to retool specifically for 2021's difficult bond environment, consider this group of seven bond funds that might be up to the task. Yield is going to be difficult to come by, but then, so could bond-price upside, given a scarcity of additional downward drivers to interest rates. The onus, then, is on low costs and either ruthless index efficiency or managerial excellence.

Kyle Woodley was long BA and CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Small Caps Hit a New High on Rate-Cut Hope: Stock Market Today

Small Caps Hit a New High on Rate-Cut Hope: Stock Market TodayOdds for a December rate cut remain high after the latest batch of jobs data, which helped the Russell 2000 outperform today.