Stock Market Today: Big Tech Beatdown Keeps Stocks in a Slump

Apple (AAPL), Facebook (FB) and Amazon (AMZN) helped lead the market lower in an especially painful Friday for the tech-heavy Nasdaq.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The usual store of worries -- election uncertainty, COVID's resurgence and stalled stimulus -- no doubt weighed large on investors during a broadly brutal Friday for U.S. equities.

But Big Tech gets a special nod for its role in dragging down the wider market.

Apple (AAPL) slightly topped earnings expectations, but shares slumped 5.6% amid a 20% decline in quarterly sales and a lack of forward-looking guidance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It wasn't all bad. "The bang-bang launches of iPad Air, Watch series 6, the service bundles, and the new 5G iPhones in autumn show that Apple is firing on all cylinders," writes Argus Research's Jim Kelleher (Buy, $150 price target), who adds that "the September iPad and Watch launch and the October iPhone launch should drive momentum for Apple products heading into the holiday season."

Facebook's (FB) top and bottom lines easily exceeded estimates, but a decline of 2 million users across North America triggered a 6.3% exodus from shares. And Amazon.com (AMZN)? A Street-beating 37% jump in revenues, and profits that were 67% better than estimates … but the stock sank 5.5% thanks to disappointing Q4 earnings estimates amid high COVID-related costs.

"None of Thursday's tech earnings results were bad, and some were spectacular," says David Bahnsen, chief investment officer of wealth management firm The Bahnsen Group, "but the market is reacting negatively because when something is priced for better-than-perfection, it becomes pretty hard to live up to those expectations."

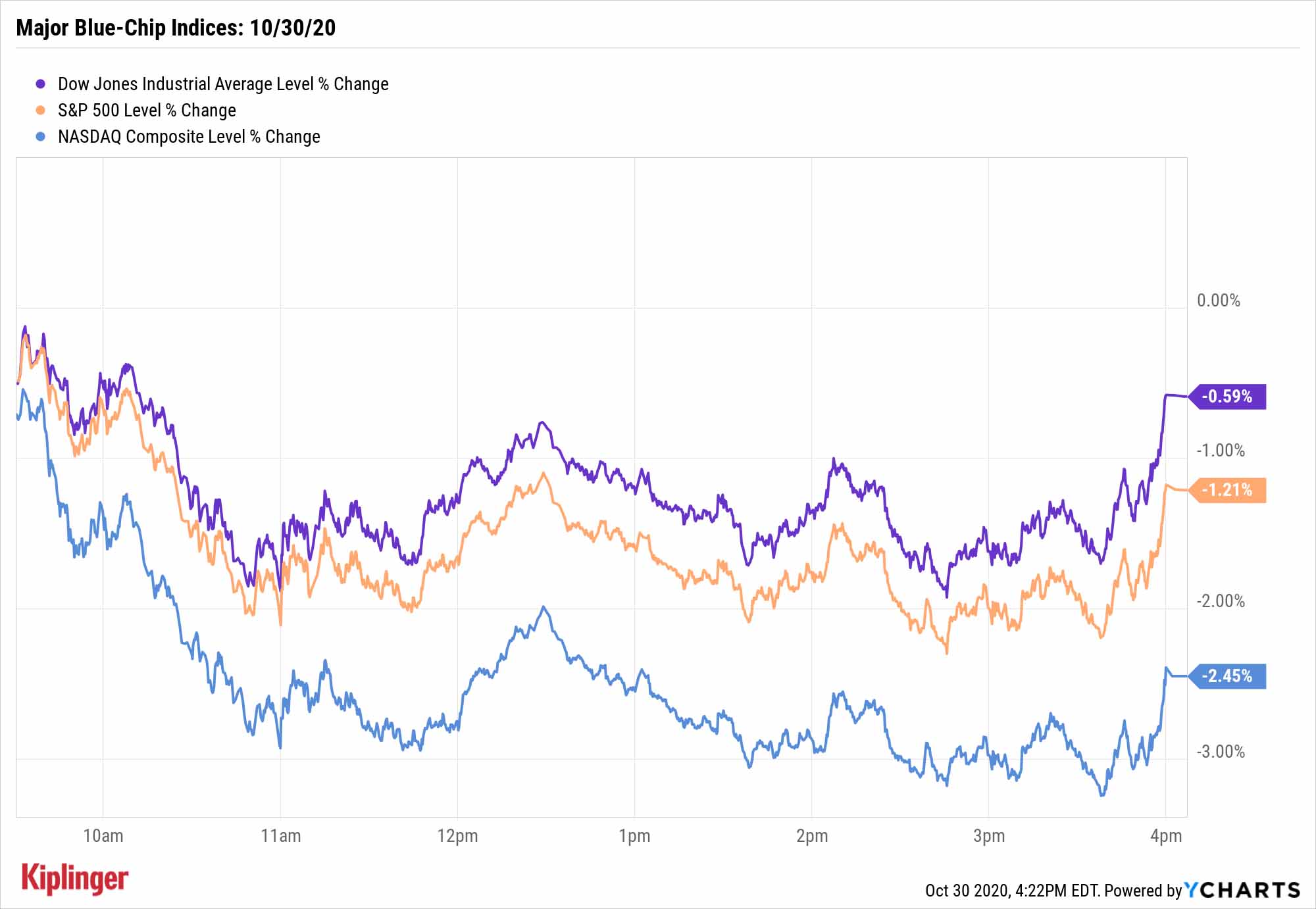

Those reports and others helped drag the tech-heavy Nasdaq Composite 2.5% lower to 10,911. The Dow Jones Industrial Average enjoyed a late-afternoon rally that limited its losses, falling just 0.6% to 26,501.

The Pros' Picks: 9 Stocks to Sell Now

Other action in the stock market today:

- The S&P 500 declined 1.2% to 3,269.

- The small-cap Russell 2000 finished 1.5% lower to 1,590.

- Google parent Alphabet (GOOGL, +3.8%) was an exception from the pain in mega-cap tech and communications, as strong advertising growth helped it exceed Wall Street expectations. Earnings of $16.40 per share easily cleared Wall Street estimates for $11.29.

- Exxon Mobil (XOM, -1.1%) reported a nearly 30% decline in revenues and an 18-cent-per-share quarterly loss for Q3, though both the top and bottom lines were better than expected. The company's dividend, which some analysts believe is in danger of being cut, was maintained at 87 cents per share for the fourth quarter.

For Those Who Buy Dips ...

And thus ends the worst week for the markets since March, in what has been a downright dreadful lead-up to next week's elections.

The Nasdaq and Dow are both off 8.1% since Oct. 12, and the S&P 500 has dropped 7.5%. The latter's current level of 3,269 should be watched carefully -- if the index finishes near there or lower, that would bode poor things for the incumbent, at least based on one highly accurate market indicator.

But the low prices are becoming an increasingly sweet incentive for those investors who heeded warnings about high volatility around the election and kept some dry powder for the right opportunity. You could take a stab at growth via these seven small-cap tech plays, or seek out a balance of growth and stability via these 15 prime mid-cap opportunities.

Or you can really use lower prices to your advantage and squeeze higher yields out of the market's most aggressive dividend growth stocks. Analysts have recently highlighted a number of payout-hiking companies that have sweetened the pot by an average of 10% annually over the past half-decade -- and that level of dividend growth, over time, can give these stocks an advantage over more sluggish stocks with high current yields.

Kyle Woodley was long AAPL, AMZN and FB as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.