How to Manage Portfolio Risk With Diversification

"Don't put all your eggs in one basket" means different things to different investors. Here's how to manage your risk with portfolio diversification.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With the stock market soaring to new all-time highs on what seems like a daily basis, managing your portfolio's risk might not be the first thing on your mind.

If you wait for a downturn, though, it's already too late. You don't want your roof to catch fire before you buy homeowner's insurance.

The best way to manage your portfolio's risk is through proper diversification. And the basic idea is simple enough: Don't put all of your eggs in one basket.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But how much diversification is enough? And how do you know if your portfolio is functionally diversified vs apparently diversified?

Your 401(k) account might be spread across 10 different mutual funds. But if they all own substantially the same stocks, you're not diversified. You have the appearance of diversification without the benefits of diversification.

So, let's talk about the basics of diversification and how to ensure your portfolio actually reaps rewards from doing it the right way.

What is diversification?

The core principle of diversification is that prices of different assets move independently of one another and that holding a broad mix of assets reduces your risk.

For instance, when the stock market declines, bonds may increase in value, or real estate might remain stable.

Diversification also works within an asset class. Large-cap tech stocks such as Apple (AAPL) and Microsoft (MSFT) can both be affected by the general direction of the stock market.

But these are also distinct companies with risks and opportunities specific to their respective businesses. Apple might have a great quarter and see its stock soar at the same time Microsoft has a lousy quarter and sees its stock fall, or vice versa.

Perhaps the most important beneficial impact of diversification is a smoothing effect.

Over time, you get the weighted average return of the individual pieces of your portfolio. But, along the way, you suffer less of the up-and-down volatility.

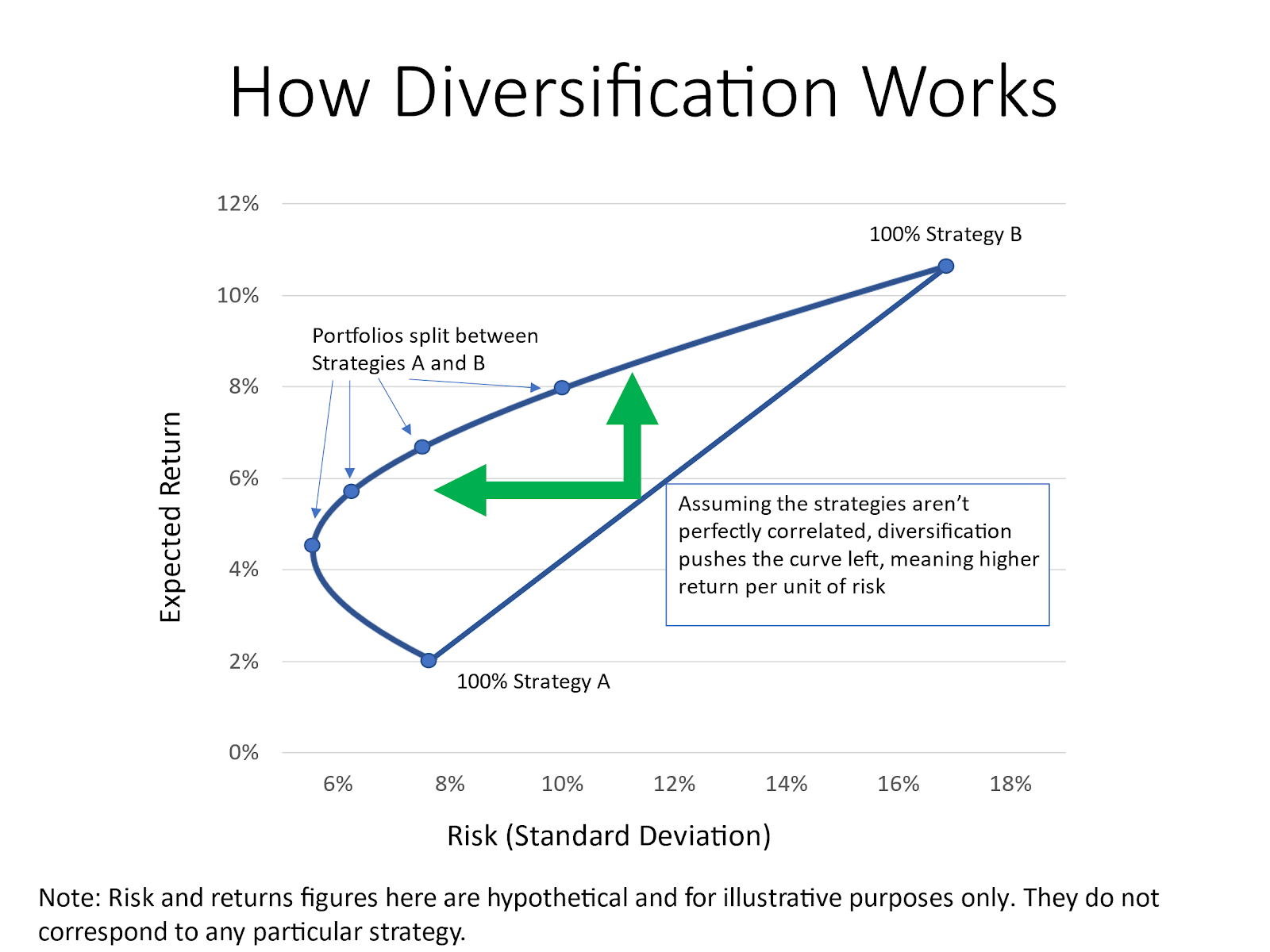

Take a look at the graphic example below. This is for illustrative purposes and does not correspond to any particular strategy.

It shows how diversification increases your return for a given level of risk or lowers your risk for a given level of return.

Strategy A has an expected return of 2% with a risk, or "standard deviation," of 8%. Strategy B has an expected return of 11% with a risk of 16%.

A portfolio split 50-50 between the two will have an expected return of 6.5%, which is the average between 2% and 11%.

But the expected risk won't be the average risk of Strategy A and Strategy B. It will be lower. The straight line gets pushed into a curve.

This is the magic of diversification.

Don't worry if you get lost in the math. The key takeaway is that diversification done right will lower your risk for a given expected return or boost your expected return for a given level of risk.

And the lower the correlation between your assets, the bigger the diversification benefit.

How to check if your portfolio is diversified

So, how do you know if your portfolio is diversified? You can get technical if you're into that sort of thing.

Morningstar, Yahoo Finance, Portfolio Visualizer and a host of other services offer tools that allow you to measure how correlated the assets in your portfolio are and what your portfolio's expected risk and return would be. Your 401(k) provider may offer something similar.

Frankly, folks, you don't need to get all that precise.

In fact, leaning too heavily into the math can give you a false sense of security. Common sense and a couple of basic concepts will likely get you close enough.

One rule of thumb quoted by financial advisers is the "100 minus your age" principle. The idea here is that your allocation to stocks should be roughly equal to 100 minus your age.

If you're 70 years old, you should have about 30% of your money in stocks and the rest in bonds or other safer assets that tend not to move in step with the market.

This is a broad guideline, not an iron-clad law of the universe. Depending on your current wealth, your attitude toward risk and your other sources of income, your ideal number might be higher or lower than that.

You should also diversify within your stock allocation.

As a general rule, you probably don't want more than a couple percent of your portfolio in any single stock. (This rule can bend if you're an aggressive trader, again based on your wealth, your risk tolerance and your objectives.)

An S&P 500 index fund is arguably all the diversification you need, particularly for smaller portfolios. Something like the SPDR S&P 500 ETF Trust (SPY) will give you exposure to a broad swath of America's largest, most dominant companies.

But the S&P 500 isn't the only game in town, and there are stretches of years or even decades at a time when small-cap, mid-cap, real estate and foreign stocks outperform it.

Diversifying with mutual funds or exchange-traded funds that focus on these sectors can potentially reduce your risk and boost your returns over time.

Diversification is a lot like horseshoes and hand grenades: You don't have to hit an exact target.

Close is usually going to be good enough.

Related content

- Kiplinger Interest Rates Outlook: The Fed Pulls Back on Future Rate Cuts

- What Does a Government Shutdown Mean for Stocks?

- How Decentralized Finance Is Reshaping Investment

- Embracing Generative AI for Financial Success

- Five Year-End Strategies You Can't Afford to Miss

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.