Passive Muni Investors: Is Your Strategy Missing the Mark?

Passive investments in municipal bonds are popular, but do they come at a cost? Two recent examples show why an active approach can be more favorable.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

With more than $4 trillion in assets and growing, the municipal bond market is the main engine of public finance, fueling infrastructure, education and essential services nationwide.

Despite its scale and essentiality, the market remains fragmented and heavily influenced by retail investors, resulting in inefficiencies that present opportunities for active management.

Recent market conditions have led to specific trades that appear to offer questionable value for investors compared to alternative options.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While skilled active managers can strategically position portfolios to take advantage of these market conditions, passive strategies, such as many ETFs and bond ladders, may lack flexibility owing to guideline restrictions and static approaches.

California 1- to 10-year bonds priced too highly vs U.S. Treasuries

Investor demand for tax-exempt municipal bonds from California has been exceptionally strong.

This trend is even more evident for bonds with maturities between one and 10 years, as recent trades show yields are lower by as much as 40 basis points compared to similar bonds from other states (compared to general market AAA-rated municipal bonds with the same maturity).

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

Much of the demand stems from California's lofty income tax, from which California municipal bonds can provide relief — investors domiciled in the state benefit from state income tax-exemption, in addition to the federal tax-exemption.

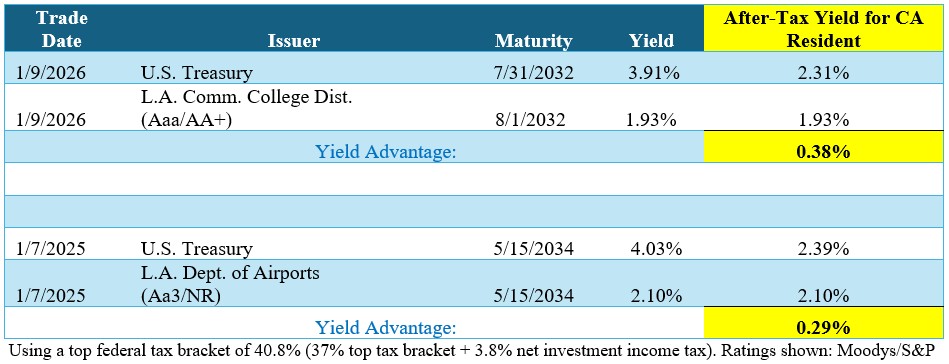

At current prices, U.S. Treasury bonds often provide notably higher yields after-tax than 1- to 10- year California municipal bonds (U.S. Treasuries are federally taxable).

This situation is unusual, as investors typically require higher yields from municipal bonds than the after-tax yield on U.S. Treasuries, owing to Treasuries' liquidity and backing by the U.S. government.

The following municipal bond trades illustrate the yield advantage for California-domiciled investors whose active managers are tactically allocating new capital into Treasuries in lieu of municipals.

For an active manager with the flexibility to tactically allocate into U.S. Treasuries, these municipal bond investments illustrate missed opportunities in capturing additional after-tax yield while taking on less risk, given the deep liquidity and government backing that U.S. Treasuries provide.

Passive municipal bond investing typically focuses on managing portfolios that generate 100% federally tax-exempt income, overlooking the bigger picture. We believe investors should focus on the after-tax yield vs the tax-exempt yield.

Active management with a focus on after-tax yield can produce higher income levels and improve the risk profile and liquidity of a portfolio in certain conditions.

Prioritizing the yield curve over lower credit quality

Lower-rated bonds represent another segment of the market that tends to be less appealing in today's environment.

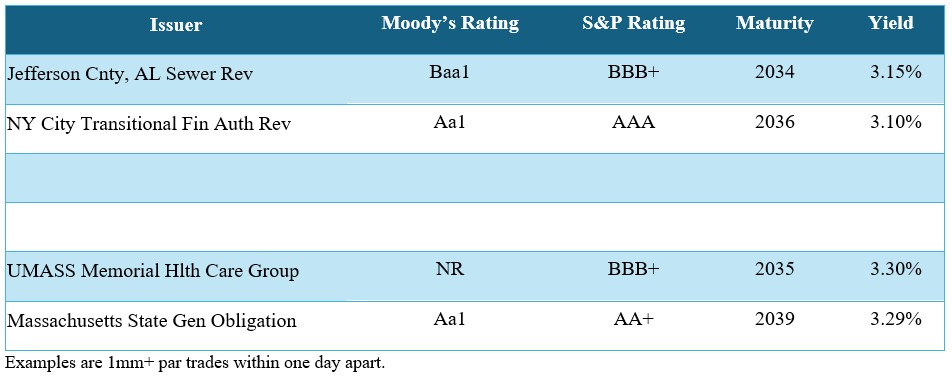

Given the additional credit risk associated with BBB-rated bonds, investors should be compensated with higher yields when compared to higher-rated bonds (e.g., AA).

However, owing to the combination of a steep yield curve and, in our observation, tighter-than-average credit spreads, in certain instances, investors can capture yields in AA- and AAA-rated bonds that are similar to those of BBB-rated bonds by moving only slightly longer in maturity.

This table shows two instances that demonstrate this point.

The yields of the BBB bonds are comparable to those of AA and AAA-rated bonds, with just two years or four years longer maturities in these examples — a compelling value in our opinion, given the six-notch difference in credit rating.

These examples underscore our view that in today's market, unconstrained investors are generally better served by seeking income through high-quality bonds positioned further along the yield curve, rather than undertaking additional credit risk by moving down the quality spectrum.

Conclusion

Given the characteristics of the municipal bond market, we are seeing dislocations occur that provide possibilities for active managers to maximize value for investors.

In more passive strategies, certain transactions may prove suboptimal for the prevailing market environment.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

Passive municipal bond ETFs and similar passive products may limit their responsiveness to evolving market conditions.

For instance, some short-maturity ETFs have over 15% of their portfolio in California bonds despite the rich valuations discussed earlier.

We believe skilled active managers, on the other hand, can adapt to market conditions like those that exist today.

Managers who can move across instruments, maturities and structures, guided by after-tax economics, are better positioned to turn transitory dislocations into lasting advantages.

Peter Aloisi is a fixed income portfolio manager at A&M Private Wealth Partners (AMPWP), where he focuses on tax-advantaged intermediate and short-duration strategies tailored to the unique needs of ultra-high-net-worth clients. Throughout his career, he has enhanced client value by identifying optimal risk-reward opportunities within the municipal bond landscape, leveraging market dislocations across various cycles.

Abdulla Begai is a director and head of Fixed Income Trading at AMPWP and a founding member of the firm. He brings deep expertise in financial analysis, risk management and portfolio construction, combining rigorous analytical skills with intuitive market insight to deliver consistent, risk-adjusted returns. Abdulla specializes in structuring tax-advantaged municipal bond portfolios, blending internal credit analysis with broader market dynamics.

Related Content

- Here's Why Munis Aren't Just for Wealthy Investors Now

- 10 Things You Should Know About Bonds

- This Boring Retirement Income Source Has Big Tax Benefits

- Keep Tax Collectors at Bay with Muni Bond Funds

- Financial Analyst Sees a Bright Present for Municipal Bond Investors

A&M Private Wealth Partners, LLC (AMPWP) is an investment adviser registered with the Securities and Exchange Commission. Registration does not imply any certain level of skill or training. Additional information about AMPWP is available at the SEC's website at www.adviserinfo.sec.gov.

Nothing herein should be construed as an investment recommendation. Nothing herein shall be construed to be a solicitation to buy or offer to sell any security, product, or service to any persons including a non-U.S. investor, nor shall any such security, product or service be solicited, offered or sold in any jurisdiction where such activity would be contrary to the securities laws or other local laws and regulations or would subject AMPWP to any registration requirement within such jurisdiction. The information contained herein reflects AMPWP's views as of the date of this publication and the information and AMPWP's views are for informational purposes only. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. AMPWP has obtained the information provided herein from various third-party sources believed to be reliable but such information is not guaranteed and is subject to unintentional errors, omissions, and changes. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. AMPWP is not responsible for the consequences of any decisions or actions taken as a result of the information provided and AMPWP does not warrant or guarantee the accuracy or completeness of this information. Not all investments are suitable for all investors. Portfolios should also be viewed in the context of the broad market and general economic conditions. Any references to future returns/risk are not promises of the actual return the client portfolio may achieve.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Peter Aloisi is a fixed income portfolio manager at A&M Private Wealth Partners (AMPWP), where he focuses on tax-advantaged intermediate and short-duration strategies tailored to the unique needs of ultra-high-net-worth clients. Throughout his career, he has enhanced client value by identifying optimal risk-reward opportunities within the municipal bond landscape, leveraging market dislocations across various cycles.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Private Capital Wants In on Your Retirement Account

Private Capital Wants In on Your Retirement AccountDoes offering private capital in 401(k)s represent an exciting new investment opportunity for "the little guy," or an opaque and expensive Wall Street product?

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.

-

Fix Your Mix: How to Derisk Your Portfolio Before Retirement

Fix Your Mix: How to Derisk Your Portfolio Before RetirementIn the run-up to retirement, your asset allocation needs to match your risk tolerance without eliminating potential for growth. Here's how to find the right mix.