Winning With SPACs Is a Long Shot

With SPACs, you're betting on companies with short track records and uncertain futures – and relying on someone else to find them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Getting in early on the next Tesla (TSLA) or Netflix (NFLX) is a major selling point of SPACs, or special purpose acquisition companies.

SPACs offer an alternative to traditional initial public offerings (IPOs) and have surged in popularity. But picking a winner is far from a sure thing.

Because of the way SPACs are structured – think of them as "blank check companies" whose sole goal is to acquire early-stage businesses and take them public – it's hard for SPAC investors to assess the merits of what they're buying.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

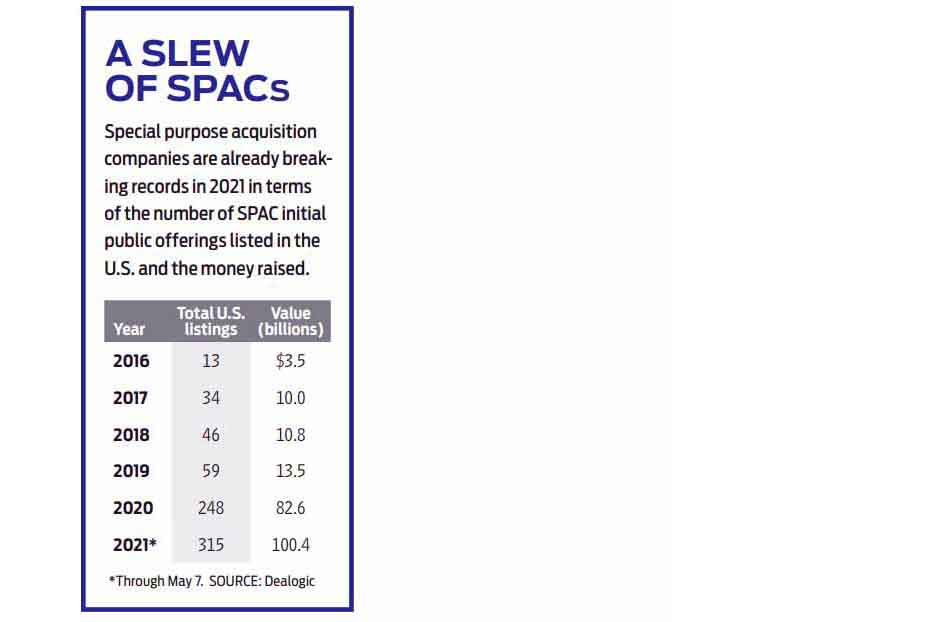

SPAC mania has been driven by cheap money, a soaring market and investors' search for new opportunities. SPACs had a breakout year in 2020, with a record 248 SPAC IPOs, a fourfold rise from 2019, according to data provider Dealogic.

High-profile SPAC IPOs that now trade as regular stocks include sports-betting firm DraftKings (DKNG) and space-tourism company Virgin Galactic (SPCE). (For more on Virgin Galactic, see How to Cash In on the Final Frontier.)

SPACs got off to a hot start this year, with 315 SPACs listed and $100.4 billion raised through May 7, topping full-year records for 2020. So far this year, SPACs account for 41% of all IPOs.

How SPACs Work

When you invest in a SPAC, you're not investing in a company such as Tesla with real products and sales. You're giving your money to a "sponsor," or investment team, who will identify and invest in the next potential Tesla for you. The sponsor has two years to acquire a yet-to-be-identified company. Until a business combination is completed, the money raised from investors is held in a trust account.

SPAC shares trade on an exchange while the sponsor searches for a company to take public, and it’s not uncommon for SPACs to trade sharply higher as investors react to rumors about merger candidates.

If an acquisition target isn't found in the allotted time, the SPAC will liquidate. IPO investors will get back their initial investment, and buyers in the secondary market can redeem their shares at the initial offer price, typically $10 a share, dubbed the pro rata share.

Once a target company is announced, you must decide whether to stay invested in the new, post-merger company, which will trade with its own symbol, or redeem your shares at the pro rata price. You can get burned if you jump into a SPAC at or near a top.

How Have SPACs Performed?

SPAC fever cooled in mid-February, as SPACs sold off with tech stocks and other speculative issues.

"SPACs were exhibiting bubble-like characteristics, and growing pains were likely," says Jason Draho, head of asset allocation Americas at UBS Financial Services. The wipeout has been swift, with some of the worst-performing SPACs and post-merger stocks down 50% to 70% from mid-February through mid-April, according to Bespoke Investment Group.

Regulatory scrutiny hurt, too. The Securities and Exchange Commission recently warned SPACs about issuing misleading sales projections and noted that SPAC sponsors may pursue deals that aren’t in the best interests of investors.

Overall, post-merger performance hasn't been great. Of the SPACs that brought companies public in 2020, the median post-acquisition return trailed the S&P 500 Index by 13 percentage points after one month and by 27 points after six months, according to investment bank Goldman Sachs. SPACs have also underperformed traditional IPOs by a wide margin. A sizable SPAC pipeline may signal a saturated market. In April, there were nearly 400 SPACs seeking acquisitions, Goldman Sachs says.

David Sekera, chief market strategist at Morningstar, thinks most retail investors should steer clear of SPACs. "I don't think this is an appropriate product," he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

What's the Difference Between a Bond's Price and Value?

What's the Difference Between a Bond's Price and Value?bonds Bonds are complex. Learning about how to trade them is as important as why to trade them.

-

Bond Basics: U.S. Agency Bonds

Bond Basics: U.S. Agency Bondsinvesting These investments are close enough to government bonds in terms of safety, but make sure you're aware of the risks.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: U.S. Savings Bonds

Bond Basics: U.S. Savings Bondsinvesting U.S. savings bonds are a tax-advantaged way to save for higher education.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.