Where to Invest for the Rest of 2017

Corporate America is firing on all cylinders, but share prices are high and so are risks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

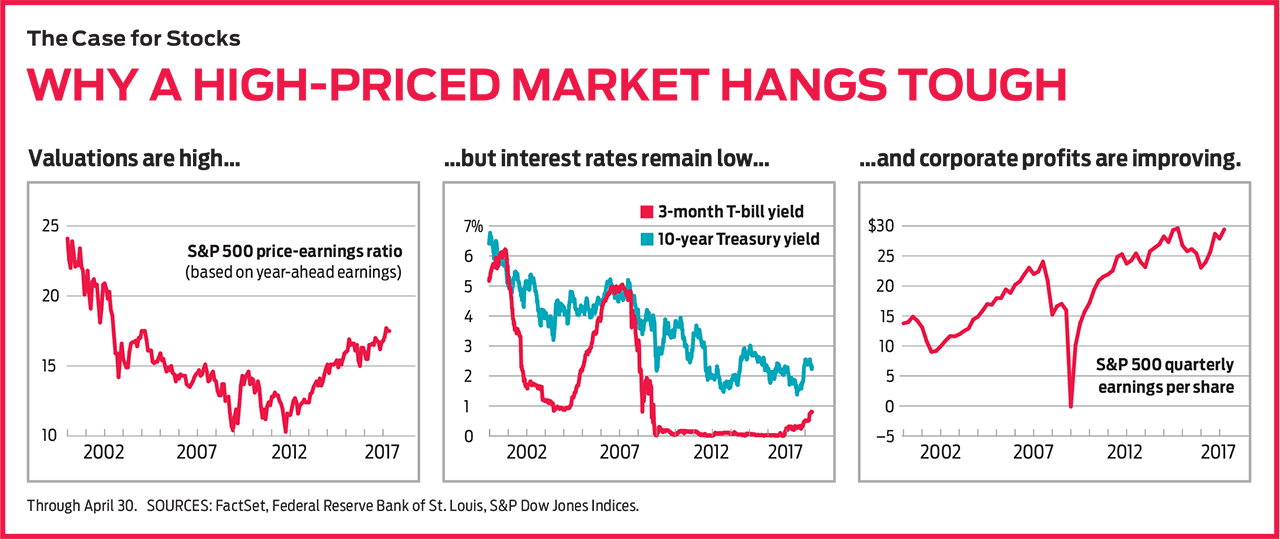

Bull markets become trickiest to navigate just when they start to look easy. Lately, this one has been a breeze. Investors in U.S. stocks have gotten more than a year’s worth of gains in six months, with Standard & Poor’s 500-stock index returning 12.5% since last November’s election, far ahead of the long-term annual average of 10%.

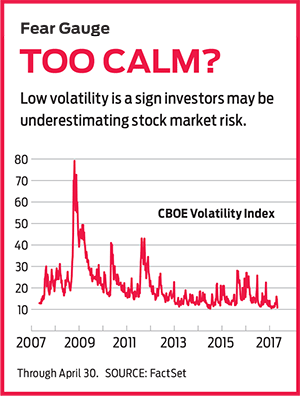

Moreover, the ride couldn’t have been smoother, with volatility levels at a multi-decade low—that is, until crises at the White House boiled over, with worries over mounting investigations of the Trump campaign sending stocks plunging in a one-day rout on May 17. Expect continued political fallout to result in more speedbumps for the market. But skepticism about stocks is, ironically, usually a good sign, and the economy and corporate profits still seem sound.

It’s not surprising that many Wall Street analysts have raised their year-end targets for the S&P 500 as the index has surged past their previous forecasts–and we’re raising ours, too (more on that below). But we’re raising some yellow flags as well. Returns from here to year-end are likely to be tepid and harder to come by. Stocks could continue to tread water for a while, but the market’s tranquility can’t last forever.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Corrections, typically defined as downturns of between 10% and 20%, occur about every two years. The last one, which shaved 13% off the S&P, ended in February 2016. But pullbacks of 5% to 10% occur every seven months or so, which means we’re overdue. As you look toward the end of 2017, it’s crucial to take stock of your investments—what you need to earn and, yes, what you can stand to lose—and to tweak your portfolio accordingly.

Our forecast

In January, we said the S&P 500 could generate a total return, including dividends, of 6% in 2017. In the first four months of the year, it delivered 7.2%. Now, a return of 9% to 11% for the year, including about two percentage points of dividend yield, seems more like it, with the S&P ending 2017 between 2400 and 2450. That suggests a rise in the index of 1% to 3% from its recent close of 2384 and a year-end target for the Dow Jones industrial average of about 21,600, up from 20,941. (Current prices, returns and yields are as of April 30.)

The impressive gains at the beginning of the year portend subpar results for the second half. “You can’t put lipstick on a pig,” says Burt White, chief investment officer of LPL Financial Research. “Stocks aren’t cheap. For the second half, being disciplined and buying on dips will be the strategy to employ.” Think beyond a portfolio of U.S. stocks and bonds. Investors who will do best in this market will be nimble, discerning bargain hunters and, above all, willing to venture overseas.

At eight years and counting, this bull market will become the longest ever, surpassing the great technology-fueled advance of the 1990s, if it remains intact until September 2018. Although stretched by any measure, the market has been remarkably resilient, and for good reason. Investors today can benefit from a rare period of sustained, synchronized economic expansion across the globe. “Growth is picking up in the U.S., Europe and in Asia, the first time we’ve seen all three major global regions rising at the same time,” says Richard Turnill, global chief investment strategist at BlackRock Investment Institute, the investment firm’s research arm. The International Monetary Fund forecasts world economic growth at 3.5% in 2017, the fastest rate in five years and up from 3.1% in 2016.

In the U.S., a pro-business agenda in Washington that calls for lower corporate tax rates and less regulation has lifted animal spirits. The Conference Board’s quarterly survey of CEO confidence and the National Federation of Independent Business’s Small Business Optimism index are both at their highest levels since 2004. Business spending on workspaces and equipment, missing for much of the economic recovery, is sure to follow, says Tobias Levkovich, chief U.S. stock strategist for Citigroup. “Capital spending is stronger than people think,” he says. Lack of spending in the beleaguered energy sector has been the biggest drag, but exploration and production companies expect to spend 40% more this year than last year, Levkovich says, and tech companies that Citi tracks say their capital spending will be up 16%.

Consumer confidence measures are also the highest since the early 2000s, which bodes well because consumer spending accounts for roughly 70% of the U.S. economy. At 4.4%, the unemployment rate is at the lowest level since May 2007, and wages are ticking higher. “Consumers have been very disciplined coming out of the financial crisis, saving money and repairing their own balance sheets,” says Ameriprise Financial strategist David Joy. “They have the capacity to provide steady support to this economy, without overspending, for a few years.”

The current U.S. expansion, which began in June 2009, has been much longer than usual. That’s because it has been punctuated by “rolling recessions” that roil industries one at a time instead of plunging the overall economy into a downturn, says economist Ed Yardeni, of Yardeni Research. The energy industry, for example, fell into a severe recession from mid 2014 until early 2016 as oil prices plunged. More recently, the recession has rolled into brick-and-mortar retailers, as department stores struggle against incursions from online merchants and warehouse clubs. With March vehicle sales down more than 10% from December 2016 and car-loan delinquencies rising, the auto industry may be next in line for hard times, Yardeni says. Yet the overall economy remains buoyant, if not ebullient: Kiplinger expects gross domestic product to increase by 2.1% in 2017, up from growth of 1.6% in 2016.

Central bank policies, here and abroad, remain supportive of economic growth. In the U.S., the Federal Reserve is raising rates, but oh-so-gradually and with an eye toward not upsetting the stock market. Look for the Fed to hike its key short-term interest rate two more times this year (including a boost expected in June), bringing the total increase for the year to three-fourths of a percentage point. The yield on the benchmark 10-year Treasury bond will end the year at 2.7%, up from the current yield of 2.3% and still providing little competition for stocks.

Corporate earnings—an important determinant of share prices—are having a growth spurt. “We’re in one of the strongest earnings seasons we’ve seen in many years,” says Turnill. First-quarter profits for S&P 500 companies increased by nearly 15% from the same period in 2016, the fastest growth rate since the third quarter of 2011. For all of 2017, Wall Street analysts predict earnings growth of more than 11%, a big improvement from 2016, when earnings were flat compared with the previous year. Look for the biggest earnings gains in the energy, materials, financial and tech sectors, according to a survey of analysts’ estimates from Thomson Reuters.

Little wonder confidence is through the roof. The question is whether investors have crossed the line from confidence to euphoria. Levkovich doesn’t think so. “We’re not seeing excessive enthusiasm that would indicate people getting over their skis. If we did, I’d become a little more nervous,” he says.

An expensive market

Still, stock prices in relation to earnings, sales and other measures of corporate performance are sky-high. At nearly 18 times expected earnings for the coming four quarters, stocks are trading above the five-year average P/E of 15 and the 10-year average of 14, according to FactSet Research. “When stocks have relatively low P/E ratios, investors can absorb some disappointments,” says James Swanson, chief investment strategist at MFS Investment Management. Today, stocks are priced for perfection, and risks abound. “One of the biggest risks is that investors aren’t pricing in risk. There’s a lot of complacency,” says Lance Humphrey, manager of global multi-asset portfolios for USAA Investments.

Consider some of the bleaker scenarios that could derail the market. Economic data over the coming months might fail to justify the sharp improvement in sentiment. Or, says Turnill, “the anti-growth part of President Donald Trump’s agenda (protectionism) could win out over the pro-growth part (deregulation and tax cuts).” Tax reform will be a challenge in any case, facing opposition from Democrats as well as from Republican deficit hawks, with the potential for adverse investor reaction high if it fails. A misstep by the Federal Reserve—tightening monetary conditions too aggressively or failing to adequately telegraph policy changes—could choke off economic growth and slam markets. Finally, there’s the risk of escalating conflict in Syria or North Korea. But as scary as that sounds, history has shown that geopolitical crises tend not to have a severe or long-lasting impact on stock markets.

The takeaway for investors, especially those with a long-term view: Don’t shy away from the market based on short-term concerns. If you’re skeptical of that advice, talk to someone who shunned stocks after Britain’s vote to exit the European Union last year or in the wake of surprise U.S. election results—and thereby missed huge subsequent gains. “Could we have a correction?” asks Robert Doll, chief stock strategist at Nuveen Asset Management. “Sure. But the next sustainable move in my view is up.”

Nonetheless, investing wisely for the rest of 2017 may require you to step outside your comfort zone. Most investors have a home-country bias, and U.S. investors, on average, hold almost 80% of their stock portfolios in U.S. shares. That strategy has paid off handsomely in recent years. Now, investors should aim to have 30% of their stock holdings in foreign shares, with at least one-third of that amount in emerging markets, says Brian Nick, chief strategist at TIAA Investments.

You might have to steel yourself. Stocks in Europe, in contrast to U.S. holdings, have stagnated, with the MSCI Europe index returning a mere 0.4% annualized over the past 10 years. But the tables have already started to turn in Europe’s favor, says USAA’s Humphrey, who sees more opportunities on the Continent than in Japan. The index has gained 11.2% so far this year. “Valuations are attractive, earnings are picking up and, on the economic front, more positive data are coming from Europe,” he says. Corporate earnings growth in Europe is expected to be twice that in the States, coming in at 22% for 2017, while stocks in the MSCI Europe index are trading at just 15 times expected earnings.

The risks in Europe center on politics and a populist movement that could weaken the European Union, hampering trade and economic growth. For now, after the victory of the moderate candidate in the French election in May, growth expectations outweigh political uncertainty, with years of economic recovery still to play out and corporate profits well below peak 2007 levels. “The earnings trajectory makes Europe more interesting,” says Vincent Montemaggiore, manager of Fidelity Overseas Fund (FOSFX). He seeks top-quality companies that are out of favor or underpriced. The fund has 67% of its assets in Europe (including the United Kingdom), with an emphasis on financials, industrials and health care stocks. Top holdings include multinational giants Nestlé, Unilever and Bayer.

Investors who prefer exchange-traded funds can explore Vanguard FTSE Europe ETF (VGK, $54), which invests in companies of all sizes across 15 developed-market countries and charges just 0.10% annually. If you’re worried about dollar appreciation eroding your overseas gains, consider WisdomTree Europe Hedged Equity ETF (HEDJ, $65), which takes currency swings out of the investing equation.

The dark clouds hanging over emerging markets in recent years—falling commodity prices, a rising dollar and fears of a sharp slowdown in China—have parted, say strategists at J.P. Morgan Asset Management. Emerging economies should grow at a brisk 4.5% this year and 4.8% next year, compared with 4.1% in 2016, according to the IMF. In the meantime, many countries have adopted pro-business reforms, says Michael Kass, manager of Baron Emerging Markets Fund (BEXFX), a member of the Kiplinger 25. “We’re in the middle innings of a notable earnings recovery across virtually all emerging markets,” he says. Kass favors high-quality, fast-growing companies and finds India an especially promising hunting ground.

Bond investors should check out Fidelity New Markets Income Fund (FNMIX), a Kip 25 fund that specializes in emerging-markets debt. Yielding 5.4%, it holds a mix of government and corporate bonds, with large stakes in Mexico, Brazil and Venezuela.

In the U.S., decisions should be about what to avoid or where to trim, as much as about what to buy. Shares of utilities, producers of staples (such as food and toothpaste) and real estate trusts have been prized for their dividend yields, but investors can find better buys elsewhere, says TIAA’s Nick. Income investors might consider trimming outsize stakes in junk bonds, as their premium yields have moved closer to those of investment-grade debt.

As for what to buy in a bond market in which everything is expensive and so much is in flux, pay extra attention to funds that have the flexibility to buy debt instruments in all kinds of markets. Let a pro shift gears based on how much rising rates would eat into a bond’s price, how a tax cut might dim prospects for municipal bonds, or how currency gyrations could affect foreign bonds. Pimco Income (PONDX), another Kip 25 fund, has a global reach and a defensive mind-set. The fund yields 3.7%. Kip 25 selection Metropolitan West Total Return (MWTRX) has a conservative profile and yields 2.0%.

Within the stock market, shares that are bargains in relation to earnings, sales and other criteria have lagged their faster-growing counterparts this year, after so-called value stocks sprinted ahead following the presidential election. “Value is down, but not out,” say strategists at Bank of America Merrill Lynch. Value investing tends to do well when the economy is growing, rates are rising, and corporate profits are powering ahead. Mark Finn, manager of Kip 25 member T. Rowe Price Value (TRVLX), recommends health care giant Johnson & Johnson (JNJ, $123), which is benefiting from an aging population; insurer Chubb (CB, $137), which has a global footprint and strong growth prospects; and semiconductor maker Broadcom (AVGO, $221), which sells at a relatively modest 15 times expected year-ahead earnings.

In general, stocks that thrive when the economy is improving, including financials, tech and industrials, should perform well in the second half. You can also find buys in health stocks, which have been buffeted by concerns about insurance reform and controls on drug pricing. ETFs worth exploring include Financial Select Sector SPDR (XLF, $24), Vanguard Information Technology (VGT, $139) and Guggenheim S&P 500 Equal Weight Health Care (RYH, $164). All are members of the Kiplinger ETF 20.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.