Stock Market Outlook for 2015

A conflicted bull market may be experiencing a late-life crisis, but it’s not headed for a total breakdown yet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Bull markets don’t always age gracefully. This one may be entering its golden years beset by uncertainties and buffeted by crosscurrents. Toward the end of 2014, a long period of calm gave way to increasing volatility, and you can expect more of the same in 2015 as the sedative of an ultra-easy monetary policy finally starts to wear off. During this year of adjustment, the market will move less as a cohesive whole as sectors and stocks splinter off in their own directions—in the same way a robust U.S. economy is decoupling from stagnation in Europe and slowing growth in China. Your returns will depend on selecting the right companies in the right markets, rather than relying on a broad-based approach. “Anticipate a lower return trajectory, a bumpier ride and a narrower advance, with more companies getting left behind,” says money manager Gary Pzegeo, at Atlantic Trust Private Wealth Management.

Investors up to the challenge will be rewarded in 2015. We expect broad U.S. stock market indexes to rise by high-single-digit percentages, but the advance will be more erratic than usual. That would put the Dow Jones industrial average near 19,000 and Standard & Poor’s 500-stock index in the vicinity of 2200 at their peaks, up some 9% from recent levels. Add in two percentage points of dividend yield, and U.S. stocks could deliver a total return of 11% or so over the next year. That said, “whether we finish the year still in a bull market is up for debate,” says Jim Stack, of InvesTech Research, a money-management and stock-research firm. He notes that the current bull, which will celebrate its sixth birthday in March, is already the fourth-longest in 80 years. (All prices and returns are as of October 31.)

But for now, the bullish case is not only intact, it’s strong. A vibrant stateside economy will provide strong support for U.S. stocks, while Europe’s woes will create some compelling bargains. (For more, see 25 Stock Picks for 2015 and Bargains in International Stocks and Funds for 2015.) Analysts expect earnings growth in 2015 of 8% to 10%, on average, for companies in the S&P 500. With shares in the broad market selling at 16 times estimated 2015 earnings, prices of U.S. stocks carry a slight premium, but are nowhere near the peak levels of past market tops. And plenty of themes—from lower oil prices to a rising dollar to a stronger consumer—could pay off for investors in 2015.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

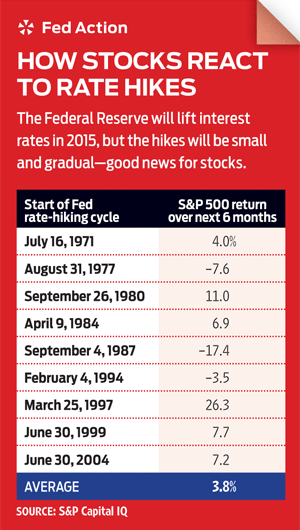

As has been the case throughout this bull market, much of the Sturm und Drang will come from the Wall Street parlor game of Guess What the Fed Will Do. The Federal Reserve Board’s bond-buying program has ended, and the central bank will likely raise short-term interest rates in the second half of 2015. The surprise might be that the hikes turn out to be benign for both the stock market and the bond market, if, as we expect, they commence late in the year, and if the increases are more gradual and modest than in past tightening cycles. Moreover, even with the Fed pushing short-term rates higher, any increase in long-term rates will be subdued by expectations for low inflation and high demand for the safety of U.S. assets, given geopolitical unrest and a lack of competition from even lower yields in Japan and Europe. (For more on the bond market, see Income Investors, Don't Fret About Higher Interest Rates.)

Still, higher rates have the power to knock the stock market for a loop. Says Stack: “I’m not dreading the first rate hike from the Fed, whenever it occurs. Bull markets almost never end with the first rate hike. At the same time, I recognize that most economic recoveries falter in a monetary climate of rising rates, tightening credit and/or a falling dollar.” He expects to keep a heavy allocation to stocks at least through early 2015. But if bond yields run up sharply or the Fed hikes rates early, he’ll boost cash reserves and shift to more-defensive stock holdings, such as companies that make the stuff we use every day—cereal, soap, toothpaste and the like. Investors should bear in mind that since 1972, shares of companies in the consumer-staples, health care, telecommunications and energy sectors have delivered the best results during periods of rising rates—although low oil prices may pose a challenge for energy stocks this time around.

Oil's double-edged sword

Beyond interest rates, the bull is being pushed and pulled, sometimes simultaneously, by a variety of other developments. Many of the dynamics driving stocks today can be characterized as double-edged swords, so investors must take care to be on the right side. Take the drop in oil prices, which, says Bank of America Merrill Lynch, is an economic lubricant or an oil slick, depending on your perspective. The price of a barrel of West Texas Intermediate crude has fallen almost 25% since its recent peak, in mid June. The downside is that a big part of the drop is due to weak demand from struggling overseas economies, which could eventually threaten growth here, too. Energy production, and profits, will likewise be jeopardized if the slump is prolonged or deepens significantly. A recent tally by FactSet Research found that analysts have already lowered profit estimates for energy companies over the coming 12 months by nearly 7%, the most for any sector.

But the bad news is offset by the windfall for big energy users—think transportation and chemical concerns, for instance. Companies that make paint, varnishes and similar substances are a prime example, says Saira Malik, a portfolio manager at TIAA-CREF. Costs for oil-based raw materials will fall, but prices for the finished products tend to keep steady, making for plumper profit margins. Malik recommends PPG Industries (symbol PPG, $204), whose brands include Glidden paint as well as automotive finishes and industrial coatings. Lower oil prices deliver a twofer to Goodyear Tire & Rubber (GT, $24): Profit margins expand because of declining material costs, while lower gas prices encourage drivers to put more miles on their tires. S&P Capital IQ rates the stock a “strong buy.”

Gas below $3 a gallon is icing on the cake for consumers, who are enjoying a much-improved job market and the first signs of accelerating wage growth. And they spend roughly 5% of their disposable income on energy, according to government figures. “Consumer spending has been pent up for years,” says Linda Duessel, a strategist at Federated Investors. “Lower energy prices put more money in our pockets, and that’s bullish.” Money saved could give retailers a lift, especially those serving low- and middle-income consumers. Possible winners include The TJX Cos. (TJX, $63), whose stores sell designer apparel and household goods at a discount, and Wal-Mart Stores (WMT, $76).

Not all lower-oil-price winners are cashing in, though. For travel- and leisure-related businesses such as airlines, cruise operators and hotels, the good news on oil has been tempered by scares of a global Ebola pandemic—call it a crosscurrent within a crosscurrent in this mercurial market. Because of Ebola worries, travel stocks lost far more than the general market during the September–October pullback. That’s exactly the kind of jumpiness that gives investors a crack at good companies on the cheap, says Malik. She likes the hotel industry. Growth in the supply of rooms has been low, allowing occupancy rates to remain at peak levels and operators to hold prices firm. Her pick: Marriott International (MAR, $76).

[page break]

Intrepid bargain hunters might look for buys among energy stocks themselves, which dropped 8.5% from August 1 through October 31. Although oil could dip to as low as $75 per barrel, Kiplinger sees it edging back up to $85 to $90 early in 2015. “This is not a bad time to get into quality companies to own for the long term,” says USAA portfolio manager Bernie Williams. Service providers such as Halliburton (HAL, $55) and Schlumberger (SLB, $99) have been beaten up more than they deserve, he says. Investors who want to bet on more than one stock might look at Market Vectors Oil Services ETF (OIH), an exchange-traded fund that concentrates its holdings in behemoths that dominate the field.

The strong dollar is another two-sided coin. The greenback (or the Sacagawea) has climbed 10% since it started to spike against a basket of currencies last May. The dollar should continue to strengthen, albeit more gradually, as the Fed moves toward higher interest rates and central banks abroad cut rates. A beefier buck is “confirmation that the U.S. economy is doing better than the rest of the world,” says John Toohey, who directs stock investments for USAA. It attracts foreign investors, who can convert their dollar-denominated winnings into more of their local currencies. It boosts spending power for both U.S. consumers and companies, as imports become cheaper and energy costs go lower—because oil and many other commodities are priced in dollars. By helping to keep a lid on inflation, a stronger dollar gives the Fed more leeway to raise rates slowly.

By contrast, a stronger dollar hurts U.S. exporters, whose goods are less competitive overseas, and multinational companies, whose overseas earnings translate into fewer dollars here. The latter is the bigger problem because 46% of sales for S&P 500 companies come from abroad. Coca-Cola (KO, $42), McDonald’s (MCD, $94), International Business Machines (IBM, $164) and United Technologies (UTX, $107) are among the companies that have blamed a strengthening dollar for weakening profits. (See 8 Stocks to Buy for 2015.)

The best way to take advantage of Uncle Sam’s currency clout is with companies that derive the bulk of their sales here at home. That’s one reason Toohey recommends CVS (CVS, $86), the drugstore chain and pharmacy benefits manager: It derives 100% of its revenues in the U.S. Companies that generate most of their sales in the U.S. and that are rated attractive by Bespoke Investment Group include insurer Allstate (ALL, $65), health care benefits provider UnitedHealthCare Group (UNH, $95) and steelmaker Nucor (NUE, $54).

In general, you’ll find a higher percentage of domestic revenues among smaller companies. But small-capitalization stocks are hardly in the bargain bin—even though they badly lagged their blue-chip brethren in 2014, rising just 2% year-to-date, compared with 11% for the S&P 500. Moreover, small caps are often not the best choices in the later stages of economic recoveries and bull markets. So some experts think large-cap stocks will continue to dominate in 2015 as investors hew to high-quality names.

But a tilt toward U.S.-focused businesses and a pickup in merger activity are pluses for small caps. Janney Capital Markets, which specializes in small-cap stocks, sees plenty of opportunity. Top picks include Agile Therapeutics (AGRX, $7), which produces a promising contraceptive patch; Krispy Kreme Doughnuts (KKD, $19), which is seeing improving sales trends at company-owned stores in the U.S.; Mueller Water Products (MWA, $10), which is benefiting from an uptick in municipal water-infrastructure projects; and theater chain Regal Entertainment (RGC, $22), on the strength of what’s shaping up to be a strong slate of films for 2015.

Some themes that have supported the bull all along should continue to do so in 2015. Companies with the wherewithal to boost dividend payouts are far from played out. Companies in the S&P 500, which yields 2%, are paying out roughly 30% of earnings—well below the historical average of 54%. Vanguard Dividend Growth (VDIGX), a member of the Kiplinger 25, is a low-cost fund that invests in companies that raise their dividends consistently.

Health care was one of the market’s top-performing sectors in 2014. And yet Leuthold Group chief investment officer Doug Ramsey reckons that the group’s price-earnings ratio compared with the P/E of the S&P 500 is at a relatively low historical premium, making the sector a bargain. “It’s a similar story on relative valuations with tech,” he says. Consider Gilead Sciences (GILD, $112), the biotech giant whose stock rocketed 49% in the first 10 months of 2014. With a promising hepatitis C drug and a stock that trades at just 11 times estimated 2015 earnings, Gilead is a steal, says USAA’s Williams. Good choices for fund investors include Vanguard Healthcare (VGHCX) and iShares Nasdaq Biotechnology (IBB). Investors who want to beef up their technology holdings should consider Fidelity Select IT Services (FBSOX) and T. Rowe Price Media and Telecommunications (PRMTX).

Here’s a closing thought: This is a 12-month outlook. But market strategist Kelly Bogdanov, at RBC Wealth Management, finds the view promising for years to come. We might be in the midst of the kind of bull market that could last 10 years, or even longer, she says. The last so-called secular bull ran from 1982 to 2000 (though it did include two relatively minor bear markets). Setbacks are inevitable. “But if you think you’re in a secular bull, it’s best to give the market the benefit of the doubt.” Let’s hope she’s right.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.