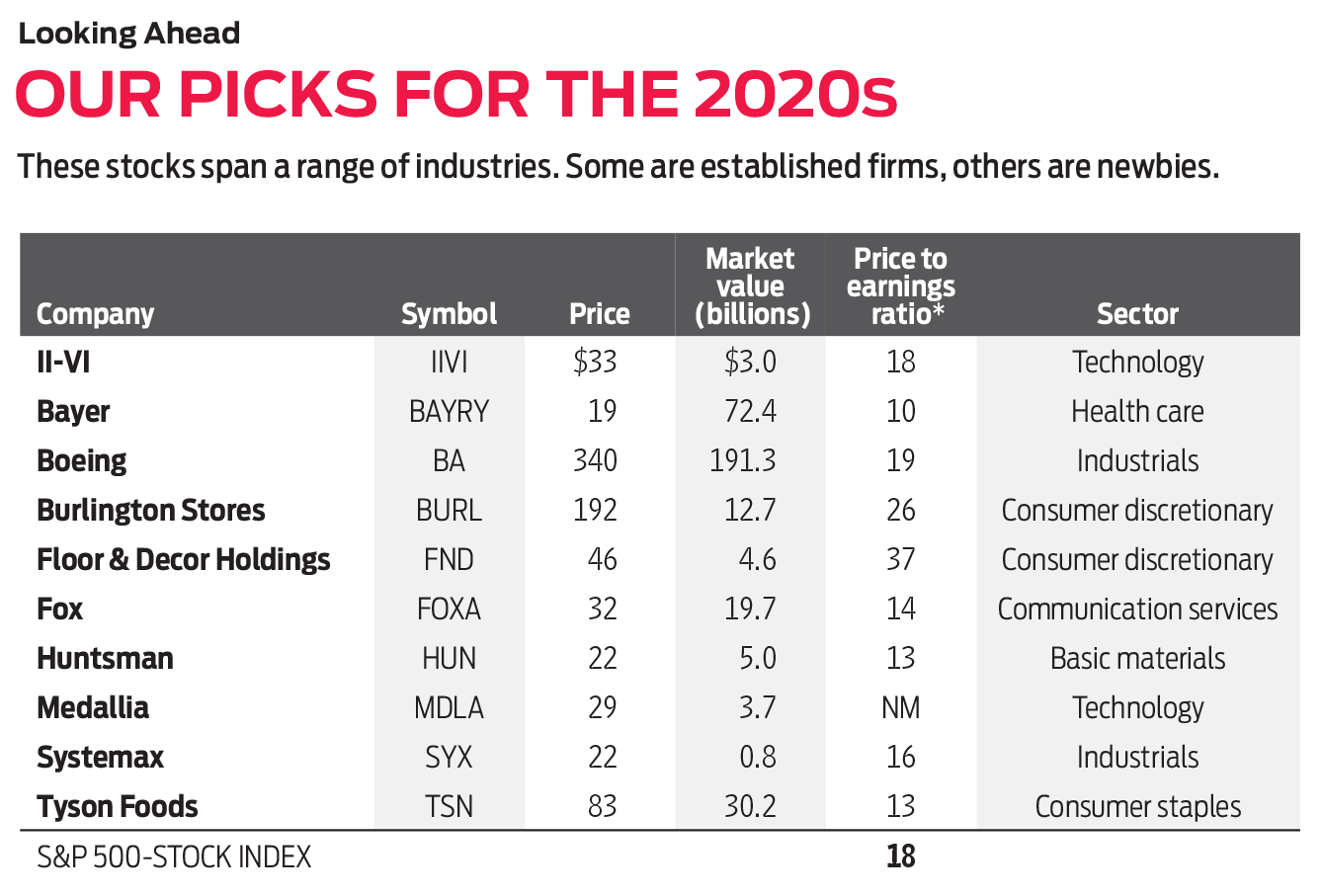

10 Stocks for the Next 10 Years

These firms are positioned to deliver robust returns for years to come.

Picking the 10 best stocks for the next decade out of thousands of companies would require psychic powers that we do not possess. But you don't need a crystal ball to see that the stocks below are positioned, for reasons we describe, to deliver robust returns for years to come. Some are established firms, others are small, potentially meteoric growers. We think all could beat the broad stock market by the end of 2029. Prices and other data are through October 31.

II-VI (symbol IIVI, $33)

II-VI (pronounced "two-six") develops and manufactures materials and products such as lasers, crystals and fiber-optic equipment; industrial, defense and semiconductor companies are among its customers. The stock has languished since late 2018, when the firm announced plans to acquire Finisar, an optical-communications firm that creates components such as the one that helps iPhones perform facial recognition. The $3.2 billion deal closed in September, and II-VI management says it should produce $150 million in annual cost savings within three years. Execs say the companies' combined technologies give II-VI solid footing in fast-growing businesses such as self-driving cars and biometric security. That could boost the potential market for the firm's products to $22 billion a year by 2022, a 20% annualized growth rate from today's levels. Needham Growth fund comanager Chris Retzler says the firm "will continue to evolve and produce cutting-edge products" for the next several years. Wall Street analysts expect the firm to boost earnings 12% this fiscal year, which ends in June 2020.

Bayer AG ADR (BAYRY, $19)

Pharmaceutical and agricultural technology firm Bayer acquired fellow agricultural giant Monsanto in 2018, and in doing so opened itself to legal risks related to weed killer Roundup. As plaintiffs alleged health side effects for users, investors dumped Bayer's stock, which is now dirt-cheap. The shares (which trade in the U.S. as American depositary receipts) trade at only 10 times estimated earnings for the year ahead, a significant discount to their five-year average price-earnings ratio of 23. The firm is likely to settle the lawsuits for less than investors first anticipated, says Oakmark International fund manager David Herro. In the meantime, investors have a bargain-priced entry point into a business with best-in-class agricultural technology—producing seeds, pesticides and digital monitoring systems that enable farmers to yield more from their crops using fewer resources. "The growing population is going to continue to consume, arable land will continue to shrink, and technology is what is needed to feed a hungry world," says Herro. The firm's health care business (48% of sales) should continue to grow as well, he says, with a strong pipeline of meds to back current blockbusters such as blood thinner Xarelto and macular degeneration treatment Eylea.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Boeing (BA, $340)

It's no secret why Boeing stock is trading 24% below its 52-week high: The firm's 737 Max aircraft, which suffered two fatal crashes over the course of five months, is still grounded. The tragedy has taken a bite out of Boeing's 2019 earnings. But a fix is in the works, and it's only "a matter of time" before the aircraft receives approval to begin flying again, says Monetta Fund comanager Bob Bacarella. In the meantime, Boeing has a backlog of more than 5,500 commercial aircraft orders—contracts worth nearly $500 billion—that Morningstar analyst Joshua Aguilar expects will boost sales and expand margins through the next decade. The firm's aerospace division will also benefit from continued increases in U.S. military spending, Aguilar says. Plus, Boeing is expanding its services business, which provides support, spare parts, modifications and data analytics, among other things, for existing aircraft. Boeing expects that segment to generate $50 billion per year in sales by 2027, up from $17 billion in 2018.

Burlington Stores (BURL, $192)

Burlington dropped "Coat Factory" from its name in 2015 and now sells discounted brand-name clothing, home goods, gifts, beauty products and toys at its nearly 700 stores. "Burlington is following the Ross Stores and T.J. Maxx playbook, and so far, it has been very successful," says T. Rowe Price Diversified Mid-Cap Growth fund comanager Don Easley. That Burlington trades at a slight premium to other discount retailers is warranted, given that the firm is opening more stores and posting faster growth in same-store sales (sales at stores open for more than one year) than its peers. Analysts at investment research firm William Blair expect the retailer to boost earnings per share by 13% in 2020—more than its competition.

Floor & Decor Holdings (FND, $46)

Retailer Floor & Decor sells flooring, including tile, wood and laminate surfaces, at 113 stores nationwide. The firm disrupts the flooring business on two fronts, says Baron Discovery fund manager Laird Bieger: It sidesteps distributors and buys its materials straight from producers, so it typically offers lower prices than its competition, he says. And the big-box size of Floor & Decor's stores allows them to keep more inventory in stock than competitors. That's especially important to flooring professionals, who account for 60% of the retailer's sales and don't want to wait for orders to ship from a distributor, says Bieger. Floor & Decor has been buying out mom-and-pop shops and expanding its store locations at a 20% annual rate over the past three years. Overall revenues have grown at an average annual rate of 30% over the same period. Trading at 37 times estimated earnings, the stock isn't cheap. But analysts at investment firm Wedbush say the premium is justified given prospects for 20% annualized growth in new stores long-term, as well as "major" profit margin expansion.

Fox (FOXA, $32)

This isn't the big, old Fox. Disney bought 74% of the firm in 2019, including the film studio, the FX channel and Fox's stake in streaming service Hulu. What remains is "New Fox": Fox News, Fox Sports, Fox Business, affiliate news stations, a share in the streaming platform Roku and the Fox studio lot, currently leased to Disney. Like most TV and cable companies, Fox makes money from advertising, distribution and licensing fees for its programs. Fox is betting that its news and sports programs, which viewers tend to watch live, will be less affected by the trend of viewers cutting the cord and streaming content digitally. The stripped-down Fox boasts "all-star" executives, says Yacktman fund comanager Jason Subotky. The firm is financially healthy and small enough—with a $20 billion market value—for smart investments to impact returns. Fox recently invested $236 million in a partnership with the Stars Group, a Canadian gambling firm, to launch Fox Bet, an online sports betting service that will operate in 13 states where sports gambling is legal. Should sports gambling become legal nationwide, the business could take off. Wall Street expects a dip in earnings this fiscal year, which ends in June 2020, followed by a 23% boost next year.

Huntsman (HUN, $22)

Chemical producer Huntsman is in the midst of a transformation. The company is ditching bulk sales of commodity chemicals (widely available compounds), a business prone to boom-and-bust cycles, in favor of its more predictable, higher-profit specialty chemical operation. The company recently inked a deal to off-load two commodity chemicals units for $2 billion in cash—a major influx for a company with $5 billion in market value. Company execs have shed unprofitable businesses and paid down debt to improve the firm's balance sheet. This year, credit-rating agencies upgraded Huntsman to an investment-grade, triple-B rating after years in junk territory, citing the firm's commitment to keep debt levels manageable, among other reasons. With shares trading at 13 times estimated year-ahead earnings, investors have yet to appreciate the changes at the firm, says Royce Special Equity fund comanager Charlie Dreifus. Following an expected dip in earnings growth in 2019, analysts at investment bank UBS expect the firm to boost earnings at an annualized 24% clip through 2023. The shares yield 2.9%.

Medallia (MDLA, $29)

Investors will need a speculative bent to take a chance on Medallia, a tech firm fresh off its July 2019 initial public offering. The firm isn't expected to produce profits for at least another two years. But Medallia is a leader in the "experience management" market, which represents $68 billion in potential revenues overall. Only 1% of that market is currently being served, according to investment research firm Stifel. Medallia sells subscriptions to its cloud-based software platform, which uses artificial intelligence to help insurance, hotel, auto and media firms assess customer and employee satisfaction. To gather feedback, its technology culls language from sources such as social media, travel blogs and interactions with the internet of things. This form of aggregating opinions is rapidly replacing the old method of asking users to fill out surveys. Baron Funds' Bieger, whose fund owns the stock, says the firm is investing heavily in sales and marketing, and he expects Medallia to boost revenues at an annualized percentage rate in the mid to high 20s for the next five years.

Systemax (SYX, $22)

Systemax is a direct marketer of industrial and business equipment and supplies, selling everything from personal computers to pallet jacks (used in warehouses to lift and move wooden pallets). In recent years, the company has sold off its struggling overseas businesses to focus on its core of U.S. distribution, unearthing "a gem of a business," says Grandeur Peak Global Contrarian fund comanager Keefer Babbitt. He says Systemax's well-trained sales staff, easy-to-use website and efficient warehouses allow the firm to offer superior service to small and midsize businesses. And CEO Barry Litwin, who took over in January 2019, has energized the firm with new initiatives, among them efforts to streamline the firm's distribution network. Systemax carries $96 million in cash on its debt-free balance sheet, money that Babbitt says the firm could use to make an acquisition or invest in growth projects. He expects Systemax to boost sales at an annualized rate in the double-digit percentages over the next five years.

Tyson Foods (TSN, $83)

Tyson, one of the world's largest suppliers of beef, pork and chicken, stands to benefit from misfortune on the other side of the globe. African swine fever has killed more than 20% of China's pork herd and may force an even greater cull. It's an unfortunate development, but CFRA analysts say it could kick off a multiyear boost in Tyson's pork sales starting in 2020. The company's meat business already stands to gain over the next decade from the growing global middle class, which will drive exponential increases in protein demand, says T. Rowe Price Value fund manager Mark Finn. Meanwhile, Tyson is also expanding its prepared-foods business (currently 21% of sales), which comes with higher profit margins and is less susceptible than the meat business to swings in commodity prices. The shares trade at 13 times year-ahead earnings, below the average multiple of 17 for the food and meat products sector.

<

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Stock Market Today: Stocks Step Back From New Highs

Stock Market Today: Stocks Step Back From New HighsInvestors, traders and speculators continue the low-volume summer grind against now-familiar uncertainties.

-

Ask the Editor — Tax Questions on the New Senior Deduction

Ask the Editor — Tax Questions on the New Senior DeductionAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the new $6,000 deduction for taxpayers 65 and older.

-

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

If You'd Put $1,000 Into Procter & Gamble Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Procter & Gamble Stock 20 Years Ago, Here's What You'd Have TodayProcter & Gamble stock is a dependable dividend grower, but a disappointing long-term holding.

-

My Three-Day Rule for Investing: And If it Applies Now

My Three-Day Rule for Investing: And If it Applies NowStock Market I've seen a lot in my career. Here's what I see now in the stock market.

-

Is It Time to Invest in Europe?

Is It Time to Invest in Europe?Stock Market Europe is being shaken out of its lethargy, militarily and otherwise, by Donald Trump's changes in U.S. policy. Should investors start buying?

-

Why Is Warren Buffett Selling So Much Stock?

Why Is Warren Buffett Selling So Much Stock?Berkshire Hathaway is dumping equities, hoarding cash and making market participants nervous.

-

If You'd Put $1,000 Into Google Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Google Stock 20 Years Ago, Here's What You'd Have TodayGoogle parent Alphabet has been a market-beating machine for ages.

-

Stock Market Today: Stocks Retreat Ahead of Nvidia Earnings

Stock Market Today: Stocks Retreat Ahead of Nvidia EarningsMarkets lost ground on light volume Wednesday as traders keyed on AI bellwether Nvidia earnings after the close.

-

Stock Market Today: Stocks Edge Higher With Nvidia Earnings in Focus

Stock Market Today: Stocks Edge Higher With Nvidia Earnings in FocusNvidia stock gained ground ahead of tomorrow's after-the-close earnings event, while Super Micro Computer got hit by a short seller report.