James Glassman’s Top Stock Picks for 2020

Nvidia may be the best artificial intelligence play. The stock has bounced off its June low but still offers excellent value.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

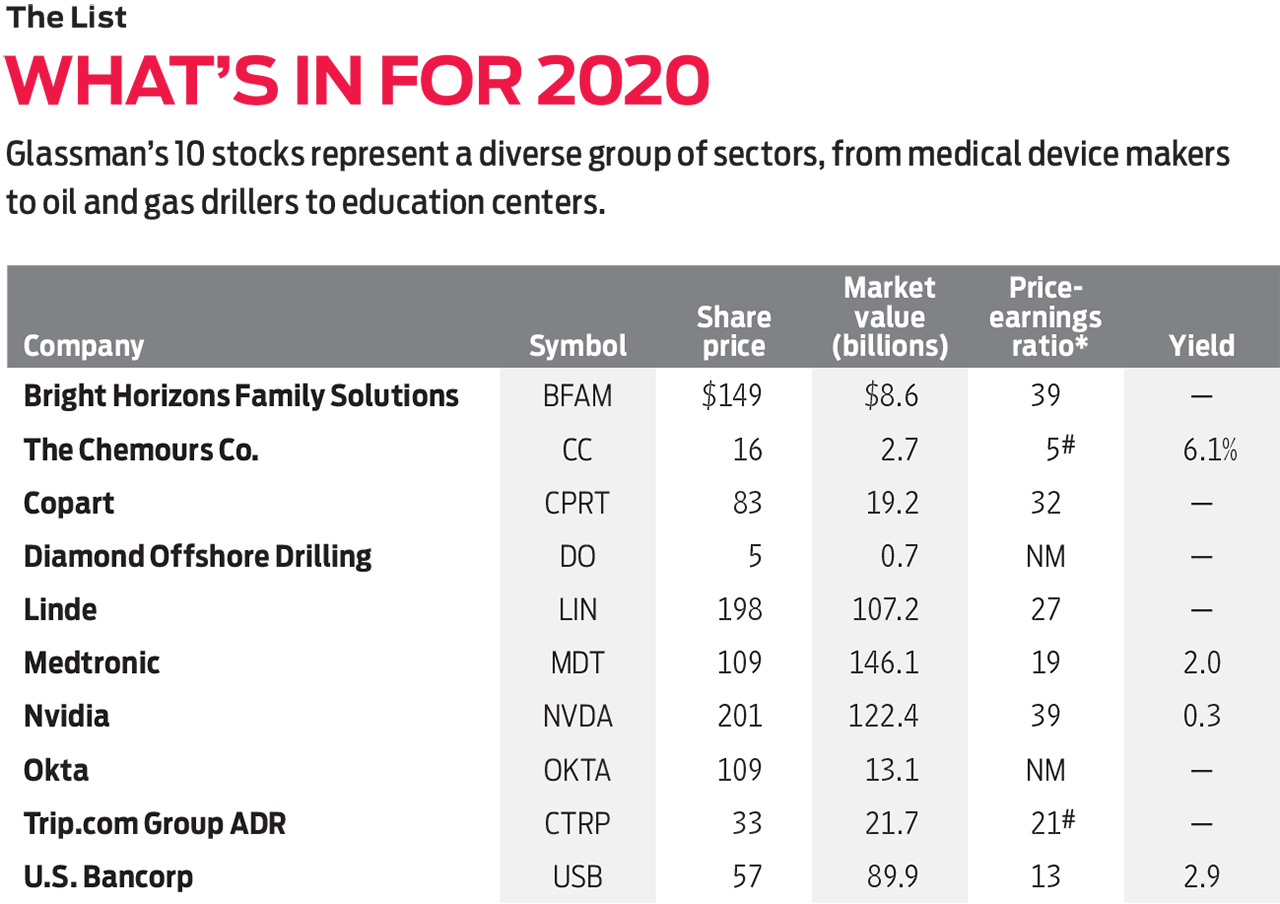

My annual stock choices beat Standard & Poor's 500-stock index for the fourth year in a row in 2019, and the margin was pretty spectacular, if I do say so myself. For the 12 months ending October 31, 2019, my picks returned, on average, 30.0%, compared with 14.3% for the S&P. But as I reminded readers last year, don't get too excited about my forecasting ability. No one beats the market consistently.

Since 1993, I have drawn nine selections for the year ahead from experts and added a choice of my own. The big winner for 2019, returning 112.1%, was Coupa Software (symbol COUP), which connects businesses with suppliers. It was the choice of Terry Tillman, an analyst with a golden touch at SunTrust Robinson Humphrey. His picks on my list have beaten the S&P for eight years in a row. Among his recent recommendations, I like Okta (OKTA, whose software verifies and manages the identity of people seeking online access to company websites—a valuable corporate defense against hacking. Okta went public in 2017 and now has a market value of $13 billion. The company still hasn't turned a profit, but revenues are soaring.

Another successful regular on the list is Jerome Dodson, founder of Parnassus Endeavor (PARWX), my favorite fund in the socially responsible investing category. The Dodson pick for 2019 was Starbucks (SBUX), up 47.6%. A year ago, Dodson took advantage of a big price drop and began acquiring shares of Nvidia (NVDA), the giant maker of processors for applications that include PC gaming and artificial intelligence. In fact, Nvidia may be the best AI play. The stock has bounced more than 50% off its June low, but it still offers excellent value.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Despite China's tariff strife with the U.S., I remain an advocate of Chinese stocks—especially those that don't depend on selling manufactured goods abroad, such as Trip.com Group (CTRP), the company formerly known as Ctrip.com International that is called the "Expedia of China." It serves a nation crazy for travel. The stock is trading well below its 2017 highs, with a price-earnings ratio, based on estimated 2020 earnings, of 21—lower than its historically high P/E levels. Trip.com is one of the top 25 holdings of my favorite Asian stock mutual fund, Matthews China (MCHFX).

Daniel Abramowitz, of Hillson Financial Management, in Rockville, Md., is my go-to guy for small-capitalization value stocks. For the year ahead, he likes The Chemours Co. (CC), a chemical manufacturer that DuPont spun off in 2015. Major products include titanium dioxides, which give brightness and hardness to porcelain enamels, and Opteon, a refrigerant with environmental advantages over Freon. Chemours soared in price the first few years after the spin-off, then ran into operating problems that Abramowitz believes are temporary. Chemours, he says, "is a well-run, shareholder-friendly business, and the stock is unreasonably depressed after a sharp sell-off." It's certainly cheap. The P/E is just 5.

Last year, I highlighted Artisan Thematic Investor (ARTTX), barely a year old, as "a mutual fund worth watching." My selection from its portfolio, IHS Markit (INFO), returned a delightful 33.3%. Linde (LIN), a major supplier of industrial gases including nitrogen and oxygen, is a recent acquisition and the fund's seventh-largest portfolio holding. The company was formed in 2018 through a merger of the German firm Linde AG, and the U.S. giant Praxair. Since then, it has performed exceptionally—with more to come.

The Value Line Investment Survey is an invaluable resource that packs tons of information into a small space. Last year's highly rated choice from Value Line was Home Depot (HD), which returned 36.3%. For 2020, I looked at Value Line's 20-stock model portfolio for aggressive investors and found a single stock with the top ranking for both timeliness and safety. That stock is Medtronic (MDT), which makes cardiac pacemakers and other medical devices. Medtronic's earnings have increased year over year for more than a decade in what I call a beautiful line. This stock is as solid as it gets.

Whatever your religion, pay attention to a mutual fund called Ave Maria Growth (AVEGX), which, according to its website, is part of the largest Catholic mutual fund family in the U.S. and places "equal emphasis on investment performance and moral criteria in selecting securities." Whatever Ave Maria is doing, it's working. The fund has returned an annual average of 12.7% over the past five years, compared with 10.8% for the S&P 500. The largest holding, as of September 30, was Copart (CPRT), which runs online vehicle auctions, mainly selling damaged cars on behalf of insurance companies. It's a great business; Value Line projects earnings will rise at an annual average of 17.5% for the next five years. The stock has more than quadrupled in three years, but even with a P/E of 32, based on estimated earnings for the next four quarters, it doesn't appear overpriced to me.

My usual modus operandi is to let the previous year's big winners be this year's pickers, but for 2020, I'm giving Warren Buffett, chairman of Berkshire Hathaway (BRK-B), a second chance. His choice for 2019 was U.S. Bancorp (USB), which returned a mediocre 12.0%. Buffett has been adding to his holdings of USB and now owns 8% of America's fifth-largest bank (more than any other shareholder), so I'm putting it down here as a 2020 pick, too. Earnings have been rising consistently for the broadly diversified bank, and the stock is yielding nearly 3%, or roughly twice the yield of a five-year Treasury note.

T. Rowe Price New Horizons (PRNHX), one of the original small-cap and (now mostly) mid-cap growth funds, celebrates its 60th anniversary next June. It beat the Russell Midcap Growth index, Morningstar's benchmark for the fund, in nine of the past 10 years (including 2019 through October 31). The fund is currently closed to new investors, and a new manager arrived last March, but you can check out the portfolio for investing ideas. The top holding as of September 30 was, appropriately, Bright Horizons Family Solutions (BFAM), which runs child care and early education centers as well as providing college-entrance advisory services. It's an impressive business, and, though the stock is not cheap, it's down from its highs of last summer.

My personal pick for 2019 was The New York Times Co. (NYT), which returned 17.8%. I still like it. But for 2020, I have decided to search for bargains by checking out market strategist Ed Yardeni's regular sector review. The worst category for 2019 has been energy, especially oil and gas drillers such as Diamond Offshore Drilling (DO), which was trading above $25 a share in 2016. But Diamond's majority shareholder is Loew's (L), which is flush with cash and run by the savvy Tisch family. I am willing to wait for the inevitable rebound in energy prices. With shares trading at these prices, Diamond looks like a very good bet.

Here are my usual warnings: These 10 stocks vary in size and industry, but they are not meant to be a diversified portfolio. I expect they will beat the market in the year ahead, but I do not advise holding shares for less than five years, so consider these long-term investments. And most of all: I am just offering suggestions here. The choices are yours.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Nvidia Earnings: Updates and Commentary November 2025

Nvidia Earnings: Updates and Commentary November 2025Nvidia reported fiscal 2026 third-quarter earnings and the leader of the AI revolution delivered the goods once again.

-

I'm 55 With 10 Years Until Retirement, and I've Made $2 Million on Nvidia Stock. What Do I Do with It Now?

I'm 55 With 10 Years Until Retirement, and I've Made $2 Million on Nvidia Stock. What Do I Do with It Now?What do you do with all that appreciated Nvidia stock? We asked a financial expert for advice.

-

Trump's Economic Intervention

Trump's Economic InterventionThe Kiplinger Letter What to Make of Washington's Increasingly Hands-On Approach to Big Business

-

Nvidia Earnings: Updates and Commentary August 2025

Nvidia Earnings: Updates and Commentary August 2025Nvidia reported solid fiscal second-quarter earnings showing that AI demand is going strong.