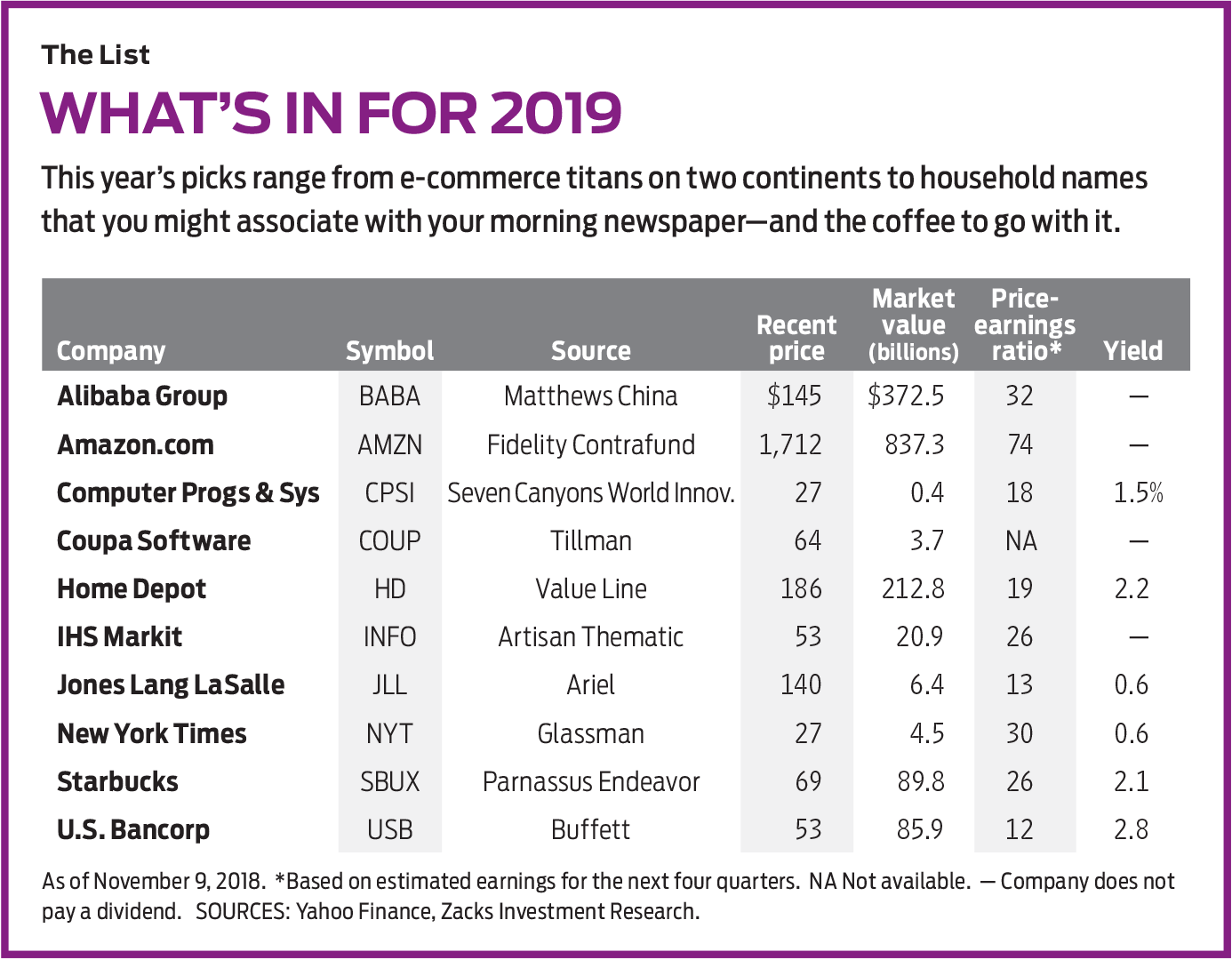

James K. Glassman's Top 10 Stock Picks for 2019

I am making a contrarian pick: the New York Times. The industry is said to be dead. But the Times is figuring out how to make money.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For the third year in a row, my 10 annual stock choices beat Standard & Poor’s 500-stock index. Since we published the 2018 list, the picks have returned, on average, 15.5%, or 5.3 percentage points more than the S&P 500. Don’t get too excited about my forecasting ability. No one beats the market consistently.

Let me brag, however, about one selection. Every year for more than two decades, I have drawn up the list by choosing among the selections of experts, and lately I have been throwing in a stock of my own. This year, for the first time, that personal stock pick ranked number one among the 10. It was Lululemon (symbol LULU), the athletic clothing maker and retailer—up 123.6%. According to tradition, that gives me the first choice this time. (Prices and returns are from October 31, 2017, through November 9, 2018.)

For the 2019 list, I am making a contrarian pick: the New York Times (NYT). I know, according to President Trump, the Times is “failing,” and the industry is said to be dead. But the Times is figuring out how to make money, mainly by raising prices for digital and paper subscriptions and by creating advertising opportunities with products such as a brilliant daily podcast. The Value Line Investment Survey notes that earnings have fallen at an annualized rate of 20% for the past five years but are estimated to rise by an average of 42% annually for the next three to five years. The company has almost no debt. The market value (share price times shares outstanding) is just $4.5 billion—for what’s probably the best newspaper brand in the world. The only drawback is that the stock has doubled since Donald Trump’s election, but shares still trade at about half of what they did in 2002.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Terry Tillman, a software analyst at SunTrust Robinson Humphrey, continued his incredible streak in 2018, beating the S&P for the seventh year in a row. His pick, HubSpot (HUBS), a marketing platform to convert website visitors into customers, returned 56.4%. This year, among his “buy” recommendations is Coupa Software (COUP), which connects businesses with suppliers and manages procurement, billing and budgeting. Coupa is risky, with profits only on the verge of showing up. The company says revenues for the 12 months ending January 31, 2019, will be up about one-third over 2018.

London-based IHS Markit (INFO), which provides data and analytics to financial, transportation and energy firms, is one of the most respected companies in a burgeoning 21st-century sector. It is a top holding of Artisan Thematic (ARTTX), a mutual fund worth watching. Barely a year old, the fund has returned a sparkling 23.8% for the past 12 months, thanks to the stock picking of Christopher Smith, who has worked for some of the best hedge funds in the world. The fund is not cheap, with a 1.57% expense ratio. But you are free to scan the fund’s top holdings on its website or the websites of trackers such as Morningstar.

Wasatch World Innovators, one of the best performers on my lists in 2017 and 2018, got a new investment adviser in September and changed its first name to Seven Canyons. But it didn’t change its lead portfolio manager (Josh Stewart) or its symbol (WAGTX). Stewart, who searches for mid- and small-cap technology stocks, has scored an annual average return of 15.9% over the past 10 years. Although his fund’s portfolio is dominated by foreign stocks, surprisingly high on the list of holdings is Alabama-based Computer Programs and Systems (CPSI), a provider of software for community hospitals. A micro cap with a market value of just $373 million, the stock has a great niche and a price-earnings ratio of just 18, based on the consensus of analysts’ earnings forecasts for 2019.

Amazon is the classic buy-the-dip stock, and I still trust Will Danoff.

Fidelity Contrafund (FCNTX), with Will Danoff at the helm since 1990, is the best mutual fund in the world. Danoff has whipped the S&P soundly over the past two years, but for my 2018 list I chose Facebook (FB), the number-one asset in his portfolio at the time, and it fared poorly. For 2019, I am going with the fund’s new top holding, Amazon.com (AMZN). Third-quarter earnings disappointed investors, who marked the stock down in the fall. But CEO Jeff Bezos doesn’t care about short-term profits. He wants to grab market share. This is the classic buy-on-the-dip stock, and I still trust Will Danoff.

My interview with John Rogers Jr., founder of Ariel Fund (ARGFX), convinced me that value investing is alive and well, despite its lagging growth-oriented strategies for so long. Rogers likes bargain-priced companies based in his hometown of Chicago, and he has owned one such firm, Jones Lang LaSalle (JLL), since 2001. Jones Lang, a global property management company, has suffered due to worries that the commercial real estate market may be weakening. Shares plunged from $172 in July to $127 in October, before rebounding some, making them attractive to value mavens.

Only a handful of stocks gain the top ratings for timeliness and safety as well as for financial strength from the Value Line Investment Survey. One is Home Depot (HD), the powerhouse home-improvement retailer whose stock has risen in what I call a beautiful line, with earnings per share increasing every year since 2009. Over the next three to five years, Value Line projects that Home Depot’s profits will rise 12.5% annualized and the dividend, now $4.12, will roughly double.

Micron Technology (MU), the selection from Parnassus Endeavor (PARWX) for my list of favorites for 2017, returned 158%. But United Parcel Service (UPS), the 2018 choice from Parnassus, by far my favorite socially conscious investment fund, was a clunker. No one, not even Parnassus founder Jerome Dodson, wins them all. This year, I’m turning to a major acquisition Dodson made in June: Starbucks (SBUX), the global coffee-shop chain. Shares have languished for three years, and the company is facing strong domestic competition. But the market in China is perking up, and the stock yields 2.1%. I almost made Starbucks my own choice for 2019; it’s reassuring that Dodson likes it so much.

We get a glimpse every quarter, in federal filings of Berkshire Hathaway, of what chairman Warren Buffett is buying. The latest report shows that the best investor of our time added no new names but increased his stake in U.S. Bancorp (USB). Morningstar notes that, unlike money-center banks, U.S. Bancorp is “primarily funded by low-cost core deposits from the communities it serves.” The bank has been lagging its peers in share-price gains but boosting its dividend aggressively. The stock yields 2.8%.

Tariffs are roiling Chinese markets, so this is a time to consult a fund that knows the region well. The top holding of Matthews China (MCHFX), at 10% of assets, is a stock unlikely to be affected by trade troubles: Alibaba Group (BABA), which runs China’s most popular online marketplaces. Because of worries about the Chinese economy, shares are down more than 30% since June despite the company’s sharply rising revenues, presenting what looks like a good buying opportunity.

I’ll conclude with my usual warnings: These 10 stocks vary in size and by industry, but they are not meant to be a diversified portfolio. I expect the stocks to beat the market in the year ahead, but I do not believe in holding shares for less than five years, so think of these as long-term investments. I am just offering suggestions here. In the end, the choices are yours.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. Of the stocks recommended in this column, he owns Amazon.com. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.