Dividend-Paying Stocks: An Investor's Swiss Army Knife

You can add current income, capital appreciation and tax advantages to your portfolio with this one type of investment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tradeoffs are a fact of life. Every time we make a decision, we weigh the positives and negatives of one choice against another. And even though we go through that sometimes painstaking exercise, there are times when the choice we make doesn't fully eliminate the desire we had for the option we didn't choose.

Consider the tradeoffs your hypothetical friend made when she decided where to vacation this summer. She always loves going to the mountains, but this year she was equally interested in spending a week in New York City. The mountains offer beauty, peacefulness, nature and solitude. The city offers activity, entertainment, museums and great restaurants. This year the vacation in the mountains won, but that doesn't mean she isn't still dreaming about a meal at her favorite restaurant or that she's stopped wishing she'd gone to see "Hamilton."

As an investor, you may feel like you've had to make tradeoffs along the way. You probably worked with your financial adviser to choose investments that offered you the potential for the income, appreciation and tax benefits you needed to help you achieve your goals. Of course, no one investment does it all. That's one of the main reasons you're diversified.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But one investment, over the long-term and through all types of markets, has delivered a number of the benefits you've been seeking. What is it? Dividend-paying stocks.

Dividend-paying stocks

As she prepared for her journey, your friend focused on packing light. She knows that the less weight she has to carry, the easier it will be for her to focus her energy on the task at hand. So instead of taking along a number of heavy tools, she opted for one that has many uses: a Swiss Army knife.

Like a Swiss Army knife, dividend-paying stocks provide investors with a number of benefits—three, in particular, that may eliminate the need for tradeoffs. They include:

1. Current income that may grow over time

Historically, investors have purchased equities, or stocks, which represent proportional ownership in a company, hoping their shares will appreciate in price as the company becomes more profitable. But stocks may deliver other benefits as well. As companies prosper and mature, they often decide to share some of their profits with shareholders in the form of cash dividends, though this is not guaranteed. Like bond interest payments, cash dividends represent a current form of income. Unlike bond interest payments, which remain fixed for the life of the bond, cash dividends paid to equity shareholders may grow over time.

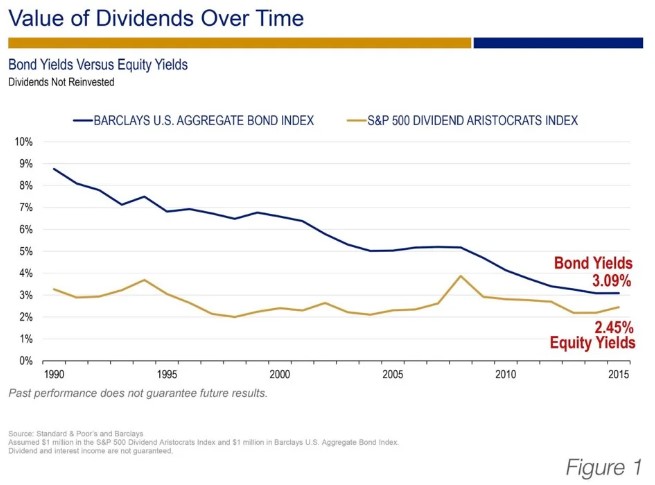

For many years, investors have lived in a declining interest-rate environment. Figure 1 (above) demonstrates that between 1990 and 2015 bond yields, as illustrated by the yield on the Barclays U.S. Aggregate Bond index (composed of approximately 8,000 publicly traded bonds including U.S. government, mortgage-backed, corporate and Yankee bonds weighted by the market value of the bonds in the index), dropped from a high of nearly 9% to 3.09%. Over the same period, equity yields, as illustrated by the dividend paid on the Dividend Aristocrats index declined from just over 3% to 2.45%. The Dividend Aristocrats Index includes large cap, blue chip U.S. companies within the S&P 500 Index that have consistently increased their dividends for the past 25 years.

If you're an investor who invests for income, this declining interest-rate environment is challenging and disappointing. But, before you toss in the towel, take a look at Figure 2 (below).

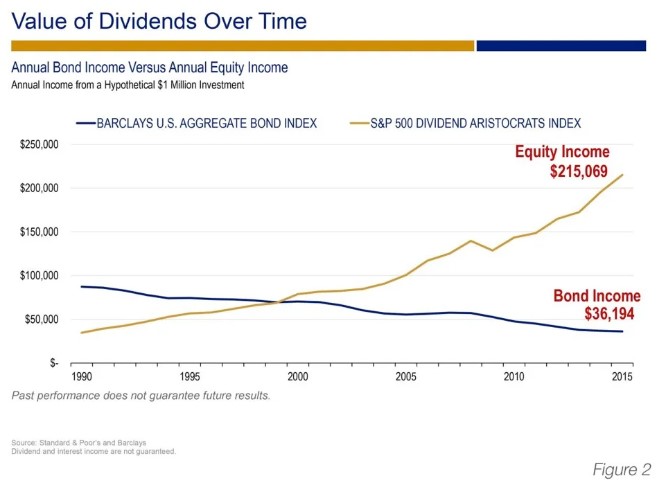

Instead of focusing on what's happened with yields as a percentage, Figure 2 shows the amount of income a hypothetical investment (investors may not make direct investments into any index) of $1 million in the Barclays U.S. Aggregate bond index or the Dividend Aristocrats Index would have generated over the same time period as Figure 1.

As the chart illustrates, the income generated from that hypothetical $1 million investment in the Barclays bond index would have dropped from about $90,000 per year in 1990 to just under $37,000 in 2015, while the dividend-paying stocks within the dividend index would have increased from approximately $30,000 in 1990 to slightly more than $215,000 in 2015.

2. Potential capital appreciation

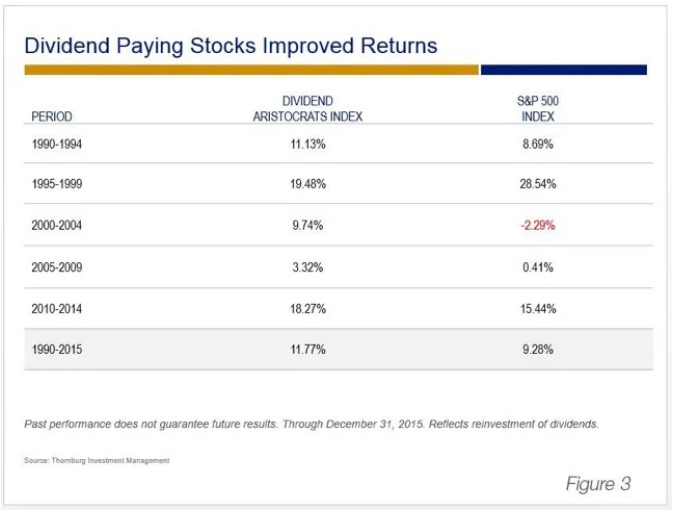

In addition to possibly generating a current income stream that has the potential to grow over time, dividend-paying equities also provide investors with the opportunity to grow the value of their investment over time. Figure 3 (below) compares the total return of the Dividend Aristocrats and the S&P 500 Index during different time periods. When you compare the returns in each of the periods, the stocks in the Dividend Aristocrats outperformed the stocks in the S&P 500 during every period except the five years between 1995 and 1999 (which was a time of rampant speculation that drove the prices of many stocks to unsustainable levels).

3. Potential tax-advantaged income

Finally, according to the United States Internal Revenue Code, cash dividends investors receive from equities may qualify to receive tax-advantaged treatment. As a result, ordinary cash dividends paid to shareholders that meet specific criteria may be taxed at the lower long-term capital gains tax rate rather than at the higher rate that's applied to an individual's ordinary income. It should be noted that everyone's tax situation is different and this should not be considered tax advice. You should consult your tax advisor for personal tax concerns.

None of this means you should have a portfolio that is comprised entirely of dividend-paying stocks, but it does mean that dividend-paying stocks are a very versatile investment that you may have previously overlooked. Tradeoffs may be a fact of life, but when it comes to investing, you may not have to make as many as you originally thought.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jan Blakeley Holman is director of advisor education at Thornburg Investment Management. She is responsible for identifying and creating advisor education programs that support financial advisors as they work with their clients and prospects. Jan has spent more than four decades in the financial services industry. Over the course of her career, she’s served as a financial advisor, an advisor to financial advisors and a financial services corporate executive. Visit Thornburg’s website to enjoy more of Jan’s articles and podcasts.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.