American Century Equity Income Focuses on Value

This fund chooses high-quality but overlooked stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

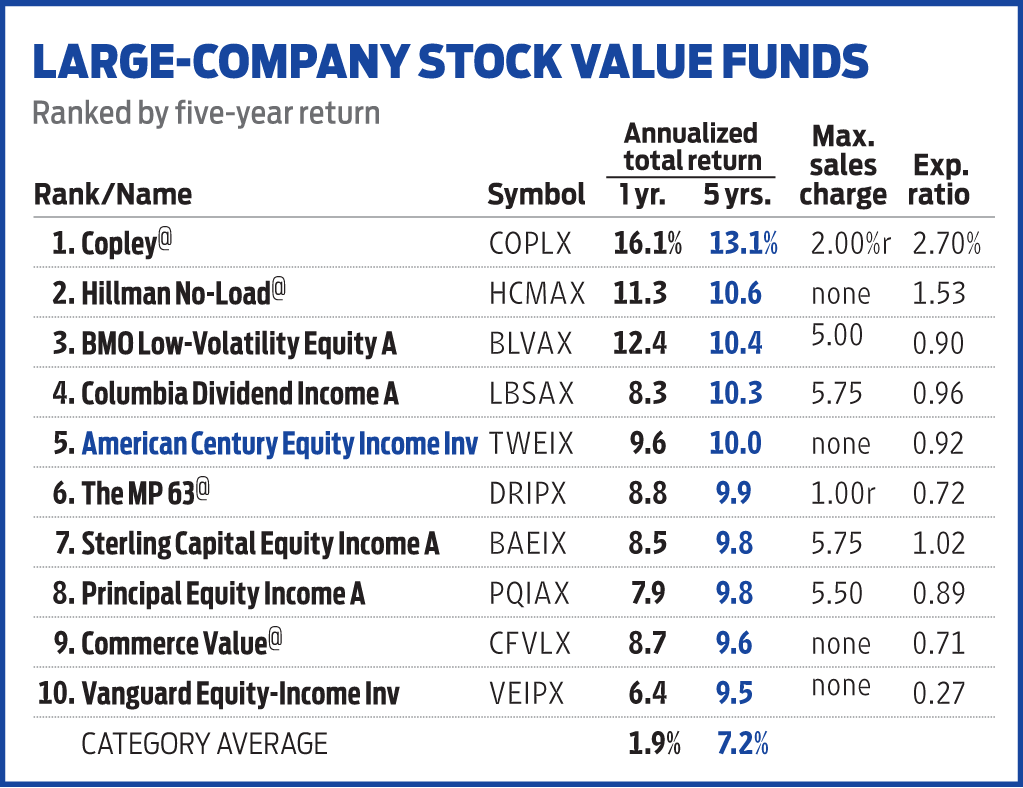

Famed Hollywood director Howard Hawks is said to have defined a good film as one with three good scenes and no bad ones. The management team behind American Century Equity Income (symbol, TWEIX) takes a similar approach when it comes to undervalued large-company stocks. "Any value index will have stocks that do poorly and go to zero. If you avoid those firms that are significantly impaired or that have poor balance sheets, you'll do better than the index with less volatility," says comanager Phil Davidson. The fund's strategy goes beyond filtering out losing firms, but its performance reflects that basic tenet. Over the past 15 years, the fund's 8.2% annualized return beat that of its benchmark Russell 3000 Value index by 0.4 percentage point. Over the period, Equity Income was 33% less volatile than the benchmark and 29% less volatile than the broad stock market. (Returns are through September 30.)

The avoidance of stock market horror shows and a focus on high-quality, dividend-paying stocks have led to the fund's superior downside performance. For instance, the fund lost only 39.2% during the 2007–09 bear market, when Standard & Poor's 500-stock index plunged 55.3%. More recently, the fund surrendered 13% during the S&P's near-20% downdraft in late 2018.

The fund's four comanagers and 15 analysts favor financially healthy firms that trade cheaply relative to measures such as earnings and free cash flow (cash profits left over after capital outlays). Top holdings include medical device maker Medtronic (MDT), telecom giant Verizon (VZ) and PNC Financial Services Group (PNC).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The managers further tamp down volatility by allocating nearly 20% of assets to preferred stocks, convertible securities and bonds, all of which tend to be less volatile than common stocks. These investments also help boost the fund's yield, which currently stands at 2%.

The value-oriented fund has lagged the broad stock market over the past decade, a period that has seen fast-growing stocks outperform undervalued names. "But investors looking for a diversified portfolio with sustainable yields will appreciate our fund's ability to hold up in tougher markets," says Davidson.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Stock Market Today: Stocks Gain to Start the Short Week

Stock Market Today: Stocks Gain to Start the Short WeekStocks struggled for direction Tuesday, though Intel made a beeline higher on M&A buzz.

-

Best Long-Term Investment Stocks to Buy

Best Long-Term Investment Stocks to BuySome of the best long-term investment stocks include companies that are in good financial standing, pay consistent dividends and buy back their own stock.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.