How Medigap Insurance Is Affected by Preexisting Conditions

Delaying enrollment in a medigap policy can lead to higher premiums and denial of coverage in most states.

Kathryn Pomroy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Medigap, also called Medicare Supplement Insurance, is additional insurance you can buy from private health insurance companies to help pay the out-of-pocket costs, such as copays and deductibles, associated with original Medicare. You must have original Medicare, Part A, and Part B, to buy a Medigap policy. Medicare Advantage plan participants can't buy Medigap insurance.

A Medigap policy pays out after both you and Medicare have paid your share of the medical costs. However, unlike Medicare, there are circumstances when insurance companies factor in preexisting conditions when deciding whether to offer you a Medigap policy or when setting premiums. In some cases, Medigap will also cover emergency medical expenses if you travel outside of the U.S.

Although there are ten Medigap plans available — A, B, C, D, F, G, K, L, M, and N — some of these plans (C, F, E, H, I and J) are no longer available to new enrollees in Medicare. However, if you are already enrolled in one of these plans, you can keep it for now. If you were eligible for Medicare before January 1, 2020, you can still buy Plan C or F.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Medigap open enrollment only happens once

You get a six-month “Medigap Open Enrollment” period that starts the first month you have Medicare Part B and you’re 65 or older. During this period, you have what is called 'guaranteed issue rights' that protect you from denial of coverage for preexisting conditions and higher premiums. An insurance company can’t use medical underwriting to decide whether to accept your application or upwardly adjust your costs.

Keep in mind that after your Medigap open enrollment period is over an insurer can deny you coverage if you don’t meet their medical underwriting requirements, and you may have to pay more and there may be fewer options for you to consider.

Remember, the Medicare open enrollment period is October 15 to December 7.

How preexisting conditions can affect your Medigap eligibility

Many people don’t realize that even though preexisting conditions can’t affect your ability to get other types of health insurance, such as Medicare, the rules are very different for Medigap policies.

You can pick any Medigap plan available in your area within six months after you initially sign up for Medicare Part B. But after that, Medigap insurers in almost all states can reject you or charge more based on your health.

It can be challenging to switch to another insurer with better Medigap rates or if you had a Medicare Advantage plan for more than a year and want original Medicare and a Medigap policy instead.

You may also buy a Medigap policy without concern about preexisting conditions if you move out of your Medicare Advantage plan’s service area or change your mind within 12 months of signing up for Medicare Advantage at age 65. For more information, see Medicare's When Can I Buy Medigap?

Also, your insurer may let you switch to a less-comprehensive policy regardless of your health (such as switching from a Plan G to a high-deductible Plan G). See the Medicare Rights Center’s list of what each type of Medigap policy entails.

By the way, if you currently have a Medicare Advantage Plan, it’s illegal for someone to sell you a Medigap policy. But if you are considering switching to original Medicare, you can change plans during the Medicare open enrollment period each year.

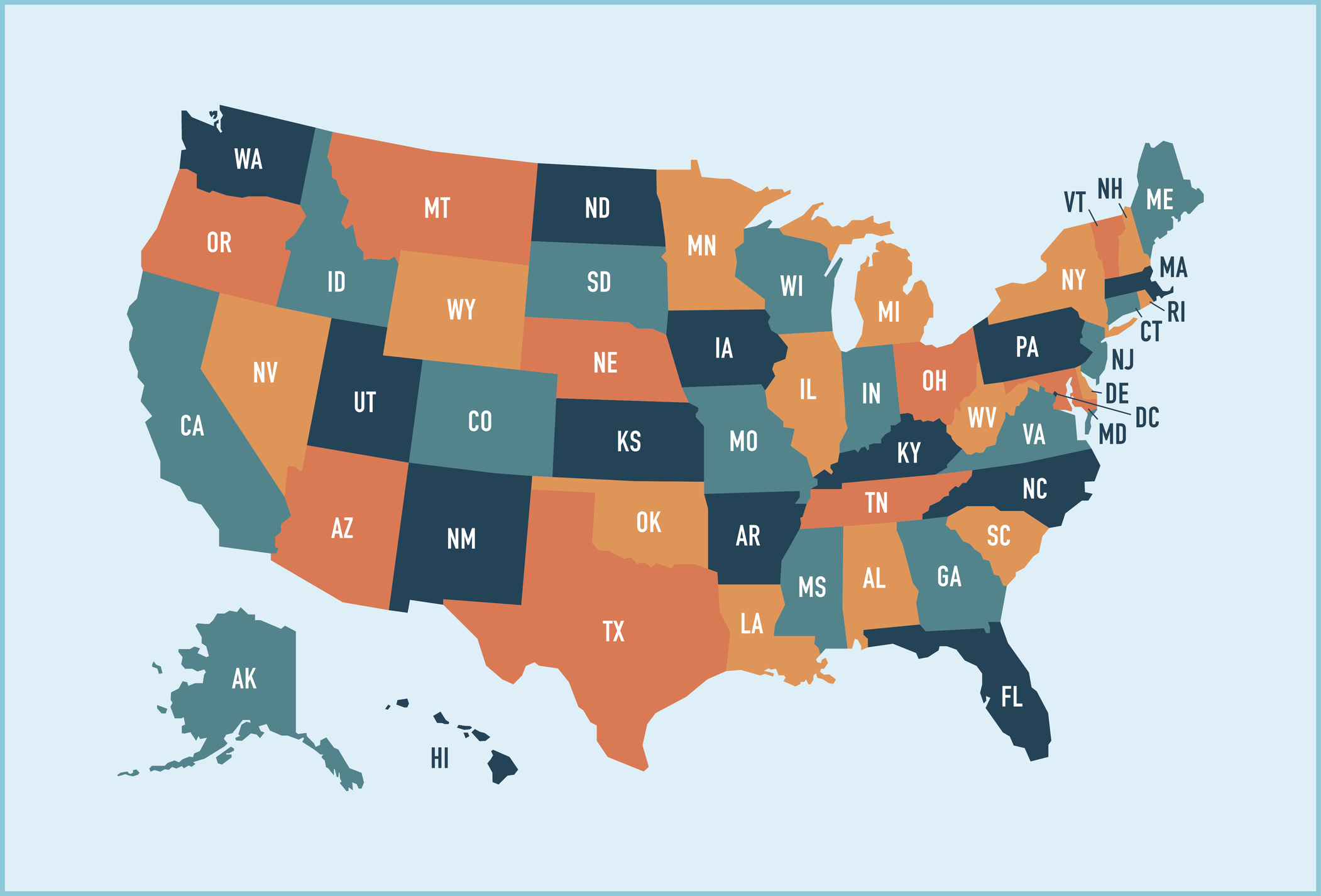

States where insurers can't deny Medigap coverage after your initial enrollment period

Four states — including Connecticut, Maine, Massachusetts and New York — have special rules that let residents switch Medigap plans regardless of preexisting conditions. These states require Medigap insurers to offer polices to beneficiaries age 65 and over on a contingent or annual basis.

The birthday rule. Other states waive underwriting requirements and permit you to change plans at certain times. For example, if you live in California, you can select a different Medigap plan that has the same or fewer benefits if you make a decision to change within 30 days after your birthday each year.

In addition to California, there are eleven other states that have a Medigap birthday rule: Idaho, Illinois, Kentucky, Louisiana, Maryland, Nevada, Oklahoma, Oregon, Utah, Virginia and Wyoming all have a form of the birthday rule. In 2026, a birthday rule will take effect in Indiana.

Some states allow Medicare participants to change plans during a specified window of days around their birthday. Some limit beneficiaries to keeping the same plan, but allow them to sign up with a different insurer. If you live in one of those states, check with your local SHIP office (State Health Insurance Program) to determine how long you have to make a change to your Medigap coverage.

The Medicare Select exception

In some states, it's possible to buy another type of Medigap policy called Medicare SELECT. A person with a Medicare SELECT policy is required to use hospitals or healthcare professionals within a specific network to get the maximum benefit from their plan’s benefits. Outside of emergency treatment, enrollees who use out-of-network hospitals or doctors will likely be liable for some or all of the costs that Medicare does not pay.

If you later decide that you don't like being limited to the network or want or think Medigap is better, you are allowed to switch to a standard Medigap policy within 12 months.

Resources to help find a Medigap policy

For more information about your state’s rules, check out www.naic.org/map. Most states have consumer guides that list Medigap prices and provide information for seniors searching for a plan. Your State Health Insurance Assistance Program can also help. See www.shiptacenter.org to find your state SHIP.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

- Kathryn PomroyContributor

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

Medicare or Medicare Advantage: Which Is Right for You?

Medicare or Medicare Advantage: Which Is Right for You?From overall costs to availability of care, here's what to know about the differences between traditional Medicare and Medicare Advantage plans.

-

Is a Medicare Advantage Plan Right for You?

Is a Medicare Advantage Plan Right for You?Medicare Advantage plans can provide additional benefits beneficiaries can't get through original Medicare for no or a low monthly premium. But there are downsides to this insurance too.

-

Medicare Advantage 2024 Plans Dip in Ratings

Medicare Advantage 2024 Plans Dip in RatingsMedicare Advantage and Medicare Part D plans lose 'star' on the CMS performance score card.

-

Considering a Medicare Advantage Plan? Be Wary of Promises

Considering a Medicare Advantage Plan? Be Wary of PromisesThese private insurance alternatives to Medicare are growing in popularity at the same time they’re under scrutiny for their sales tactics and coverage.

-

Medicare Open Enrollment Occurs Annually from October to December — Here's What You Need to Know

Medicare Open Enrollment Occurs Annually from October to December — Here's What You Need to KnowMedicare open enrollment is underway. Here's what you need to get done.

-

4 (Imperfect) Ways Retirees Can Pay for Dental Care

4 (Imperfect) Ways Retirees Can Pay for Dental Carehealth insurance Since Medicare doesn't provide dental benefits, seniors must consider other options to cover this need.

-

Get Free Over-the-Counter COVID Tests Through Medicare

Get Free Over-the-Counter COVID Tests Through MedicareMedicare Beneficiaries can get up to eight tests a month through both original Medicare and Advantage plans.