Making It in the Gig Economy

Whether you’re earning extra money or working full time, you’ll need to adopt new financial strategies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Dan Simms spent decades working in sales, but after more job-hopping than he preferred, he was ready for a career change. A friend suggested DogVacay, a service that linked up pet owners with people who could walk or care for their animals while they were at work or away. (DogVacay was acquired by Rover, a similar service, in 2017.) Simms and his wife, Denise, had owned dogs for more than 30 years, and their Long Island, N.Y., house and large yard were ready-made for a new crew of canines.

In late 2016, Simms set up a profile on the website, printed a stack of business cards and pitched his services to veterinarians and travel agents, figuring they might be a good source of clients. Now, he regularly pulls in more than $5,000 each month after paying estimated taxes and oversees an average of five dogs during the week and eight over the weekend. To keep both his human and non-human clients happy, he sends short videos of each dog to its owner during its stay. He even makes house calls to care for aggressive or injured dogs as needed. Although Simms works seven days a week, “it’s a labor of love,” he says. “I see myself doing this for another 12 to 15 years.”

New twist on an old idea

Freelance and independent contract work is nothing new, but the apps and websites that power the gig economy have brought on-demand employment into the mainstream. “The gig economy crosses all sectors, incomes and education levels,” says Diane Mulcahy, author of The Gig Economy (HarperCollins). “It has infiltrated professions that were dominated by full-time work.” For example, you can consult as a lawyer, flex your admin skills as a virtual assistant, share your hometown with tourists as a private guide or cook up a feast for paying guests—all on your own time and schedule (see our list of promising side hustles).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

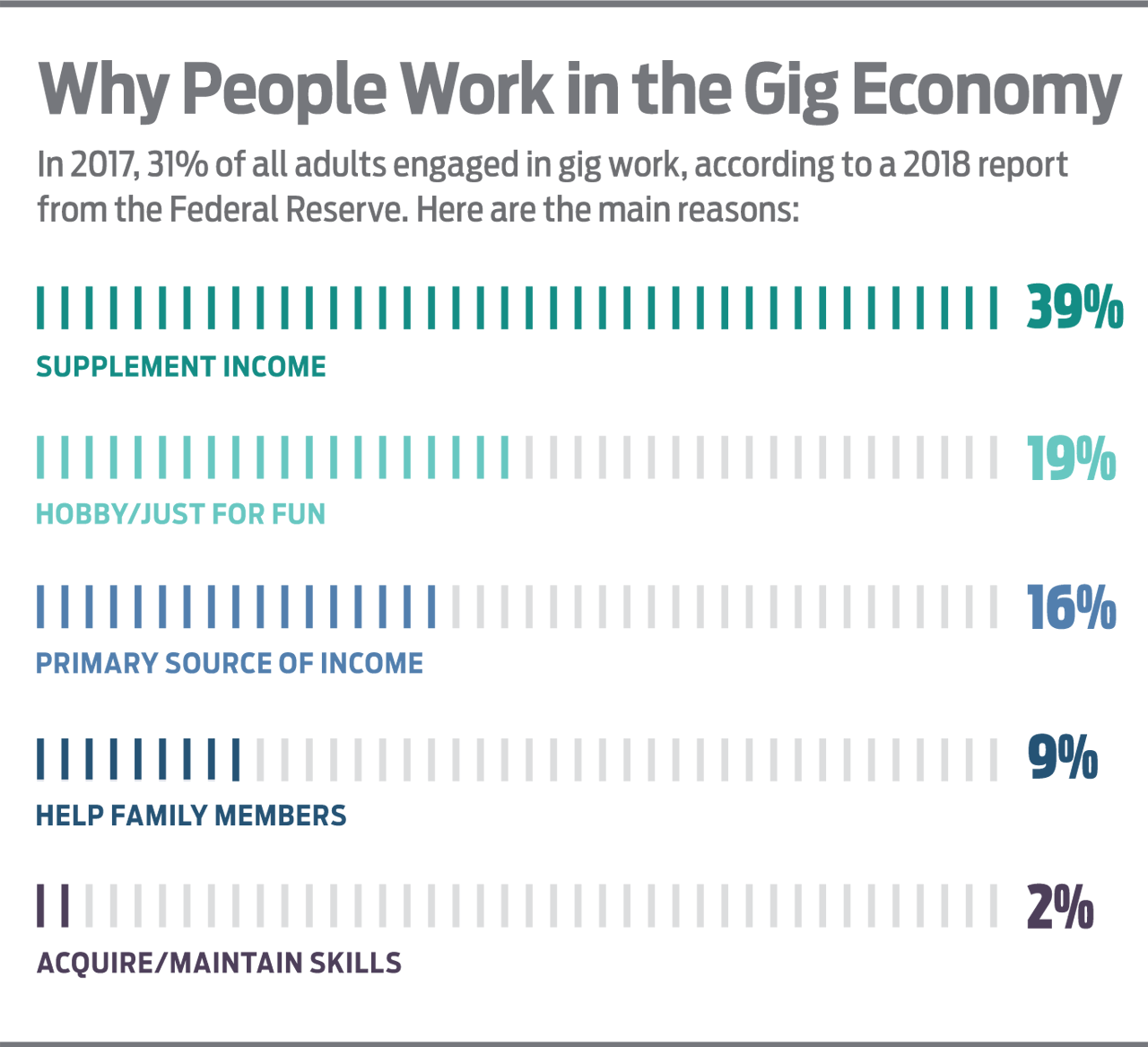

According to a 2018 report from the Federal Reserve, 16% of gig workers say their side hustles are their primary source of income, and 39% treat their gigs as supplemental income. When you hold down a traditional day job, reeling in extra income through a side hustle can help you pay down debt, save more for retirement or fund other goals. Sandra Creason and her husband, John Wain, of Harrisburg, Pa., both have full-time jobs, but they deliver restaurant meals and other goods for services such as DoorDash, Grubhub and Shipt in the evenings and on weekends. “I maximize my earnings by having every platform running at the same time,” says Creason. When they started doing the extra gigs last August, their main goal was to buy a house. In less than a year, they saved $20,000 and settled on their new home at the end of May.

But for many gig workers, the picture is less rosy. A 2017 survey from Prudential says that the gig model provides more flexibility for many workers but overall has negative consequences for workers’ pay, benefits and job security. It found that “gig only” workers earned an average of $36,500 per year, versus $62,700 for traditional full-time employees.

After she was laid off in 2009, Antoinette Kunda wasn’t able to find a full-time position, and she started driving for Lyft in Los Angeles in 2015. “I was holding my breath every week to bring home $700,” she says. In 2017, she signed on with Uber, several delivery services and a few other platforms, which let her reduce her schedule from seven days a week to five. Now her goal is to bring in at least $1,000 each week. “That means not putting anything in for savings or, God forbid, if something goes wrong with the car or me,” she says. While she enjoys the flexibility, she says “the price fluctuations on rideshare are horrendous.”

Whether you take on gigs as your sole source of income or as a supplement to other earnings, you’ll have to tweak your budgeting strategies, follow a new set of tax rules, and perhaps seek out new insurance policies and ways to save for retirement as well.

Budgeting

If a side hustle (or hustles) will be your full-time gig, you will need to smooth out the uneven cash flow. To get a handle on your budget, track expenses for a month or two, including regular bills that need to get paid no matter what, and set aside surplus funds in the good months to make up for leaner periods, says Eric Feldman, a certified financial planner in Brielle, N.J. Consider using a budgeting tool such as You Need a Budget ($84 per year), which aims to distribute all of your income between monthly expenses and longer-term goals. On top of that, set aside an emergency fund that will cover expenses for six months or more, depending on the diversity of your income stream and how nimbly you could pick up new work.

You will also need to account for benefits that may have been part and parcel of previous full-time jobs, such as health insurance, paid time off, or new gadgets. And if your home or car is part of your gig, expect a significant sum to go toward upkeep. Rick Mendell, of Las Vegas, spends 60 to 70 hours per week driving for Uber. In the two years after he became a rideshare driver, he spent about $4,000 to $5,000 each year on repairs, replacements and touch-ups for his 2015 Chrysler. (He recently traded it in for a new car after it broke down.) He pays $200 per year for a business license and $25 per year for a county permit. More modest expenses include the phone chargers and cold water he keeps on hand for passengers, as well as the 100-year-old pennies he buys from eBay to give to couples as a “something old” token on the way to their wedding chapel. “The amount of money I gross is fabulous, but the amount I net pays all the bills and leaves me enough to go out to dinner a couple of times a month and make sure my wife and I have money in our emergency fund,” he says.

Open a small-business bank account or a separate personal bank account to distinguish business-related expenses. Business checking accounts often have maintenance fees, but credit unions may have low- or no-fee options.

Taxes

The U.S. tax system operates on a pay-as-you-go basis, which means you’re expected to pay your taxes all year round. If you wait until April 15 to pay taxes on income from your small business or side gig, you could be hit with an underpayment penalty, even if you pay the bill in full.

If you have a regular job in addition to your side gig, you could increase the amount of taxes withheld from your paycheck by filling out a new W-4 and giving it to your employer. If you expect to owe the IRS $1,000 or more after any withholding, you’ll need to pay estimated taxes. Estimated taxes are paid in four installments on Form 1040-ES. Deadlines for estimated tax payments are April 15, June 17 and September 16 in 2019, and January 15 in 2020. As long as you end up paying at least 90% of what you owe for the year, or 100% of what you owed the previous year (110% if your adjusted gross income exceeded $150,000), the IRS won’t hit you with underpayment penalties.

In addition to paying taxes on your business income, you must pay payroll taxes to cover Social Security and Medicare. When you’re an employee, your employer picks up half of your payroll taxes, but self-employed workers must pay the entire 15.3% rate. Calculate your self-employment taxes on Schedule SE, available at irs.gov. You can deduct half of the amount you pay in self-employment taxes.

In addition to setting up a separate bank account, get a credit card for your business so you can keep track of your business-related expenses. You’ll need these records to claim deductions that will reduce your tax bill—and increase your profits. Deductible expenses range from postage stamps to a new computer—anything that’s “ordinary and necessary” for your business, says Mike Savage, a certified public accountant and founder of 1-800Accountant. Self-employed workers report income and business expenses on Schedule C. The IRS tends to pay more attention to tax returns that include a Schedule C, Savage says. That doesn’t mean you should avoid deducting legitimate expenses—just keep good records. For example, if you drive your car for business, keep a log of your business-related miles.

New tax break for business owners. Once you’ve calculated your income and deducted business expenses, you may be eligible for a new tax break that could significantly reduce your tax bill.

If your total taxable income—which includes interest and dividends, as well as income reported on Form W-2 if you also have a regular job—is less than $160,700 on an individual return or $321,400 on a joint return, you can deduct 20% of your qualified business income, no matter what type of business you’re in. Qualified business income is your net income after you’ve claimed all of your business-related expenses.

The deduction phases out for business owners who provide personal services, such as consultants, lawyers and financial planners, once total taxable income exceeds these thresholds. It disappears when taxable income exceeds $210,700 if you’re single or $421,400 if you’re married and file jointly.

There has been a lot of discussion about what qualifies as “personal services” for the purposes of the pass-through deduction. If your business is in a gray area—and you’re bumping up against the phase-out limits—consult with a certified public accountant or enrolled agent.

Insurance

If you rent out part or all of your home on a home-sharing site such as Airbnb or HomeAway, your insurance carrier may be okay with “incidental” rentals (meaning you still treat your home as your primary residence) or it may sell you an add-on that covers short-term rentals. Or you may need to find a new policy that covers home-sharing activities (see "Tips for Renting Out Your Home on Airbnb").

If you are a rideshare driver, chances are good that your personal auto policy will stop covering you as soon as you log into the rideshare app. Lyft and Uber provide insurance to their drivers, but there are gaps: In Period 1 (meaning your app is on but you have not accepted a ride request), both companies include contingent liability coverage, with a typical limit of $50,000 per person, $100,000 per accident and $25,000 for property damage. But the driver’s own injuries and car are not covered. In Period 2 (you’ve accepted a ride and are heading to pick up a passenger) and Period 3 (transporting a passenger), higher limits kick in, including up to $1 million per accident in liability, uninsured/underinsured motorist coverage, and contingent comprehensive and collision coverage, with a $1,000 deductible for Uber and $2,500 deductible for Lyft. (“Contingent” means that you must have your own personal liability and collision coverage and turn to it first, says Janet Portman, executive editor of Nolo.) But laws and coverage limits vary by city and state.

Several major insurers, including Allstate, Farmers, Geico, Progressive and State Farm, offer supplemental coverage specific to ridesharing, which might fill any gaps. But insurers may limit the coverage to transporting people, not delivery items. You could also resort to commercial insurance, but that is likely to cost two to three times more than a personal auto policy, says Spencer Houldin, president of Ericson Insurance Advisors in Washington Depot, Conn.

Rick Mendell found a new insurer to cover his rideshare business by comparing quotes for every company listed for Nevada on rideshare-information site The Rideshare Guy’s state insurance guide (go to therideshareguy.com and click on “Insurance”).

A personal umbrella policy will probably exclude regular business activities, says John Farnan, an attorney at Weston Hurd in Cleveland, Ohio. For example, although Rover provides some protections, Dan Simms purchased a no-deductible professional liability policy that currently costs $247 per year. Simms also registered his business as a limited liability company so, in a worst-case scenario, a lawsuit from a dog owner would affect only his business and his personal assets would be protected.

Retirement

You can use your earnings to boost the funds in your retirement accounts, or open a new account for self-employed individuals. With these special accounts, you can potentially save even more for retirement than you could through a workplace plan, traditional IRA or Roth IRA.

As a full-time self-employed gig worker, you act as both employer and employee, and your best bets are a solo 401(k) or SEP IRA, says Maura Cassidy, vice president of retirement at Fidelity. In 2019, a self-employed individual can save up to $19,000 in a solo 401(k) as the employee, or $25,000 if age 50 or older, plus up to 20% of net earnings as the employer, for a grand total of $56,000 ($62,000 if you’re 50 or older). Employee contributions are typically made on a pretax basis, although some firms, such as Vanguard, offer a Roth 401(k) option.

Part-time contract workers who contribute to a 401(k) through their regular jobs can also contribute to a solo 401(k), but your solo 401(k) limits will be reduced by any contributions you’ve made to your workplace plan. A SEP IRA allows you as the employer to sock away up to 20% of net earnings, to a maximum of $56,000 in 2019. Most firms that offer IRAs also offer SEPs, while Fidelity, Schwab and several other brokers offer low-cost solo 401(k) plans.

Create your own benefits

As a full-time gig worker without access to traditional benefits, you may have to re-create a corporate benefits package for yourself, says Diane Mulcahy, author of The Gig Economy (HarperCollins). In terms of insurance, she recommends prioritizing health insurance, then turning to life insurance and disability coverage.

You can shop for health insurance on your state’s health insurance exchange (go to healthcare.gov for links); through a web broker such as eHealthInsurance.com; or directly through the insurer. Gig workers with relatively modest incomes will probably qualify for a subsidy if they buy coverage on their state exchange. Some insurers may offer off-exchange policies with different premiums, cost-sharing or provider networks than their on-exchange versions. (For more information about buying individual coverage, see =How to Get the Best Individual Health Policy in 2019=.)

As for disability insurance, the market for freelancers is limited. One option is to become a member of the Freelancers Union, which is free to join and helps independent workers of any stripe locate health, dental, long-term disability, term life and liability insurance. The Freelancers Union also partners with a short-term disability insurance start-up called Trupo, which is currently available in Georgia and will launch in New York soon.

See if your gig company provides any other help with insurance. For example, Uber, TaskRabbit, Postmates, Care.com and other platforms partner with Stride Health, which helps workers find medical, accident and life insurance plans and submit the right documents to receive a subsidy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Nvidia Earnings: Live Updates and Commentary February 2026

Nvidia Earnings: Live Updates and Commentary February 2026Nvidia's earnings event is just days away and Wall Street's attention is zeroed in on the AI bellwether's fourth-quarter results.

-

I Thought My Retirement Was Set — Until I Answered These 3 Questions

I Thought My Retirement Was Set — Until I Answered These 3 QuestionsI'm a retirement writer. Three deceptively simple questions helped me focus my retirement and life priorities.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and More

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and MoreAmazon Prime The Amazon Prime Big Deal Days sale ends soon. Here are the key details you need to know, plus some of our favorite deals members can shop before it's over.