What a Weaker Dollar Means to You

Travel abroad is more expensive, but your overseas investments may benefit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Diane Swonk, founder of DS Economics, is past president of the National Association for Business Economics and a member of the Council on Foreign Relations. Her firm works with public- and private-sector organizations to identify and hedge against economic risk.

The dollar has fallen about 9% against major foreign currencies this year. Why is the greenback losing value? It’s a combination of factors. Hopes for tax reform and pro-growth economic policies have dissipated since the election, and the Federal Reserve doesn’t see as much urgency to raise interest rates rapidly. Plus, economies in Europe and Japan are showing more strength, pushing up their currencies relative to the buck.

How will this impact U.S. consumers? We could see higher prices for Japanese cars and some luxury goods from Europe. But many companies hedge their exposure to the dollar to lessen the impact of currency changes. Online competition is also making it hard for companies to raise prices.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Will U.S. companies benefit from a weaker dollar? Domestic manufacturers should be able to sell more goods abroad. But a bigger issue is the impact of tariffs and the potential for trade wars. Building a house now costs an extra $1,700 because of tariffs recently imposed on Canadian lumber. The Trump administration wants to narrow the trade deficit. But if we get into a trade war, it would result in higher costs for all sorts of imported goods and raw materials. That will raise prices for consumers and businesses much more than a weaker dollar.

Do you think the dollar will lose more value against major currencies such as the euro? We think it will fall another 2% against a basket of major currencies through the end of 2017 and then stabilize in 2018. The dollar remains the world’s primary reserve currency: Foreign governments hold trillions of dollars in reserves (mostly Treasury securities) because it’s still the safest and most secure form of money.

Have you felt the impact of a weaker dollar personally? Yes. I was in Europe this summer, and our hotel bills got more expensive as the dollar fell during the trip. If you are booking a trip abroad, some hotels allow you to pay in dollars in advance. There are no guarantees, but locking in a rate at least buys you the reassurance of knowing up front what it will cost.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

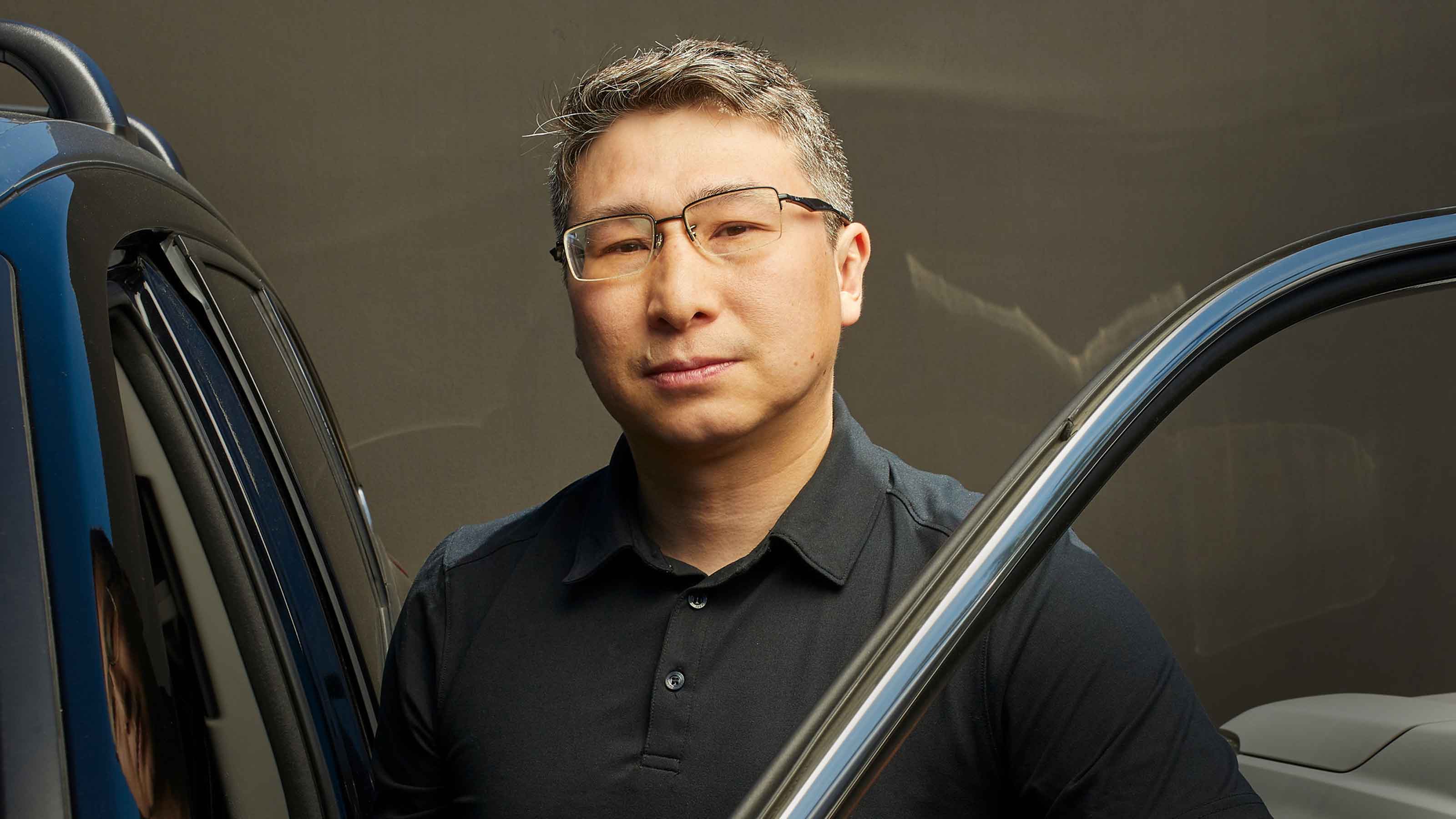

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.