Kiplinger Interest Rates Outlook: Crosscurrents Keeping Rates in Narrow Band

Interest rates will stay in a holding pattern, as concerns about future inflation balance fears of an economic slowdown. The Federal Reserve is also on hold.

Kiplinger’s Economic Outlooks are written by the staff of our weekly Kiplinger Letter and are unavailable elsewhere. Click here for a free issue of The Kiplinger Letter or to subscribe for the latest trends and forecasts from our highly experienced Kiplinger Letter team.

Federal Reserve Chair Jerome Powell emphasized that the Fed won’t cut rates until it has a better understanding of how higher tariffs affect longer-term inflation expectations. Because price effects from tariffs take time to work through the supply chain to the consumer, that will not be soon. Even though tariffs have not had much of an impact on inflation so far, Powell noted that all professional forecasters are saying tariffs will raise inflation this year, at least temporarily. Because of the danger that these price increases could affect longer-term inflation expectations, it is necessary to maintain a moderately restrictive monetary policy, as the Fed has been doing.

The Fed also released its new economic projections, showing that, by a 12-to-7 majority vote, the Federal Open Market Committee (FOMC) thought rates would be lower by the end of the year. About half of the committee expects two quarter-point cuts. It's worth noting, though, that seven committee members felt rates will be unchanged at the end of the year. Committee members raised their inflation projections a bit, indicating that any cut in rates would likely have to come with evidence of a slowing economy. The Fed’s next meeting is July 30.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Long-term interest rates will remain in a narrow range. With the Fed standing pat, and with President Trump’s deficit-widening fiscal bill working its way through Congress, Treasury investors have become nervous about the potential consequences. That, and inflation concerns provoked by tariffs, have caused long-term rates to move upwards in the past month, balancing fears of an economic slowdown that had caused them to dip a bit recently.

The potential impact of future government fiscal deficits has become a new worry for bond investors. Large deficits mean that the supply of Treasury securities could, at times, be higher than investor demand for them. That would cause prices to decline and bond yields to rise. Whether Treasury auctions will be soft or not is usually unknowable in advance, and can catch investors unawares. The stock market also often reacts negatively when yields rise.

Mortgage rates won’t be changing much for now. 30-year fixed-rate mortgages are still around 6.8%, while 15-year loans are at 5.9% for borrowers with good credit. If the economy weakens, then rates should ease a bit. Mortgage rates are still higher than normal relative to Treasuries, but whenever the Fed cuts short-term rates again, it will boost banks’ lending margins, which should eventually lower mortgage rates a bit, too.

The Fed is allowing Treasury securities to mature and run off its balance sheet at $5 billion per month. But it is running off mortgage-backed securities at $35 billion per month. The central bank would like to get non-Treasuries out of its portfolio as much as possible, in order to avoid creating unintended influences on those asset markets over the long term. The disparate treatment of the Fed’s balance sheet may keep mortgage rates elevated a bit more than usual over the 10-year Treasury note’s yield.

Top-rated corporate bond yields have also been treading water along with Treasury yields. AAA-rated long-term corporate bonds are yielding 4.9%, BBB-rated bonds are at 5.4%, and CCC-rated bonds have eased to 13.1% from their 15.2% peak in April on reduced recession fears. But they are still above their early March level of 12%.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

Stock Market Today: Stocks Step Back From New Highs

Stock Market Today: Stocks Step Back From New HighsInvestors, traders and speculators continue the low-volume summer grind against now-familiar uncertainties.

-

Ask the Editor — Tax Questions on the New Senior Deduction

Ask the Editor — Tax Questions on the New Senior DeductionAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the new $6,000 deduction for taxpayers 65 and older.

-

Stock Market Today: Stocks Step Back From New Highs

Stock Market Today: Stocks Step Back From New HighsInvestors, traders and speculators continue the low-volume summer grind against now-familiar uncertainties.

-

Breaking China's Stranglehold on Rare Earth Elements

Breaking China's Stranglehold on Rare Earth ElementsThe Letter China is using its near-monopoly on critical minerals to win trade concessions. Can the U.S. find alternate supplies?

-

Do You Need Flood Insurance? I'm an Insurance Expert, and Here's Where You Can Get It

Do You Need Flood Insurance? I'm an Insurance Expert, and Here's Where You Can Get ItStandard homeowners insurance does not cover flood damage, so you might need separate flood insurance, which you can get either through FEMA or private companies. Here are the details.

-

I'm an Investment Professional: These Are the Three Money Tips I'm Giving My College Grad

I'm an Investment Professional: These Are the Three Money Tips I'm Giving My College GradCollege grads can help set themselves up for financial independence by focusing on emergency savings, opting into a 401(k) at work (if it's offered) and disciplined, long-term investing.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

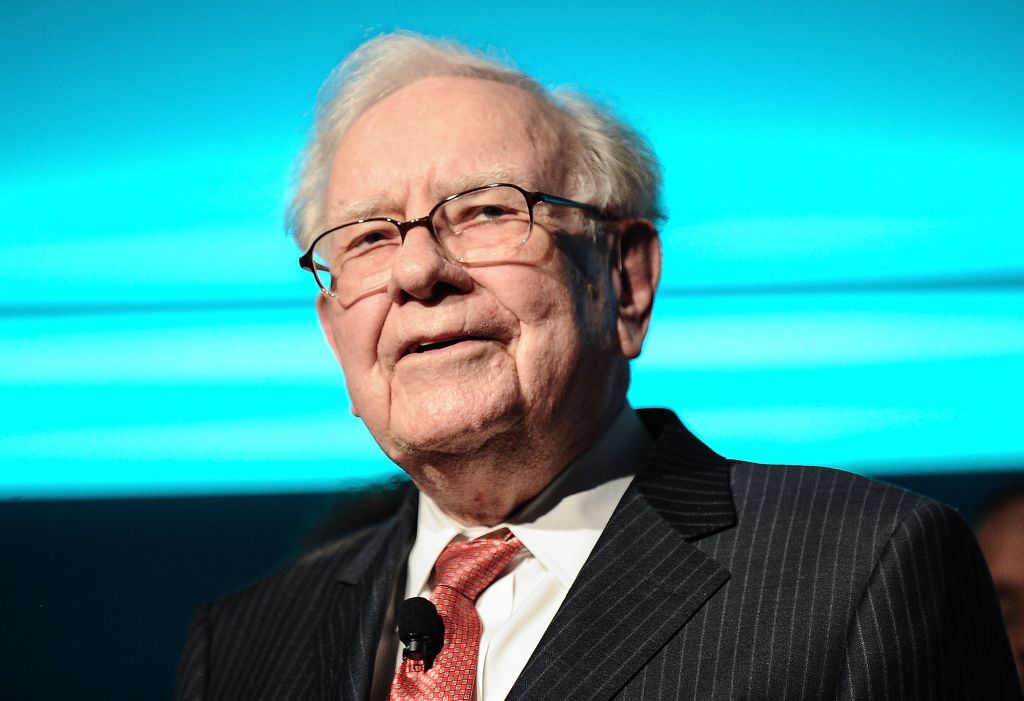

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

Know Your ABDs? A Beginner's Guide to Medicare Basics

Know Your ABDs? A Beginner's Guide to Medicare BasicsMedicare is an alphabet soup — and the rules can be just as confusing as the terminology. Conquer the system with this beginner's guide to Parts A, B and D.