Snowflake Stock Upgraded on Promise of Generative AI

Snowflake stock has market-beating potential thanks to easier comparisons and growth in generative AI such as ChatGPT.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Snowflake (SNOW) stock received a much needed lift from an analyst upgrade that cited a stabilizing revenue environment and SNOW's potential to benefit from the explosive growth seen in generative artificial intelligence (AI).

Stifel analyst Brad Reback on Monday raised his recommendation on Snowflake stock to Buy from Hold. He also lifted his price target to $185 from $145. Reback's new target price gives SNOW implied upside of about 16% in the next 12 months or so – something which shareholders in the downtrodden stock would certainly appreciate.

Snowflake, which is a cloud-based data warehouse firm, went public in September 2020, pricing 28 million shares at $120 a pop. The tech unicorn garnered such hype at the time that even Berkshire Hathaway (BRK.B) Chairman and CEO Warren Buffett – who usually eschews initial public offerings – bet on the blockbuster Snowflake IPO.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Today, Berkshire Hathaway owns 6.1 million shares worth $987 million at current levels. With a weighting of just 0.3%, however, Snowflake stock represents an essentially immaterial part of the Berkshire Hathaway portfolio.

Which is just as well considering how poorly SNOW has fared since growth stocks peaked out 18 months ago. Indeed, Snowflake stock remains 64% below its all-time closing high set back in November 2021.

Snowflake stock outlook

Stifel's Reback says that recent commentary from Microsoft (MSFT) and other third-parties leads him to believe that the "optimization headwinds" the group has felt over the past nine months are stabilizing. Snowflake is also heading toward easier year-over-year top-line comparisons. Between those two developments, Reback figures that "SNOW's revenue growth should stabilize in the high 30% range."

The analyst also notes that management's cost discipline should continue to drive margin expansion and higher free cash flow (the cash leftover after expenses, capital expenditures and financial commitments have been met).

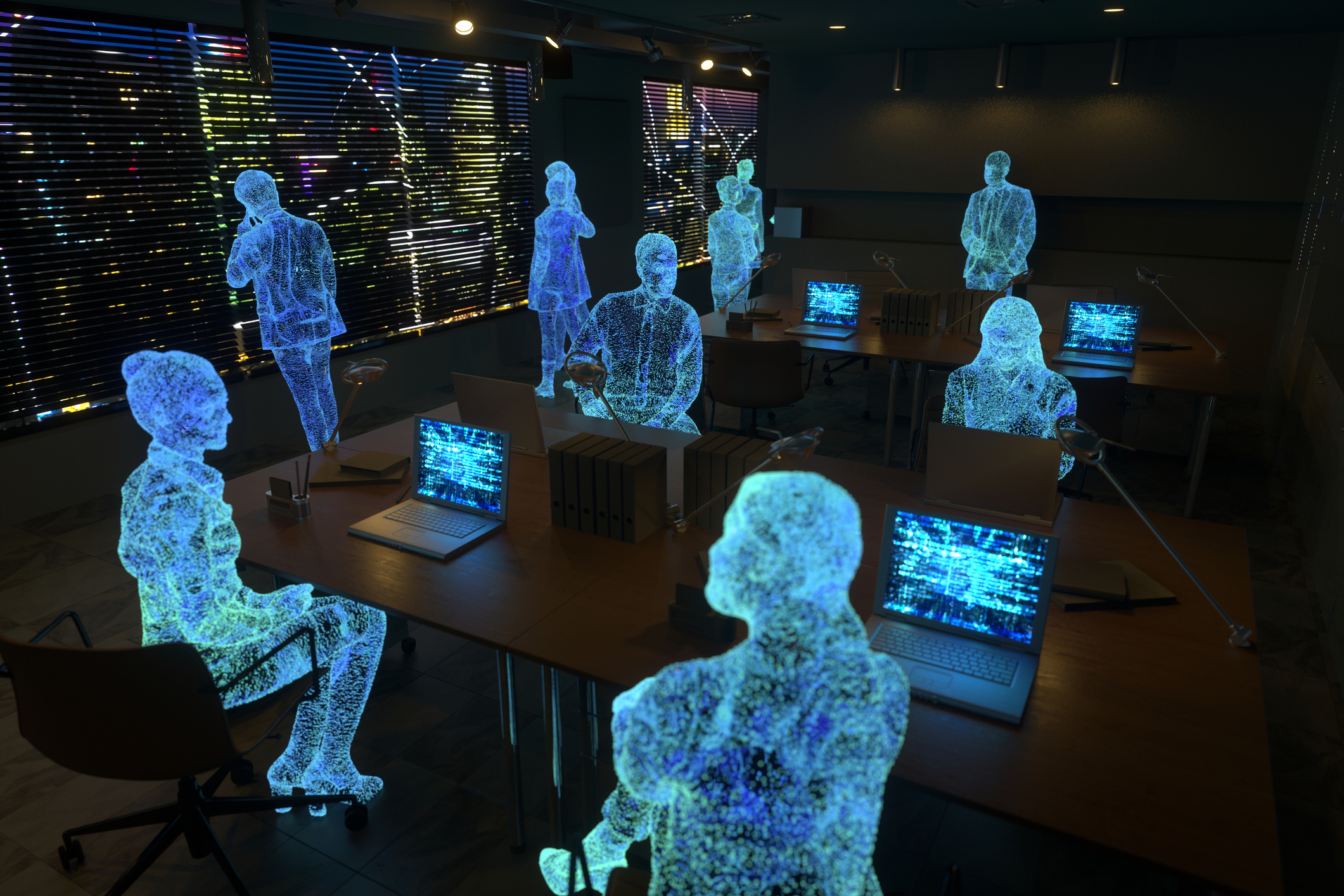

Perhaps most intriguing is the opportunity afforded by the sudden and explosive growth of generative AI services such as ChatGPT and Stable Diffusion.

"Snowflake’s leading cloud-based data platform helps organizations gain greater insights from structured and semi-structured data," Reback writes in a note to clients. "The company stands as a net beneficiary from the growth of the emerging generative AI-market, as Snowflake's data cloud platform contains the data necessary for organizations to effectively train these models for their respective operational needs."

The analyst has a fair bit of company on the Street, which gives Snowflake stock a consensus recommendation of Buy, albeit with middling conviction. Of the 41 analysts surveyed by S&P Global Market Intelligence, 17 rate it at Strong Buy, 10 say Buy, 12 have it at Hold, one says Sell and one calls it a Strong Sell.

Meanwhile, with an average price target of $184.95, the Street gives Snowflake stock implied upside of about 16% in the next 12 months or so.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Small Caps Hit a New High on Rate-Cut Hope: Stock Market Today

Small Caps Hit a New High on Rate-Cut Hope: Stock Market TodayOdds for a December rate cut remain high after the latest batch of jobs data, which helped the Russell 2000 outperform today.

-

S&P 500 Tops 6,500 Even as Nvidia Slips: Stock Market Today

S&P 500 Tops 6,500 Even as Nvidia Slips: Stock Market TodayThe world's most valuable company closed lower after earnings, but the S&P 500 managed to notch a new record high.

-

Stock Market Today: Stocks Chop After House Passes Trump's Tax Bill

Stock Market Today: Stocks Chop After House Passes Trump's Tax BillThe bill, which was narrowly approved by the House of Representatives, will now move to the Senate.

-

Stock Market Today: Mixed Messages Muddle Markets

Stock Market Today: Mixed Messages Muddle MarketsStocks cruised into pre-market action on encouraging news for the AI revolution but stumbled on yet another policy disturbance.

-

Snowflake Stock Rallies on Rising Revenue

Snowflake Stock Rallies on Rising RevenueSnowflake stock is surging Thursday after the cloud company beat fourth-quarter expectations, issued strong guidance and expanded a partnership with Microsoft.

-

Stock Market Today: The Dow Leads an Up Day for Stocks

Stock Market Today: The Dow Leads an Up Day for StocksBoeing, American Express and Nike were the best Dow stocks to close out the week.

-

Stock Market Today: Stocks End Higher in Whipsaw Session

Stock Market Today: Stocks End Higher in Whipsaw SessionThe main indexes were volatile Thursday with Nvidia earnings in focus.

-

Why Snowflake Stock Is Still a Buy After Earnings

Why Snowflake Stock Is Still a Buy After EarningsSnowflake stock is surging Thursday after cloud company beat expectations for its third quarter and raised its full-year outlook. Here's what you need to know.