5 Retirement Lessons Learned From the Great Recession

The Great Recession of 2007-09 turned retirement dreams into nightmares.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Great Recession of 2007-09 turned retirement dreams into nightmares. Stocks plunged as the government took over Fannie Mae and Freddie Mac, Lehman Brothers went bankrupt, and the Reserve Primary Fund suffered losses, shattering investor confidence in safe-haven money-market funds. For many, it was the most hair-raising moment in a crisis that ultimately wiped out $3.4 trillion in retirement savings.

The pain didn’t stop with the market slide. The financial crisis also meant plummeting home values, stagnating wages, a loss of job security and the start of a long era of rock-bottom interest rates that proved devastating for savers.

Many retirees and near-retirees felt the effects of the financial crisis for many years to come. Fifty percent of working-age households were at risk of being unable to maintain their standard of living in retirement in 2016, up from 44% in 2007, according to the Center for Retirement Research at Boston College.

For the older workers and retirees who survived it, the crash is much more than a historical event. It’s a reminder of all their retirement-planning strengths and weaknesses. We talked to preretirees and retirees in 2018 about the lessons they learned from the Great Recession. Today, we're sharing them again to help you navigate current and future market turmoil.

Lesson 1: Don't Time the Market

The long-term impact on retirement portfolios depended in part on investors’ reactions to the crash. In 2018, when he talked with Kiplinger's Retirement Report, Jeffrey Smith was still living with the consequences of his portfolio moves a decade earlier. During the financial crisis, Smith’s IRA dropped 75%, as individual stock holdings, such as the troubled insurer American International Group, got crushed.

Even more devastating, Smith missed the market rebound that began in March 2009. He tried various trading strategies to recover his losses, but nothing worked. Then in 2012, he shifted into cash—where he stayed until 2017. “I lost confidence in my broker and lost confidence in myself,” Smith recalled to us. “So there was no recovery.”

That moved the goalposts for his retirement. “After the crash, it was apparent to me I could not retire at 60, which had been my goal,” said Smith, who also conceded he and his wife “are not going to be able to live in a big house and travel the world.”

Lesson 2: Turn Chaos Into Opportunity

Paul Franceus saw the financial crisis as the best thing that ever happened to him financially. But it didn’t start out well at all. In October 2007, he invested the $150,000 proceeds from the sale of his Baltimore home—right at the stock market’s peak. That money “went through the whole bloodbath,” Franceus told us. But he kept his cool. “I figured it would come back at some point,” he said. “I ignored the news and ignored the 60 Minutes stories of people crying about losing their retirement and kept putting money into my investments the whole time.”

- The steady-eddie approach allowed Franceus to pick up stocks at bargain prices near the market’s lows, putting the software engineer from San Francisco on track to retire early, and squelching his fear of market crashes. “I feel like I have enough now that I can afford the volatility,” he said.

Lesson 3: Build a Strong Defense

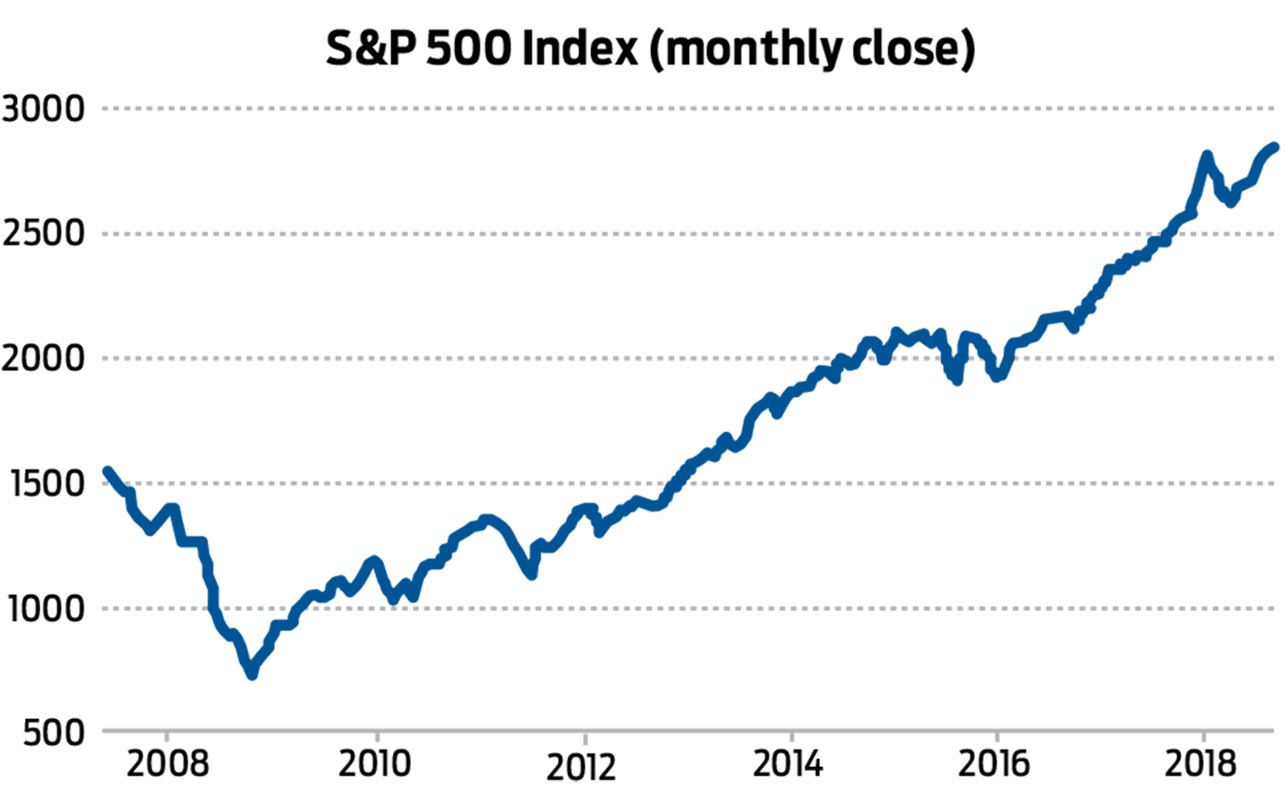

Bill Ahlstrom, who retired from his accounting career in 2015, favored defensive, dividend-paying stocks such as food and pharmaceutical companies. Those types of holdings served him well during the financial crisis, when his portfolio lost only about 25%, while Standard & Poor’s 500-stock index dropped 57% from its 2007 peak to its 2009 low.

“You can’t wait until you retire to get defensive” with your investments, Ahlstrom told us. “You have to do it in advance.”

Ahlstrom has remained “a little nervous” about market crashes, but told us his investment income is sufficient to cover his living expenses. “As long as I can live off the dividends,” he said, “market fluctuations don’t affect me.”

Lesson 4: In a Crisis, Cash Is King

G.W. Potter retired in 1995, with a strategy of keeping 18 to 24 months’ worth of spending money in the bank. That became a portfolio-saver during the market downturn, because he didn’t need to sell any of his beaten-down investments to cover his living expenses. Instead, he pulled money from his cash hoard to pay the bills.

“My mantra is simple,” Potter, a former chemistry teacher in Georgia, told us. “Avoid at all costs selling low.”

Lesson 5: Create Checks and Balances

When Smith, the telecom worker who lost most of his IRA in the crash, finally reinvested -- in “very aggressive stocks,” he said -- he asked his wife to help keep watch over the portfolio. He gave her full access to the IRA account, he told us, with instructions to “sell it instantly” if she saw a stock she didn't like.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.