7 Stocks the Bull Market Left Behind

These are frustrating times for bargain-hunting investors, especially those seeking deals in U.S.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

These are frustrating times for bargain-hunting investors, especially those seeking deals in U.S. stocks. Not much is cheap by traditional value standards, with Standard & Poor's 500-stock index priced at about 15 times estimated 2014 earnings. And in most instances the stocks that look the cheapest statistically are highly speculative.

As is the case with every bull market, though, not every stock has been bid up to the stratosphere. Look carefully and you can find companies that are reasonably valued compared with the overall market and that are industry leaders with established franchises, rich assets and attractive long-term prospects.

If you're reluctant to buy anything at current prices, you might at least want to put these seven stocks on your watch list. Any sharp selloff would be an opportunity.

All prices and related data are as of February 18, 2014. Unless otherwise noted, price-earnings ratios are based on estimated profits for the four quarters that end in December.

American International Group

- 52-week price range: $36.68-$53.33Price-earnings ratio: 12Dividend yield: 1.0%

Let’s start with an idea that may repulse many Americans but that should tantalize bargain hunters. The near-collapse of AIG (AIG) in 2008 necessitated a $182 billion bailout by the Federal Reserve and the Treasury. Now, disdain for the insurance giant is keeping the stock cheap. Not only is AIG’s P/E well below the market’s, but the stock trades for 27% below the company’s book value (assets minus liabilities) of $69 per share.

The company has fully repaid the Fed and the Treasury, with interest. CEO Robert Benmosche, who took over in 2009, has slashed costs, sold off unrelated businesses, such as an aircraft-leasing unit, and taken AIG back to its roots as a major North American provider of life and property-casualty insurance. AIG has gone from its deathbed in 2008 to posting after-tax operating income of $6.8 billion, or $4.56 a share, in 2013.

The risks? The company's property-casualty business lags many of its rivals in profitability, in part because of high expenses. Any major natural disaster could slam AIG and other insurers. So could rising interest rates (by devaluing bond holdings). Benmosche acknowledges that AIG has more restructuring to do. But in a sign of confidence, the company announced in February a 25% dividend boost, to an annual rate of 50 cents a share.

Deere & Co.

- 52-week price range: $79.50-$93.88Price-earnings ratio: 10Dividend yield: 2.4%

If you believe that one of the hallmarks of smart value investing is going against the crowd, you ought to love Deere (DE) , the dominant seller of farm equipment in North America. Out of 22 Wall Street analysts who cover the company, 19 advise selling or holding (the latter often being a polite way of saying sell). Just three think the stock is a buy.

What's the problem? With corn and wheat prices down sharply over the past year, Wall Street is pessimistic about farmers' equipment spending in 2014. So analysts see Deere's earnings slipping to $8.41 per share in the fiscal year that ends this October, down from $9.09 the previous year.

But if you can look out a few years, you'll see Deere has set ambitious goals. Given surging food demand with the rising world population, the company is making a major push to boost foreign sales, which now account for just one-third of its total. As Morningstar notes, "Large populations in areas such as China, India and Brazil will require more-complex — and more-costly — agricultural equipment to improve crop yields over a limited amount of acreage." What's more, Deere continues to be aggressive in returning cash to shareholders by buying back stock and raising its dividend.

Ford Motor

- 52-week price range: $12.10-$18.02Price-earnings ratio: 11Dividend yield: 3.2%

Ford Motor (F) today is perhaps the classic value stock: It's cheap, but it also demands patience from shareholders. The auto titan warned in December that 2014 earnings would be weak compared with 2013 results, as the revitalized firm spends heavily to introduce 23 new or upgraded models, including a new lightweight aluminum model of the wildly popular F-150 truck.

The payoff is expected to materialize in 2015. Analysts see Ford's earnings declining to $1.36 per share this year from $1.76 last year, then surging to $1.92 in 2015. The stock, down 15% from its 52-week high, sells for 8 times the 2015 estimate.

Unless you think the global economy is headed for a new recession, Ford's prospects appear bright. The company signaled its confidence by announcing a 25% dividend boost in January. With a yield of 3.2%, compared with 2% for the average blue-chip stock, Ford offers a healthy cash payout while you wait for the market to look beyond this transition year.

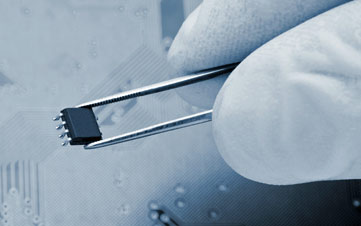

KLA-Tencor

- 52-week price range: $50.23-$67.05Price-earnings ratio: 14Dividend yield: 2.8%

Value stock investors know that they may have to wait a while for a catalyst to spark other investors' interest. For KLA-Tencor (KLAC), a maker of semiconductor-manufacturing equipment, that catalyst may be here: an expected upturn in the chip industry capital-spending cycle.

The company is the leading producer of equipment that measures and detects defects during chip production, allowing problems to be identified and fixed. As chips become more complex and are used to power ever-faster and smarter mobile devices, "The number of process steps requiring inspection and measurement is increasing," KLA-Tencor CEO Richard Wallace told investors in January. The company, with about $3 billion in annual sales, projects chip industry capital spending to rise a healthy 10% in 2014.

Analysts expect KLA-Tencor's earnings to hit $3.79 per share in the fiscal year that ends in June 2014, then to jump 24%, to $4.69 per share, the following year. The stock now sells for about 14 times fiscal 2015 earnings, while yielding nearly 3% — two attractive numbers for value hunters. Investors in KLA-Tencor are in good company: Among the biggest owners of the shares are savvy stock pickers American Funds, Primecap Management and Artisan Partners.

Medtronic

52-week price range: $43.51-$60.93

Price-earnings ratio: 14*

Dividend yield: 2.0%

Medtronic (MDT), a world leader in medical devices, is an example of a company whose image as a hot growth name has faded over time. The stock is no higher than it was in 2005, yet earnings have doubled since then. That's a cue for value hunters.

Medtronic makes a wide array of devices, including pacemakers, artificial heart valves, insulin pumps and artificial spinal discs. Sales are expected to reach a record $17 billion in the current fiscal year, which ends in April. But Wall Street has had a number of concerns lately. One is Medtronic's apparent failure with a new device aimed at lowering chronic high blood pressure by dulling nerve endings in the kidneys. Analysts had high hopes for the technique. Second, a jury in January ordered Medtronic to pay archrival Edwards Lifesciences $394 million for patent infringement on a new artificial heart valve that is implanted without surgery.

Still, Medtronic now has government approval to launch its version of the valve in the U.S., taking on Edwards. In the long run, Medtronic remains an attractive play on medical innovation and the rising health care needs of aging baby-boomers.

*Based on estimated earnings through January 31, 2015.

Ross Stores

- 52-week price range: $54.86-$81.99Price-earnings ratio: 16*Dividend yield: 1.0%

Ross Stores (ROST) has built the largest off-price retail chain in the U.S., with 1,285 locations nationwide selling brand-name goods at a discount. Its success in that niche fueled huge gains in its stock over the past decade, with the price up twenty-fold since 2000. But even Ross has been hit by weak consumer spending in recent months. The company warned in November that same-store sales (revenue from stores open at least one year) in the quarter that ended in January 2014 would be up as little as 1% from the same period a year earlier. That has driven the shares down 17% from their 52-week high.

Yet as smaller off-price retail competitors such as Filene's Basement and Loehmann's die off — and major chains such as Sears and J.C. Penney struggle — Ross's long-term prospects should improve. Morningstar calls the company "one of the more compelling long-term ideas in the apparel retail space" and thinks Wall Street has undervalued the chain's growth potential.

Two other draws: Ross has little debt and a recent history of strong dividend increases. The payout has surged at an annualized rate of 25% since 2008. When Bloomberg News in January ranked S&P 500 stocks for expected dividend growth over the next three years, Ross was ninth on the list, with estimated growth of 19.5% a year.

*Based on estimated earnings through January 31, 2015.

Whiting Petroleum

52-week high/low: $42.44-$70.57

Price-earnings ratio: 16

Dividend yield: 0%

The bull market has rolled along without Whiting Petroleum (WLL) since 2011, when the shares peaked in the mid $70s. They have traded erratically since and have pulled back again in recent months. The problem? For one thing, Wall Street doesn't believe the company has yet lived up to the hype as one of the largest oil producers in the Bakken shale-oil field of North Dakota.

Whiting has more than doubled its annual revenue since 2008, to about $2.8 billion, but ballooning expenses have held earnings to a much more modest 40% rise. The company doesn't pay cash dividends. And some investors have been exasperated as rumors of a buyout of Whiting by a bigger energy company periodically boost the stock, then fade away.

Still, at current valuation levels, the shares are a compelling way to play the continuing oil boom in the Bakken region, where Whiting remains an aggressive driller. The firm also has exciting prospects in a new area of drilling in northern Colorado, in the so-called Niobrara shale formation. Ultimately, this is a bet on the U.S. moving closer to energy independence — and on crude prices staying high enough to keep shale-oil drilling lucrative.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.