10 Must-Watch Third-Quarter Earnings Reports

The third-quarter earnings season is officially here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The third-quarter earnings season is officially here. While Alcoa's (AA) Oct. 18 announcement will be touted as the starting line for the wave of quarterly reports, it's not actually the first major name to unveil its numbers … and it's certainly not the last.

It's also one of the least important earnings reports to worry about.

While aluminum was once a critical piece of the economic engine, it's not only a minor matter now, but volatile commodity prices have made Alcoa's bottom line anything but a barometer for the broad economy's strength.

Instead, we've scoured the earnings calendar for 10 companies with quarterly reports that every investor should watch. In some cases, the company in question must do well just to keep that organization's fragile stock propped up. In other cases, a corporation's bottom line is an indication of how well its industry – or the economy as a whole – is faring.

Data is as of Oct. 10, 2017. Stocks are ordered by earnings announcement date. Click on symbol links in each slide for current share prices and more.

Bank of America

- Report Date: Friday, Oct. 13

- Timing: Before the opening bell

- Bank of America (BAC, $25.93) may have had a tougher time shrugging off the ill effects of 2008's subprime meltdown than other large banks, but its past few quarterly earnings reports indicate that CEO Brian Moynihan finally has BofA firing on all cylinders – much like most other mega-banks.

Indeed, Bank of America looks like a model bank now, making it something of a yardstick for its peers.

Banks are in a situation that makes them tough to handicap right now. Credit Suisse analysts broadly like how the banking environment is shaping up, and believe BofA, JPMorgan Chase (JPM) and Morgan Stanley (MS) are among potential beneficiaries. However, the interest-rate picture is a double-edged sword. On one hand, higher rates (and the prospect for higher interest rates going forward) make lending a more profitable venture, but they also potentially crimp demand for loans because they're too expensive for consumers to take on.

Bank of America’s earnings report for the quarter ended Sept. 30 is due on the morning of Oct. 13 – Friday the 13th, eerily enough – and will offer a realistic look at the balance between the upside and downside of rising interest rates. That’s useful to know if you own any bank stock, not just BAC.

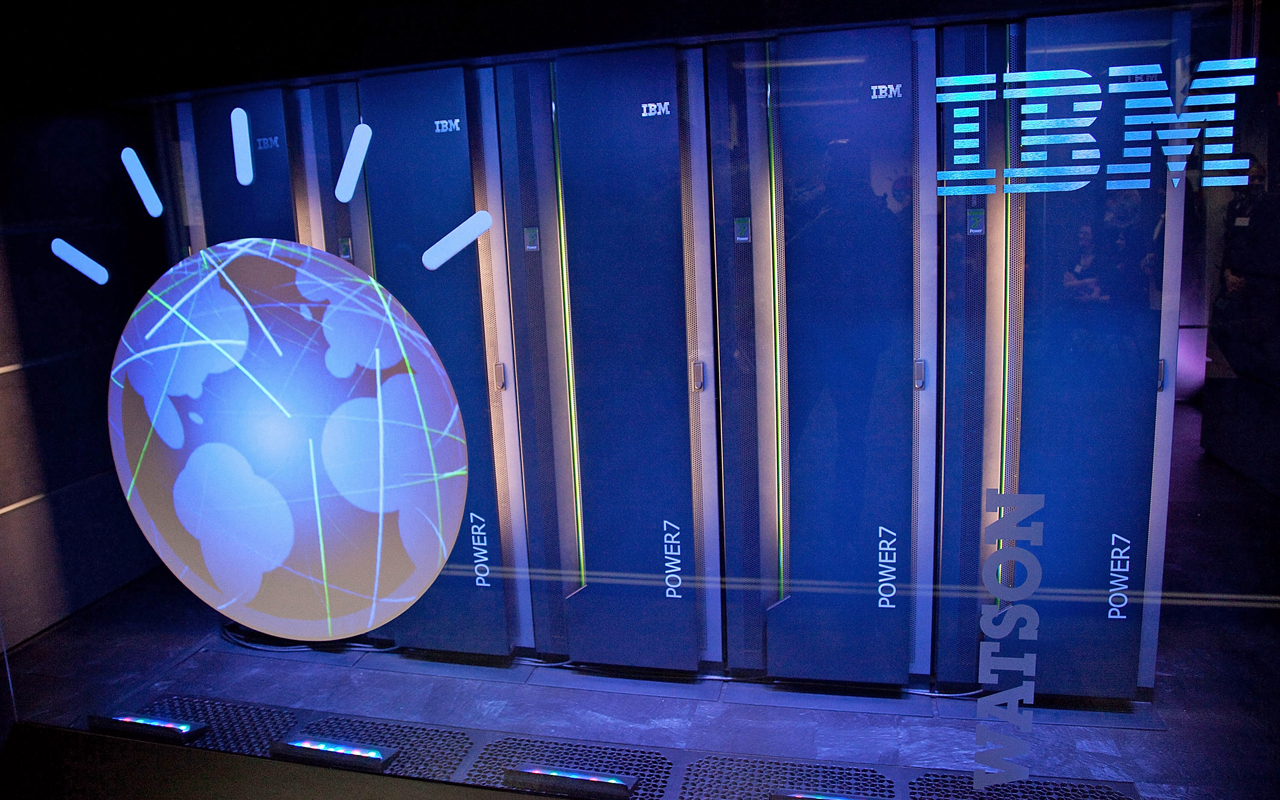

International Business Machines

- Report Date: Tuesday, Oct. 17

- Timing: After the closing bell

There once was a time when International Business Machines (IBM, $148.50) was the king of the technology world. Even Microsoft (MSFT) wouldn't be where it is today were it not able to ride IBM's coattails when the software company was young.

But times change. Technology changes too. Big Blue simply hasn't changed with it, letting the advent of cloud computing slip by without jumping into the fray until it was well too late. As a result, International Business Machines has – as of its second quarter of the year – suffered declining revenue in 21 consecutive quarters. Its per-share earnings trend has been almost as abysmal. Faithful investors desperately need something to convince them that what IBM can sell is more than offsetting sales lost to obsolescence.

IBM will get a chance to prove itself on Oct. 17, when the tech giant will unveil its results for the quarter ended Sept. 30. Analysts are collectively expecting the company to report revenue of $18.6 billion and a per-share profit of $3.28, both of which would be (slightly) lower from the year-ago period’s figures.

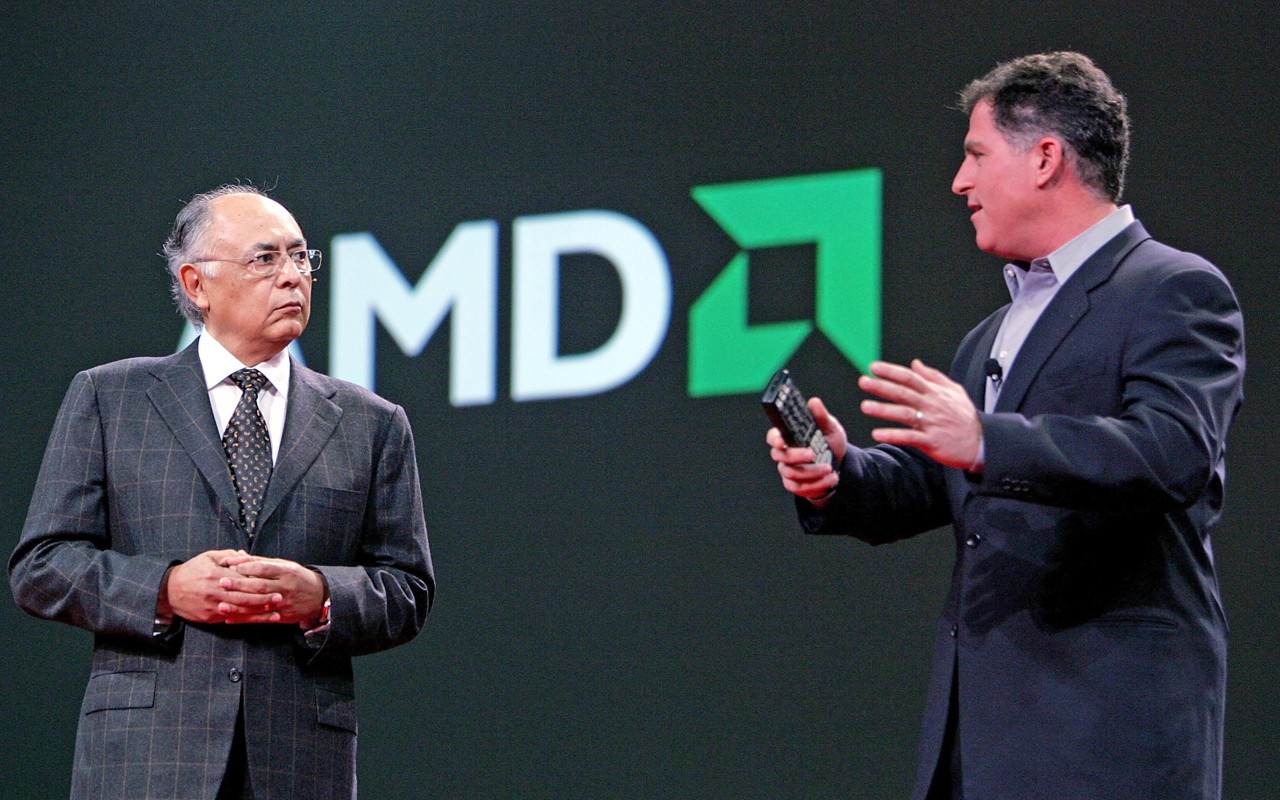

Advanced Micro Devices

- Report Date: Tuesday, Oct. 24

- Timing: After the closing bell

Although Advanced Micro Devices (AMD, $13.70) is pitted against respectable rivals like Nvidia (NVDA) and Intel (INTC), it's also something of a barometer for the computer chip industry as a whole. If AMD does well, odds are good that other companies in the business are also doing well. If it disappoints, it's a good bet that other chip players are running into the same headwind.

That said, Advanced Micro Devices still is its own company doing its own thing with its own products, and it has two relatively new products that need to start producing meaningful revenue. One of them is its Ryzen processor, which hit the market in April, and the other is its Vega line of graphics cards, which became available just a few weeks ago. They're either selling in earnest, or they're not; PC makers also have had time to evaluate and insert them into their lineups as well.

We'll get a good idea about these products' uptake – and Ryzen CPUs in particular – after the close on Oct. 24. That’s when the company will present its official earnings release for the quarter ended Sept. 30.

Chipotle Mexican Grill

- Report Date: Tuesday, Oct. 24

- Timing: After the closing bell

The saga of Chipotle Mexican Grill (CMG, $310.88) has been a mostly grim one since late 2015. That's when it was implicated as the source of an E. coli breakout that ultimately infected 52 people and led to the temporary closure of 43 locations. A month later, another 136 people were infected by norovirus, with Chipotle's restaurants once again pegged as the central source.

Although the chain had more than its fair share of food poisoning gaffes in the past, for whatever reason, this spat wasn't quickly forgiven and forgotten. Chipotle Mexican Grill's revenue has been suppressed ever since, with only a modest measure of recovery.

We're now approaching the two-year mark for the public relations disaster, which is when and where the public would start to forgive and forget. So far, that hasn’t happened, and Cowen analyst Andrew Charles doesn’t see that changing for Chipotle’s quarter ended Sept. 30. The company should report results Oct. 24, and Charles expects flat comparable-store sales – below Wall Street’s expectations for 2.5% growth – citing weak traffic trends, despite the company’s much-ballyhooed queso launch.

If the restaurateur doesn't offer a glimmer of hope, it could be difficult for investors to assume the company is anything but a lost cause.

- Report Date: Thursday, Oct. 26

- Timing: Before the opening bell

Just a few years ago, Twitter (TWTR, $17.51) was all the rage. Some even hailed it as a legitimate threat to social networking giant Facebook (FB). With a string of lackluster earnings reports in tow, however – coupled with slowing revenue and user growth – the market is becoming keenly aware that Twitter just doesn't have a terribly marketable product.

Twitter will have a chance to prove those investors wrong on Oct. 26. That's when the company is slated to post its numbers for the quarter ended Sept. 30. Analysts have set the bar rather low, for better or worse, projecting an operating profit of 7 cents per share and sales of $586.7 million. Both are lower than year-ago figures.

Those dull expectations could come back to bite Twitter, in that beating estimates still could be considered a relative letdown. And if the social media company ends up falling short of even those lowered expectations, it would take something of a miracle to prevent a panic.

Exxon Mobil

- Report Date: Friday, Oct. 27

- Timing: Before the opening bell

The road to recovery since 2014's meltdown has been a long and arduous one for oil and gas stocks. But these companies are indeed on the mend. They’re not back to their old selves yet, but at least they're pointed in the right direction – it’s just a question of figuring out where they are on the spectrum.

The energy sector's biggest name is also the best glimpse into how Big Energy is faring as a whole. That's Exxon Mobil (XOM, $82.26), which will post its results for the quarter ended Sept. 30 on the morning of Oct. 27. The pros are expecting the company to turn $65 billion in sales into a profit of 85 cents per share, up from a top line of $58.7 billion and a bottom line of 63 cents per share in the comparable quarter a year earlier.

Just as telling as the numbers will be the company's updated capital expenditure plans, which directly impact (for better or worse) Exxon Mobil's all-important credit rating. Its credit rating, in turn, dictates a key component of its expenses.

The company announced earlier in the year it was going to increase spending to the tune of 16% in 2017, but thus far it hasn't moved in that direction. The trick is figuring out which expenditures will help the bottom line, and which won't. Every penny counts right now at this tentative time, and not just for Exxon Mobil.

Apple

- Report Date: Thursday, Nov. 2

- Timing: After the closing bell

Consumer technology giant Apple (AAPL, $155.90) is not only one of the world's best-known companies, but also the world's biggest by market capitalization at more than $800 billion. Because of that, Apple accounts for 3.7% of the S&P 500's value, even though it's only 0.2% of the index's number of constituents. Even more jaw-dropping is the fact that Apple accounts for roughly 5% of the index's profits, depending on the quarter.

Point being, while the overall market's growth doesn't entirely depend on Apple's success, if the broad market is going meet or miss earnings expectations, AAPL can be a make-or-break stock.

It’s not just Apple's direct contribution to the S&P 500 that makes it worth watching. There are dozens of publicly traded companies that act as suppliers for iPhones, Macs and more. Thus, if Apple is doing well, those suppliers probably are as well.

Never even mind the fact that many investors treat Apple as a proxy for the whole stock market.

Apple’s results for the fiscal quarter and year ended Sept. 30 are scheduled to be released Nov. 2 after the market's close.

Walt Disney

- Report Date: Thursday, Nov. 9

- Timing: After the closing bell

- Walt Disney (DIS, $99.58) still makes some of the world's best and most lucrative movies, capitalizing on its ownership of Marvel, Star Wars and some animated masterpieces. Unfortunately, it also owns some TV brands that aren't nearly as successful. ESPN continues to lose viewership, choking off ad revenue for what used to be a very healthy cash cow. The previous quarter's cable business operating income fell 23% on a year-over-year basis, with the company conceding, "Lower operating income was due to a decline at ESPN. The decrease at ESPN was due to higher programming costs, lower advertising revenue and severance and contract termination costs, partially offset by affiliate revenue growth."

The division's revenue was off 3% as well, extending a long trend of deterioration.

In simplest terms, investors have grown weary of Disney's fading success. While it appreciates the efforts CEO Bob Iger has made to stop the bleeding and reverse the trend for the company's TV business, effort alone isn't enough.

The company will get a chance to prove it knows how to fix what's broken when it posts its figures for the fiscal quarter and year ended Sept. 30 after the market closes on Nov. 9.

JCPenney

- Report Date: Friday, Nov. 10 (estimated)

- Timing: Before the opening bell (estimated)

Back in late 2014 when Marvin Ellison was tapped to eventually become CEO of iconic retailer JCPenney (JCP, $3.54), hopes were high.

Then-CEO Mike Ullman was struggling to clean up the mess left by former Apple executive Ron Johnson, who departed in 2013 and left the company in shambles. However, Ellison was something of a star during his time at Home Depot (HD), and investors felt if anyone could kick-start a turnaround, it was Ellison.

So far, no dice. He got off to a modestly decent start when he assumed the role Aug. 1, 2015, but revenues for the fiscal year ending Jan. 28, 2017, declined year-over-year, and losses are still the norm.

Investors have noticed, sending JCP shares from their 2016 peak of $12 to their current price of less than $4, as hope for a meaningful turnaround faded in a big way. If JCPenney doesn't give the market some reason for hope when it posts numbers for the quarter ended Oct. 28 sometime around Nov. 10, investors may throw in the towel for good.

Note: Earnings date and timing estimates based on previous reports.

Foot Locker

- Report Date: Friday, Nov. 17 (estimated)

- Timing: Before the opening bell (estimated)

Just a couple of years ago, fitness was all the rage, and superstar athletes successfully sold sneakers, athletic apparel and more. Names like Under Armour (UAA) and Lululemon (LULU) were must-haves.

What a difference a couple of years make. Not only has the fitness mindset hit something of a plateau, but celebrity spokespeople are losing traction with consumers. We've seen a string of store closures within the industry, and they're still coming.

It's a trend that puts sporting goods and athletic shoe retailer Foot Locker (FL, $33.60) in a mixed light. On the one hand, it appears the company is on the losing end of a paradigm shift. Baird analyst Jonathan Komp downgraded FL to “Neutral” (equivalent of hold) following the company’s wide earnings whiff in August, saying “the broad-based weakness for many athletic/sporting goods retailers raises the risk that the industry at retail may be in a zero-sum environment (or worse).”

On the other hand, with the competition slowly but surely fading away, this survivor may be able to attract shoppers that have few other places to go.

While Foot Locker’s expected earnings report for the quarter ended Oct. 28 – due sometime around Nov. 17 – will provide some insight as to whether the retailer is making lemonade out of the industry's lemons, of particular interest will be management's thoughts about the future of the sports apparel and athletic shoe business.

Note: Earnings date and timing estimates based on previous reports.

James Brumley held none of the aforementioned stocks as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.

-

Trade Uncertainty Sparks Whipsaw Session: Stock Market Today

Trade Uncertainty Sparks Whipsaw Session: Stock Market TodayVolatility is making a cameo here in mid-October, a generally positive month marked by its historic stock market events.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.

-

What CEOs Say About President Trump and Fed Chair Powell

What CEOs Say About President Trump and Fed Chair PowellTop opinion-shapers and decision-makers are expressing mixed views on the evolving conflict between the White House and the central bank.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Stock Market Today: Powell Rumors Spark Volatile Day for Stocks

Stock Market Today: Powell Rumors Spark Volatile Day for StocksStocks sold off sharply intraday after multiple reports suggested President Trump is considering firing Fed Chair Jerome Powell.

-

Stock Market Today: Stocks Struggle Amid Tariff Uncertainty

Stock Market Today: Stocks Struggle Amid Tariff UncertaintyBoeing dropped after China suspended new aircraft orders, while Bank of America and Citi climbed on earnings beats.