Stock Picks That Billionaires Love

Billionaire investors are scooping up beaten-down blue chips when they're on sale.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You can't get rich simply by copying billionaires' moves, but there's still something irresistible about following their top stock picks.

The billionaires we're about to talk about have larger-than-life reputations when it comes to investing other rich people's money. Meanwhile, their resources for research, as well as their intimate connections to insiders and others, can give them unique insight into their stock picks.

Studying which stocks they're chasing with their capital can be an edifying exercise for retail investors. There's a reason the rich get richer, for one thing. But it's also helpful to see where billionaires sometimes make mistakes — at least in the short term.

No matter how successful they've been in the past, all investors are fallible. Those who've amassed multibillion-dollar personal fortunes have merely made more money being right than they've lost when getting it wrong.

Need proof? As Chairman and CEO Warren Buffett wrote in Berkshire Hathaway's 2022 annual report (PDF): "In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. Our satisfactory results have been the product of about a dozen truly good decisions."

Berkshire's "satisfactory results" happen to be a stock that has generated compound annual growth of almost 20% since 1965. The S&P 500 delivered compound annual growth of not quite 10% over the same span.

Without further ado, here are five notable top stock picks from the billionaire class.

In each case, the billionaire below initiated a substantial position or added to an existing one in the fourth quarter of 2025.

Stake values and portfolio weights are as of December 31, 2025. Data courtesy of S&P Global Market Intelligence, YCharts, WhaleWisdom, Forbes and regulatory filings made with the Securities and Exchange Commission, unless otherwise noted.

Nvidia

- Billionaire investor: Steve Cohen (Point72)

- Stake value: $1.9 billion

- Percent of portfolio: 2.1%

Steve Cohen is probably best known for using his estimated net worth of $23 billion to buy the New York Mets. But he's also known for adding to positions when stocks he already likes a lot are on sale.

Perhaps that's why his family office — Point72 Asset Management based in Stamford, Connecticut — massively upped its stake in Nvidia (NVDA) when shares trailed the broader market in Q4.

Point72, with $221 billion in assets under management (AUM), bought another 2.7 million shares in NVDA – a 38% increase – over the course of the fourth quarter, adding to a position the firm initiated in 2023. With nearly 10 million shares worth $1.9 billion as of the end of Q4, the stock rose to become the fund's single largest position. Previously, it was the fund's third-largest holding.

Point72 also increased its stakes in Amazon.com (AMZN) and Taiwan Semiconductor Manufacturing (TSM), among other AI plays.

Sea Limited

- Billionaire investor: Daniel Sundheim (D1 Capital Partners)

- Stake value: $444.6 million

- Percent of portfolio: 4.2%

Daniel Sundheim's D1 Capital Partners made a name for itself during its seven years of existence. The New York hedge fund began trading with "only" $5 billion in capital. Today, D1 boasts nearly $28 billion in AUM.

Along the way, Sundheim built an estimated net worth of $2.6 billion, according to Forbes. In a nod to his precocious success, some wags called Sundheim the LeBron James of investing.

Sundheim clients certainly hope he brings his scoring touch to D1's position in Sea Limited (SE). The hedge fund more than doubled its stake in the Singapore-based online gaming, shopping and financial services company in Q4 – a position it initiated only a quarter earlier.

With 3.5 million shares worth $444.6 million as of December 31, SE leapfrogged to become the fund's eighth-largest holding from 16th place at the end of Q3. SE lost about a quarter of its value during the fourth quarter, suggesting Sundheim spied a bargain.

Broadcom

- Billionaire investor: Stephen Mandel (Lone Pine Capital)

- Stake value: $598.8 million

- Percent of portfolio: 4.4%

It should come as no surprise that yet another billionaire investor added to yet another big bet on a mega-cap tech stock in Q4. After recovering sharply from the market's April bottom, shares in Broadcom (AVGO) traded essentially sideways in Q4.

Stephen Mandel picked up another 180,000 shares in the chipmaker in the final quarter of the year – a position he initiated in the third quarter. Mandel amassed an estimated net worth of $2.5 billion by knowing how to spot momentum, so count this as encouraging news for AVGO bulls.

Mandel's Lone Pine Capital hedge fund ($13.6 billion AUM) now owns a stake in AVGO worth nearly $600 million as of December 31. At 4.4% of the portfolio, Broadcom is the fund's eighth-largest holding, up from 13th place at the end of Q3.

In an ongoing theme, the hedge fund also added to its stake in Microsoft (MSFT) in Q4.

Meta Platforms

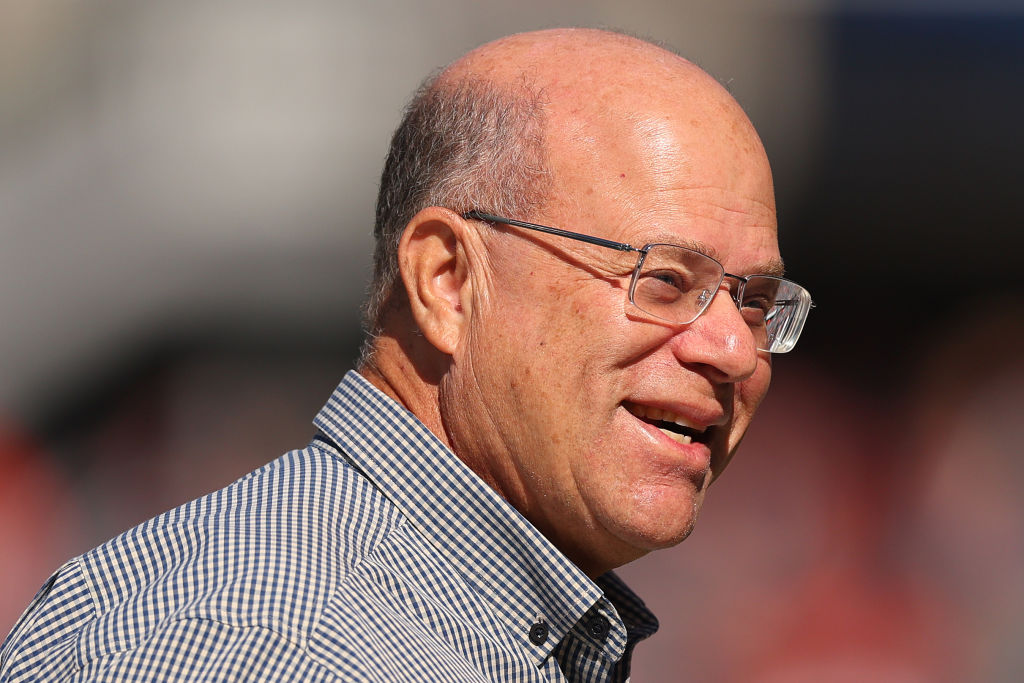

- Billionaire investor: David Tepper (Appaloosa)

- Stake value: $396 million

- Percent of portfolio: 5.7%

Meta Platforms (META) swooned by nearly 20 percentage points a little over halfway through the fourth quarter and David Tepper was there for it.

The owner of the NFL's Carolina Panthers accumulated an estimated net worth of $23.7 billion in part by knowing how to spot a bargain. His Appaloosa hedge fund (AUM $6.9 billion) boosted its stake in the Facebook, Instagram and WhatsApp parent in Q4 by more than 60%, or 230,000 shares.

Appaloosa, which has owned Meta since early 2016, now holds 600,000 shares worth nearly $400 million as of the end of the fourth quarter. With a weight of 5.7%, META is Tepper's fifth-largest holding, up from No. 9 in the previous quarter.

The hedge fund also added to positions in Micron Technologies (MU) and Microsoft.

Microsoft

- Billionaire investor: Philippe Laffont (Coatue Management)

- Stake value: $2.5 billion

- Percent of portfolio: 6.3%

Philippe Laffont built an estimated net worth of $7.9 billion partly by knowing how to stick with winners. Such skills were on display when Laffont's Coatue Management hedge fund (AUM $69.5 billion) increased its stake in Microsoft by more than 11% during the final quarter of 2025.

Coatue, which has owned MSFT since the third quarter of 2021, bought another 528,926 shares in the tech giant. The fund now holds 5.1 million shares worth $2.5 billion as of December 31, according to regulatory filings. With a portfolio weight of 6.3%, MSFT is the New York hedge fund's second-largest position.

If nothing else, Laffont finds himself in good company. Not only is Microsoft one of the most popular blue chip stocks among hedge funds, but it also gets the highest consensus recommendation of all 30 Dow Jones stocks.

It also doesn't hurt that MSFT has done extraordinary things for truly long-term shareholders. Anyone who put $1,000 into MSFT stock a couple of decades ago has clobbered the S&P 500 by a wide margin.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nvidia Earnings: Live Updates and Commentary February 2026

Nvidia Earnings: Live Updates and Commentary February 2026Nvidia's earnings event is just days away and Wall Street's attention is zeroed in on the AI bellwether's fourth-quarter results.

-

I Thought My Retirement Was Set — Until I Answered These 3 Questions

I Thought My Retirement Was Set — Until I Answered These 3 QuestionsI'm a retirement writer. Three deceptively simple questions helped me focus my retirement and life priorities.

-

How to Use Home Equity to Help With Your Long-Term Goals

How to Use Home Equity to Help With Your Long-Term GoalsHomeowners are increasingly using their home equity, through products like HELOCs and home equity loans, as a financial resource for managing debt, funding renovations and more.

-

Nvidia Earnings: Live Updates and Commentary February 2026

Nvidia Earnings: Live Updates and Commentary February 2026Nvidia's earnings event is just days away and Wall Street's attention is zeroed in on the AI bellwether's fourth-quarter results.

-

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term Goals

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term GoalsHomeowners are increasingly using their home equity, through products like HELOCs and home equity loans, as a financial resource for managing debt, funding renovations and more.

-

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026Starting July 1, federal borrowing will be capped for new graduate students, making scholarships and other forms of "free money" vital. Here's what to know.

-

5 Tips To Get Your Kids Investing as Soon as Possible

5 Tips To Get Your Kids Investing as Soon as PossibleTeaching your kids to invest early will help them build a solid financial future. Here are five ways to get them started.

-

Aging in Place Can Be Bad for Your Health: This Financial Pro's Alternative Is a No-Brainer

Aging in Place Can Be Bad for Your Health: This Financial Pro's Alternative Is a No-BrainerWhy age alone in financial hardship when you can enjoy companionship — and share the costs of housing, groceries and health care — with a small community of friends?

-

Want to Buy a Home With a Friend? Here's How to Prevent Legal Headaches

Want to Buy a Home With a Friend? Here's How to Prevent Legal HeadachesWith rising home prices leading more people to co-buy homes with friends, it's essential to have a co-tenancy agreement that clearly defines the deal.

-

When It Comes to Retirement Planning, Be More Spock Than Scotty: It's Logical, Captain

When It Comes to Retirement Planning, Be More Spock Than Scotty: It's Logical, CaptainIf you're worried about your retirement, address the concerns in a logical sequence, talk honestly with your team and prepare to go boldly into the future.

-

A 5-Step Guide to Getting AI to Give You Actionable Insight Rather Than Polished Nonsense

A 5-Step Guide to Getting AI to Give You Actionable Insight Rather Than Polished NonsenseAI can be a powerful specialist, but it can sound smarter than it is when it comes to understanding real-world stakes. That means you have to be the strategist.