Retirement Reality Check: Four Risks You'll Want to Avoid at All Costs

There's no crystal ball for retirement planning, but the closest thing could be to consider the key risks you'll face in retirement and build a plan around them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Did you have “global pandemic” on your bingo card of possible retirement risks? The reality is that risks abound, and you can’t always see them coming.

Still, a proactive stance can help you get through them — and thrive.

Here are the top risks retirees need to be aware of and how to guard against them.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

1. Outliving your savings

Americans are living longer than ever. While most would welcome increased longevity, it also means you’ll need money to fund additional years of retirement. What can you do to ensure your savings last?

- Work longer. Working just a few years longer can help you save more money, while also delaying your need to tap your nest egg.

- Part-time work. Instead of leaving work behind completely, consider taking a part-time job to bring in some income so your money can continue to grow.

- Delay Social Security. If your health is good and you have other income sources now, you can get a significantly bigger paycheck by waiting on Social Security.

- Consider an annuity. A lifetime income annuity provides you with a guaranteed source of income you can’t outlive.

2. Encountering sequence of returns risk

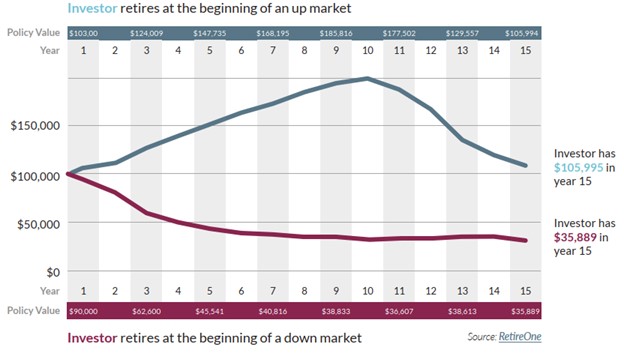

Your chances of running out of money are much less if you retire during a booming market and your portfolio is up. But what happens if you retire during a market decline? It’s a little-known phenomenon known as sequence of returns risk.

Making withdrawals from your portfolio when it’s down forces you to sell more investments to come up with the amount you need. Not only does that drain your portfolio faster, but it leaves you with fewer assets with which to participate in an eventual rebound.

A wealth adviser can work with you in the years leading up to retirement to create a pool of money for your immediate cash needs so you won’t need to make withdrawals if the market is down.

The chart below illustrates what can happen to a hypothetical portfolio based on different returns at different points in time.

3. Rising health and medical expenses

Health care is one of the biggest retirement expenses, but many people overlook it when planning for retirement.

Health care costs are expected to rise about 7.5% in 2025, a near-record trend that is driven by inflationary pressure, prescription drug spending and behavioral health utilization.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

To ensure that health care costs don’t overwhelm your retirement, pay attention to these things:

- Health savings accounts (HSAs). You can build up an account for health-related expenses by saving in tax-advantaged HSAs in the years before retirement.

- Health insurance. If you retire before age 65, you’ll need to line up health insurance coverage. Some options to consider: COBRA through your previous employer, a health exchange plan or a high-deductible plan paired with an HSA.

- Medicare. Medicare won’t cover all your health care expenses in retirement. In addition to Medicare, which covers some doctors’ visits and hospital stays, you’ll want to purchase supplemental plans to pay for out-of-pocket costs.

- Long-term care insurance. The possibility of needing long-term care is higher than you might think. Long-term care insurance can pay for care when you’re no longer able to care for yourself. The earlier you buy it, the more affordable the premiums will be.

4. Letting inflation erode your purchasing power

It may seem harmless in small doses, but over time, inflation can erode your purchasing power. Think of it as a silent thief stealing the value of your money. While Social Security has automatic cost-of-living adjustments each year, it’s up to you to make sure the rest of your money keeps up with inflation. These strategies might help:

- Invest for growth. Over time, stocks have shown the ability to outpace inflation. Even in retirement, it’s important to keep some of your portfolio invested in stocks.

- Inflation-proof your investments. Consider inflation in the context of your investment selection and work with your financial adviser to adjust based on your situation.

- Explore annuities. Some annuities come with payments that increase with inflation, providing a steady income stream that retains its purchasing power over time.

Retirement is an exciting chapter in life, offering countless opportunities for personal fulfillment and quality time with loved ones.

However, concerns about financial security can create anxiety and keep you up at night.

The good news is that with a little bit of planning, you can pave the way for a smooth transition into retirement.

Related Content

- Phased Retirement: Why Easing Into Retirement Might Be Your Best Move

- Delay Social Security Benefits — Even by a Month — to Boost Your Check

- Average Cost of Health Care by Age

- How to Help Shield Your Retirement From Inflation

- Three Essential Estate Planning Steps to Protect Your Nest Egg

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As Vice President, Wealth Fiduciary Adviser and a CERTIFIED FINANCIAL PLANNER™ professional, Nicole provides personalized financial planning and trust services to clients with complex needs to create, grow and preserve their assets. She builds relationships with her clients, their families and their trusted professionals in order to understand how to best help them achieve their goals.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.