What if You Could Increase Your Retirement Income by 50% to 75%? Here's How

Combining IRA investments, lifetime income annuities and a HECM into one plan could significantly increase your retirement income and liquid savings compared to traditional planning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You’ve worked hard to save for retirement in your 401(k) and now IRA — and succeeded. But wait. Your work isn’t done.

If you adopt a plan that combines assets to the best effect, our new IRA study shows average starting income of an IRA4Income plan of 50% to 75% over traditional planning.

Before describing the planning methodology and our study of the results, let’s describe these assets and answer the question, “Why haven’t I heard about this before?”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

What are these assets? And why haven’t we seen this before?

Are we talking about high-yield bonds, complex annuities or other exotic investments? Nope. In fact, the elements are a little boring:

- An IRA account invested 50/50 in fixed income and stock investments

- Lifetime income annuities with income starting immediately or in the future

- A home equity conversion mortgage (HECM) that generates income and liquidity

What’s unique is that the asset classes come from three separate financial businesses — investments, insurance and mortgages — and the Go2Income planning methodology (a little like AI) has figured out how to put the pieces together for maximum benefit, for all retirement ages and objectives.

If you haven’t heard about this method, it’s because the different businesses operate quite separately, sales forces have their own requirements for what they can sell you, and combining these asset classes requires complying with multiple regulations.

That means most advisers can’t, or won’t, talk about the asset classes they don’t represent.

Consumers don’t share those restrictions and can explore something like my company’s IRA4Income method, which, besides the huge increase in income, creates more liquidity than the IRA alone. By age 85, it can provide nearly double the IRA by itself.

That increase could help to cover, for example, the long-term care costs that 40% of retirees will incur.

How well do these assets have to perform?

Using our Go2Income planning technology, we’ve put the assets together into IRA4Income by first combining two programs: IRA2Income, made up of investments and immediate annuities, and HomeEquity2Income, made up of a HECM and a QLAC deferred-income annuity. (For more on this combo, see my article How Combining your Home Equity and IRA Can Supercharge Your Retirement.)

As you’ll see below, these programs can also be set up on their own to provide benefits, even if you don’t seek the maximum win-win of complete integration into your retirement income plan.

Our study analyzes results for different ages, marital status, IRA savings amounts, value of home and market conditions.

The old rule about taking $40,000 as starting income from your $1 million IRA has been upended, with starting income amounts that range from $60,000 to $80,000, depending on the case.

Highlights from the study

Each case study starts with $1 million from a rollover IRA and $1 million in home value. Besides starting income, the study looks at liquid savings and legacy, making sure we consider all three key retirement objectives. Starting income grows by 1.5% per year until age 85.

Set out below are key results for sample cases, as well as key planning assumptions:

62-year-old man

- Starting income: $70,000

- Total liquid savings at 85: $763,000

- Total legacy at 95: $2,597,000

65-year-old woman

- Starting income: $69,100

- Total liquid savings at 85: $977,000

- Total legacy at 95: $2,659,000

70-year-old couple

- Starting income: $68,200

- Total liquid savings at 85: $1,138,000

- Total legacy at 95: $2,583,000

75-year-old couple

- Starting income: $70,700

- Total liquid savings at 85: $1,115,000

- Total legacy at 95: $2,364,000

Key planning assumptions: Stock market investment returns: 8%; fixed income total return: 5%; allocation to annuities: 30% in an immediate annuity, 20% in a QLAC deferred-income annuity; HECM adjustable interest rate: 7.75%.

Too good to be true?

As with any retirement plan, the study results are based on certain assumptions about the performance of each asset class. The most important aspect is that no one assumption drives the results:

- The lifetime annuity is fully guaranteed and is issued by a highly rated insurance company

- The HECM interest rates are adjustable within limits, but with a large portion of the mortgage interest paid by the QLAC deferred-income annuity

- The IRA investment assumptions reflect an equity return that is lower than average long-term market returns

In setting up a personalized plan, you can customize the assumptions to your risk tolerance.

An IRA4Income plan in more detail

Let’s look at our example investor, Sally, age 70, who now has $1 million in rollover IRA savings and a home worth the same amount. She wants the maximum amount of income, within reason, and liquidity for long-term care costs.

Fortunately, Sally has read our articles and realizes her home is a valuable asset and that she can consider it as a way to ensure her money not only lasts for her lifetime but also provides a resource for unplanned expenses.

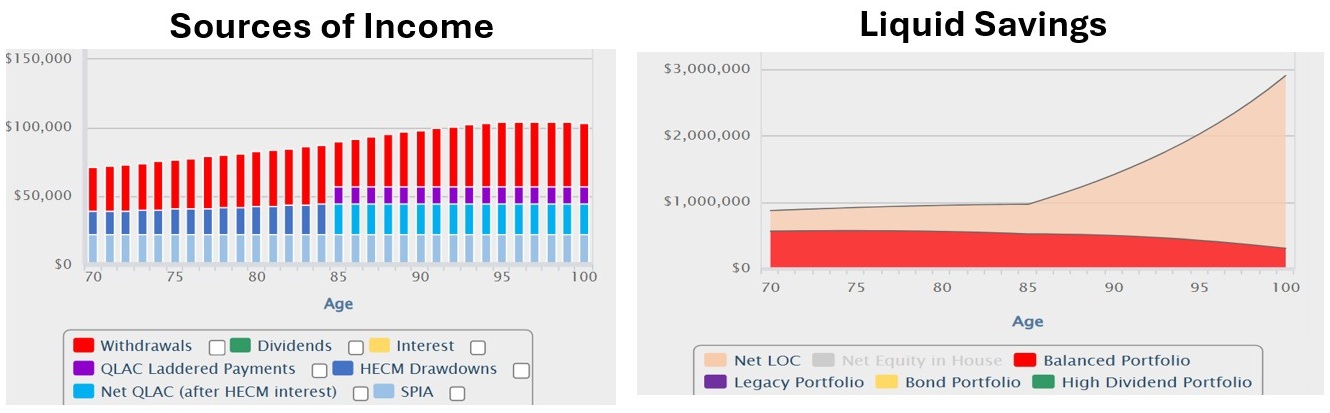

The charts below demonstrate how IRA4Income can bolster her spendable income (starting at $71,000) while providing access to savings that could pay for large unplanned expenses after age 85. Her total liquid savings under this plan are nearly $1 million at age 85 and will continue to grow thereafter.

What about taxes? What about risk?

Sally is not obsessed with taxes but would like to understand whether there’s any portion of her income, unlike the IRA, that’s free from tax. She’s pleased that, until 85, about 20% of her income is tax-free.

If we measure risk by the uncertainty of the value of the investment portfolio, a 100% IRA is all at risk, while with IRA4Income, only about 50% is subject to market risk.

If you’re nervous about plunging in all at once, the parts of an IRA4Income plan can be put in place one at a time, following your own timeline.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

As pointed out above, you could start by combining investments with an immediate income annuity (IRA2Income) or access the value of your home with a HECM and a QLAC.

At the same time, you might consider whether to delay claiming your Social Security benefits to get larger payments.

You might be able to wait until 73 (or 75 if you were born in 1960 or later) to take RMDs (required minimum distributions) from an IRA, allowing that income source to grow.

When you consider all your options together, you have choices.

Are you ready to start now?

In these articles, we have worked to explain these financial approaches in clear language so readers can talk knowledgeably with an adviser about what steps to take and when.

Still, there are indications that some people just throw their hands in the air and resolve to live with their savings in different silos for stocks/bonds, annuities and their home.

You don’t have to do that.

Visit Go2Income to order a Go2Income plan that with IRA4Income inside can meet more of your retirement objectives. A Go2Specialist can answer questions about the plan or refer you to a qualified adviser.

Related Content

- What the HECM? Combine It With a QLAC and See What Happens

- Transform Your Retirement Plan With This Powerful Combo

- How Combining Your Home Equity and IRA Can Supercharge Your Retirement

- Is Your Retirement Solution Hiding in Plain Sight?

- How Your Home Can Fill Gaps in Your Retirement Plan

- Would a Reverse Mortgage Work for You in a Gray Divorce?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.