The Final Countdown to Retire Early in 2026: A Monthly Guide

Here's how to retire early in 2026, with a month-to-month checklist of achievable goals.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor’s note: Retire Early in 2026 is part of a series on how to retire early and the FIRE (Financial Independence, Retire Early) movement. Part one is How to Retire Early in Six Steps.

It’s said that waiting for the right moment is just procrastination in disguise. What if 2026 is the year you finally prepare for early retirement and start living it by December 31?

Retiring before 62, or even by 55, is an exciting but daunting goal, as many traditional benefits aren’t yet available to you. How do you access retirement accounts without penalties? Will you have enough income without Social Security? What’s your plan for health coverage?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Retire early in 2026 (or at least by year's end)

There’s no Goldilocks moment in this story. You have to trust the work you’ve already done — whether it’s saving half your income, living modestly or building multiple streams of income. As self-help author Napoleon Hill put it: “Don’t wait. The time will never be just right.”

If you’re done waiting but aren’t sure what the final steps are, this monthly early retirement checklist is for you. By December 31, 2026, you can ceremoniously update your LinkedIn profile headline to include one very satisfying word: “former.”

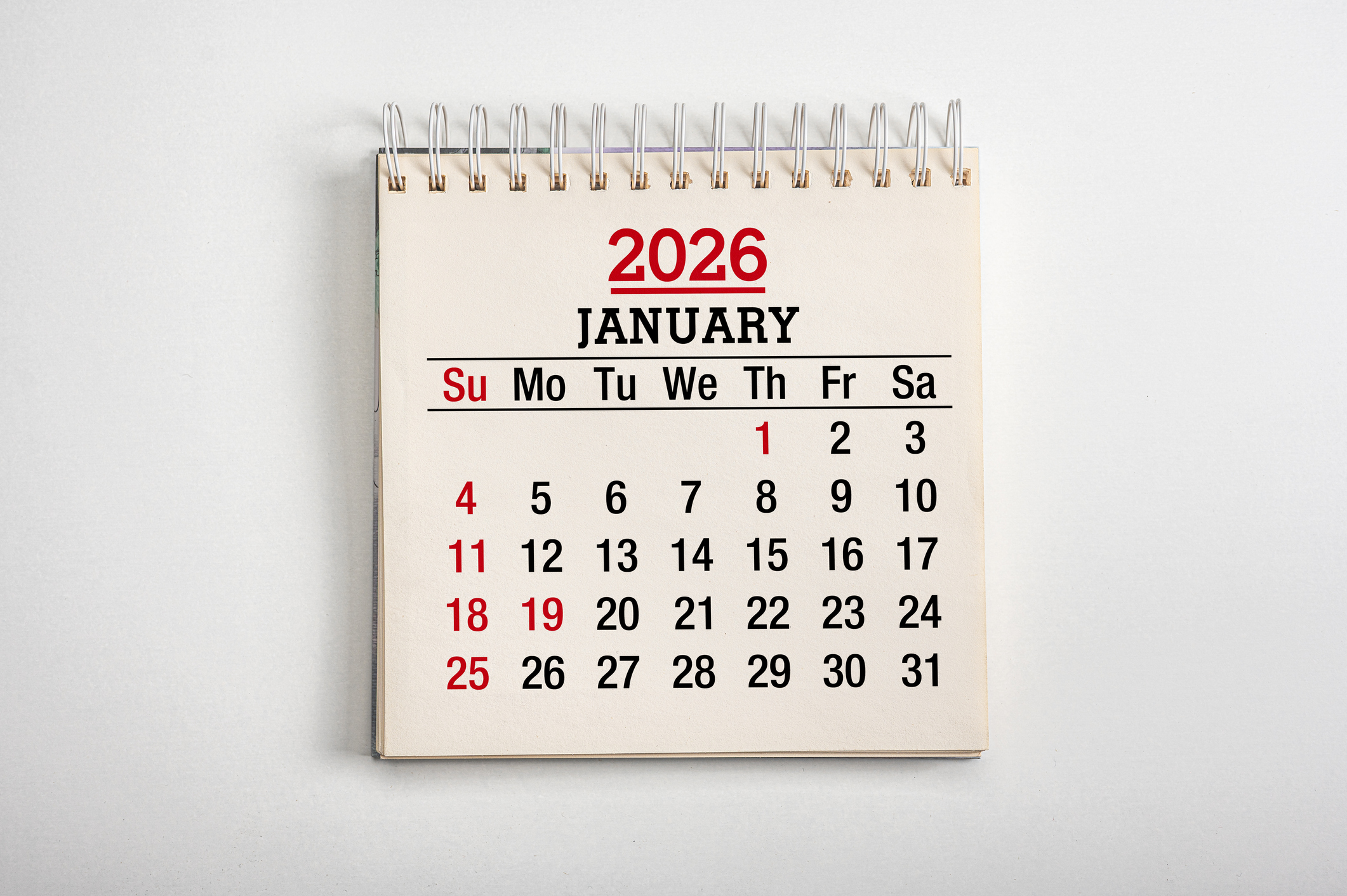

January: Review your retirement readiness

Since this year’s resolution is greater than dropping a few pounds, there’s no time to waste. Brett Spencer, CFP® and founder of Impact Financial, advises, “Retirement planning can be overwhelming, especially dealing with the nuances of early retirement. Just like a new year’s workout program, getting started is key.”

Here’s what to tackle first so your goal doesn’t collect dust like an unused gym membership.

Assess your target. How much do you need? The Rule of 25 is a simple formula: Multiply your estimated annual retirement expenses by 25. This provides a target number that could allow you to withdraw 4% annually while preserving your nest egg. For greater accuracy, try our retirement calculator.

Build a budget. Include essentials such as housing and food, as well as fun stuff such as travel. Recognizing many high-income workers in the FIRE (financial independence, retire early) movement, WorthPointe partner and CFP® John Chapman says, “High earners may not need to budget while working, but in early retirement, it’s a must.”

Get a plan and run projections: A financial adviser can stress-test your plan for worst-case scenarios, ensuring your money outlasts you — not the other way around.

February: Build a health care plan

Instead of your sweetheart, focus on your own heart this year — literally. Medicare doesn’t kick in until 65, so health care is often a major planning hurdle for early retirees.

Explore options. Look into COBRA, ACA marketplace plans or joining a spouse’s plan. Among these, enrolling in a spouse’s plan often proves most cost-effective, providing a bridge to Medicare eligibility. Chapman notes, “Premiums depend on income, so understanding coverage is critical.” You can also use funds in a health savings account (HSA) when you retire.

Schedule checkups. Knock out physicals, dental visits and specialist appointments while you’ve got coverage.

March: Organize your financial accounts

Madness is for basketball, not your finances. This month, simplify.

Consider consolidating accounts. It might make sense to combine investment and retirement accounts for easier management. Make sure you know which financial and tax documents to keep and how to store them safely.

Pay off high-interest debt. “Eliminating debt, including your mortgage, lowers fixed costs and adds peace of mind,” Chapman says. Try some of our tips for how to pay off credit card debt.

Build cash reserves. Save six to 12 months of expenses in a high-yield savings account or money market account. “Since early retirees may not access retirement accounts without penalties, it’s important to hold at least a year’s worth of expenses in cash reserves,” Chapman adds. “Also, build up significant non-retirement investments to fund spending before tapping into retirement accounts.”

April: Maximize tax opportunities

This is the rare year when tax season brings joy. Spencer says, “Beyond filing, it’s a great time to take advantage of any tax benefits and plan for the year ahead.”

Boost retirement accounts. For instance, you can max out 2025 IRA contributions by April 15, 2026. Spencer also recommends “maximizing 401(k) contributions and considering contributing to an HSA or FSA for additional tax deductions.”

Consider Roth conversions. “Once you retire early, your taxable income may drop significantly,” Chapman says. This creates a great opportunity for Roth conversions — transferring funds from pre-tax ("traditional") IRAs or 401(k)s to Roth IRAs at potentially lower tax rates. He suggests consulting a tax adviser to determine the right amount to convert without triggering unintended tax consequences.

May: Optimize your withdrawal strategy

You’re not quite done with the IRS. If you’re under 59½, accessing retirement accounts without tax penalties takes strategy. At the same time, you’ll want to ensure your portfolio is balanced and your withdrawals can sustain your lifestyle.

Create a withdrawal strategy. Explore options such as the Rule of 55 or SEPP 72(t) exceptions to tap your accounts penalty-free. Determine which accounts to draw from first (e.g., taxable accounts before IRAs) and at what rate to maintain tax efficiency and sustainability. Create an early retirement withdrawal strategy for the long haul.

Review asset allocation. Spencer emphasizes diversification to reduce downside risk: “Bonds aren’t the only diversifier. Understanding true diversification is critical.”

June: Evaluate housing needs

Some things might not change: Housing is the biggest expense for retirees, just as it is for workers, according to government data. Where do you see yourself living in retirement?

Assess your situation. Would downsizing or relocating improve your lifestyle and budget? Dreaming of a beachfront bungalow or van life?

There are so many options to consider, all of which will affect your pocketbook. For example, sometimes joining a retirement community when you're younger might save you money down the road if you need assisted living. On the flip side, if you're hearty and adventurous, you might consider retiring abroad.

You'll also need to think through whether you retire in place, buy a new home or rent in retirement. Check out our list of the best places to retire in the U.S. Now’s the time to plan.

July: Make lifestyle preparations

As you set off fireworks to celebrate America’s independence (and maybe annoy your neighbors), reflect on your own financial independence. What will you do? Who do you want to become? Early retirees can experience a loss of identity or purpose, especially when they feel there’s still more to contribute to the world.

Test your budget. Try living on your retirement income for a month and adjust as needed.

Explore interests. Start hobbies or volunteer work now to avoid post-retirement identity crises. Thinking of launching a business? Dip your toes in now.

August: Create or review your estate plan

It’s not just for older folks. If you have assets, you need an estate plan.

Update legal documents. Refresh your will, power of attorney and health care directives. “Some employers offer group legal benefits,” Spencer notes. “Use them to get started on your estate planning or other legal needs before retirement.”

Verify beneficiaries. Double-check the beneficiaries you named on retirement accounts and life insurance policies. Make their lives easier by organizing your estate planning documents for your heirs.

September: Review your progress

Cue Europe’s 1986 hit, “The Final Countdown,” because you’re in the final quarter.

Check your plan: “If you have tax or year-end strategies to implement, now’s the time,” Chapman says. “Logistics for implementing them can take weeks.”

Verify Social Security and pension details: Even if you’re years from filing, ensure that your Social Security records are accurate. Make sure you understand how Social Security might reduce payments starting in about 2033 if Congress doesn't act. If you’re eligible for a pension, ensure that payout options are clear to you.

October: Lock down insurance

Don’t let spooky surprises catch you off guard.

Confirm health coverage. Open enrollment often occurs in the fall, so now is when to finalize your post-retirement plan.

“Reassess your health coverage needs for the last few months before retirement, too,” Spencer says. “If you want to get money into an HSA before retirement, this may be a good opportunity.”

Review other insurance. Ensure long-term care, life and property policies align with your needs.

November: Notify your employer

This might be the easiest or hardest step, depending on your relationship with your company and coworkers.

Give your boss notice. Provide at least 60 days’ notice or longer if required. Use this time to wrap up responsibilities and plan your transition.

Use up benefits. Take advantage of any remaining vacation days, wellness funds or other perks. Alternatively, consider getting paid for any unused PTO you might have accrued.

Consider part-time work doing something you love. If the thought of no earned income makes you nervous, now is the time to think about a high-paying side gig or a transition to a part-time or freelance job that interests you.

December: Finalize and celebrate

You could spend the month debating whether Die Hard is a Christmas movie (it is), but there are better ways to use this time. Now’s the moment to finalize the details so you're ready to pop the champagne by year's end.

Adjust tax withholding. Ensure retirement withdrawals don’t trigger surprise tax bills.

Set up disbursements. Plan your first withdrawals for January.

Celebrate. Whether it’s a trip, a party or simply savoring the satisfaction of achieving your goal, take time to mark this milestone. It can help make the transition smoother.

Even the best plans hit bumps, but with this checklist, you’ll be ready to start 2027 focused on your bucket list instead of your to-do list.

Read More About Retiring Early

- How to Retire Early in Six Steps

- How to Retire at 40

- How to Retire at 50 or 55

- Will Retiring Early Make You Happier? It's Complicated

- Early Retirement Withdrawal Strategies for the Long Haul

- Five Early Retirement Mistakes to Avoid

- The Rule of 55: One Way to Fund Early Retirement

- A Sabbatical May Be a Smarter Move Than Early Retirement

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.