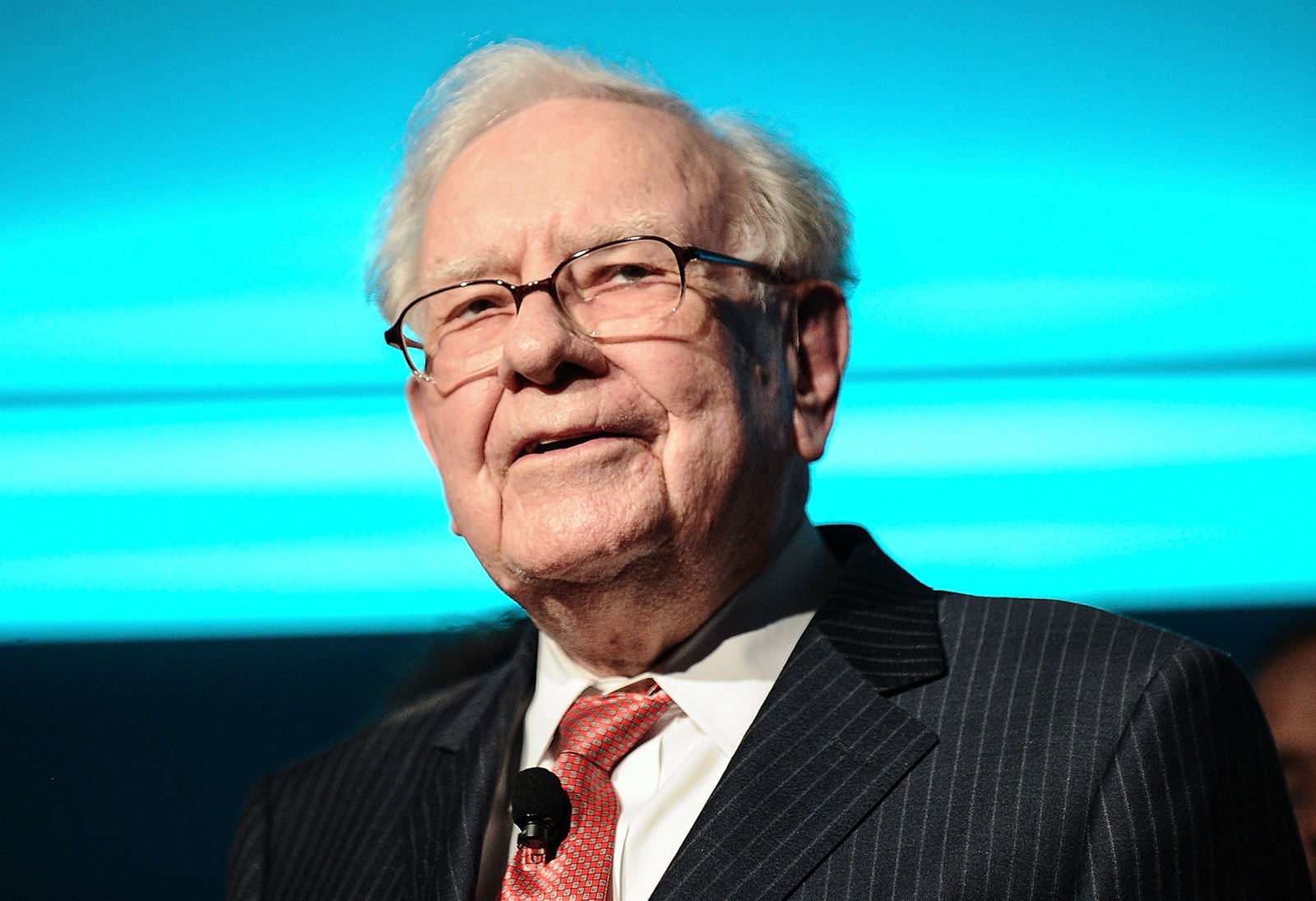

Six Warren Buffett Quotes Every Retiree Should Live By

The 'Oracle of Omaha' knows a thing or two about life, investing and retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to retirement advice, it doesn’t get better than Warren Buffett. The billionaire CEO of Berkshire Hathaway and one of the most successful investors in the world, is known for espousing sage advice on everything from investing to retiring.

He should know a thing or two about it. The 95-year-old has amassed a fortune and has a cult-like following among investors who favor his value approach to investing.

Over the years, Buffett has shared his knowledge and wisdom in his company’s annual shareholder reports, at Berkshire's annual retreats, and during addresses to universities, institutions and think tanks. His advice is too plentiful to list, but here are some of Buffett’s gems that all retirees should live by.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Six Warren Buffett Quotes Retirees Should Live By

#1. “Too often, a vast collection of possessions ends up possessing its owner. The asset I most value, aside from health, is interesting, diverse, and long-standing friends.”

-My Philanthropic Pledge

Retirement doesn’t mean people stop collecting stuff, but Buffett wants us to. Instead of focusing on acquiring new things, we can focus on health and friendships.

The Harvard Longevity Study, the longest-running study of adult life, concluded that good relationships are the strongest predictors of health and happiness, more so than career achievement, exercise, or diet.

#2. "Investors should remember that excitement and expenses are their enemies." -Berkshire Hathaway 2004 Annual Report

This is particularly important for retirees who are in the drawdown phase. Their portfolios should be focused on stable investments, not the hottest stocks or trends. Buffett is warning that excitement can lead to selling low and buying high.

Another risk: expenses. Every dollar a retiree pays in fees is one dollar less that can be used in retirement. That’s why Buffett prefers low-cost index funds and ETFs over actively-managed funds.

#3. "Our favorite holding period is forever."

-Berkshire Hathaway 1988 Annual Report

Know when to hold 'em. Buffett certainly does–forever. With this quote, the "Oracle of Omaha" is advocating for investors, even retirees, to invest for the long term.

Retirement can last twenty-plus years, which means your savings have to continue to grow. The bucket rule of spending is one way to make sure money remains invested and growing.

#4. “Be fearful when others are greedy and greedy when others are fearful”

-Berkshire Hathaway 2004 Annual Report

FOMO is real, especially when it comes to investing. Nobody wants to miss out on the next tech boom or crypto craze. Still, you don’t want to overpay, and that’s what Buffett is warning us about.

That’s particularly true for retirees. They have less time to recover from stock market losses. What's more, when stocks are high, it may be time to take some profits.

On the flip side, Buffett argues that buying opportunities abound when the markets are pessimistic and stocks are depressed. Basically, sell high and buy low.

#5. “When you get to my age, you’ll measure your success in life by how many of the people you want to have love you actually do love you.”

-Terry College of Business at the University of Georgia

For many people, their social and emotional well-being is tied to their work. After all, they've spent decades honing their trades. But that no longer matters in retirement. It's the relationships that are the true measure of success, in Buffett’s opinion.

Creating, fostering, and maintaining those relationships becomes the focus rather than making money. Buffett suggests happiness doesn’t come from how much money you have, but if the people you love love you back.

#6. “Predicting rain doesn’t count, building the ark does."

-Berkshire Hathaway 2001 Annual Shareholder Report

If this year has taught retirees anything, staying the course tends to win out. It was true after the Great Recession in 2008 and 2009, during COVID and the big sell-off in 2024.

With this quote, Buffett is urging retirees to ignore market movements and, instead of trying to time the markets, stick to their long-term plans.

The idea is to build a resilient retirement plan or an ark that will protect your money in downturns so you don't have to worry about it.

Buffett's notable quotables

This is just a small sampling of the words of wisdom Buffett has shared with the world in the years he has been investing.

Known for his modest and frugal approach to life, retirees can learn a thing or two from the legendary “Oracle of Omaha.”

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.