How to Create Retirement Income That’s Driven by Cash Flow

Using a combination of dividends and structured notes in your retirement portfolio can offer liquidity, income and risk mitigation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the U.S. economy teeters on the brink of a recession, you may be wondering how you can create a retirement income portfolio that will stand the test of time. Like many other pre-retirees or retirees, you were probably spooked by the stock market in 2022.

If your retirement income strategy involves yearly withdrawals from your investment portfolio to fund your lifestyle, a stock market decline like this one can negatively impact you. That’s because withdrawals on top of market declines can permanently impair your nest egg. That could mean reducing your lifestyle to avoid running out of money.

One way around this dilemma is to build a portfolio that creates a consistent source of reliable cash flow while allowing for capital appreciation potential. This strategy, coupled with a retirement plan based on a realistic assessment of retirement spending and optimized Social Security claiming, lays a foundation for success.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This article will discuss how an income-driven approach to retirement planning works as well as the benefits of employing it in your retirement income portfolio.

Establishing a Realistic Retirement Income Plan

To create a realistic retirement income plan, there are specific steps that place cash flow at the center of your retirement planning process, while avoiding chasing performance. These three steps are:

- Estimating your specific income needs based on your anticipated retirement lifestyle. This budget—or spending plan—should include non-discretionary and discretionary expenses. You’ll also want to cover other contingencies that arise in retirement, such as inflation, taxes and rising medical costs in later retirement.

- Optimizing Social Security and other sources of income involves determining what sources of income you'll have as well as the best timing and sequence to activate those sources of income.

- Filling the income gap is then very simple. You subtract your anticipated income from the anticipated expenses to obtain that number. While there are many ways to generate this income, one includes an approach based on multiple dividend strategies and structured notes, which will be explained in the example below.

How Cash-Flow-Driven Retirement Planning Works

Let’s say that you’re preparing to retire. You’ve got an income need of $100,000 before taxes, to which a 4% year-over-year inflation rate is applied to account for the inevitable inflation that will occur during your retirement. You and your spouse will claim a Social Security benefit of $64,000 a year. That creates an income gap of $36,000 a year, which needs to be generated from your $1 million tax-deferred IRAs.

There are many ways to generate this $36,000 to fill the income gap. Many advisers use fixed index annuities. Unfortunately, they lack liquidity and frequently carry high fees.

Dividend stocks and structured notes are a viable alternative to a fixed index annuity. Dividends from growing companies with a proven history of increasing their dividend payments over time offer income and dividend growth to offset inflation. You can use structured notes to fill this gap. Structured notes are debt instruments with a derivative component. Available through financial institutions, structured notes are available in a variety of maturities and styles.

The interest rates associated with structured notes fluctuate based on market factors, interest rates and other variables. Equity-linked structured notes such as these are associated with a particular market index, such as the S&P 500, Dow Jones Industrial Average and Nasdaq 100.

Structured notes come in several different styles. These European-style equity-linked structured notes incorporate a feature known as an interest barrier. An interest barrier is a point at which you believe the index you invest in won’t fall beyond within the time period of your investment. These structured notes have a 50% interest barrier.

The notes are designed for investors who seek a contingent interest payment with respect to each review date for which the closing level of a group of indexes — in this case, the S&P 500, the Nasdaq 100 and the Dow Jones Industrial Average — is greater than or equal to 50% of its initial value.

In other words, the interest barrier means that you’ll get your money back plus the interest payments as long as none of those indexes falls by 50% or more. However, if any of the indexes did fall by 50% or more during the period of time that you own the structured note, the value of your investment would fall by whatever market loss occurred — whether that was 50% or more. You would still collect the monthly yield payments.

It’s important to understand that you can negotiate barriers, term lengths and coupon yields that are higher or lower depending on your risk tolerance. Like all investments, structured notes are subject to risk and potential loss. The examples are for illustrative purposes only.

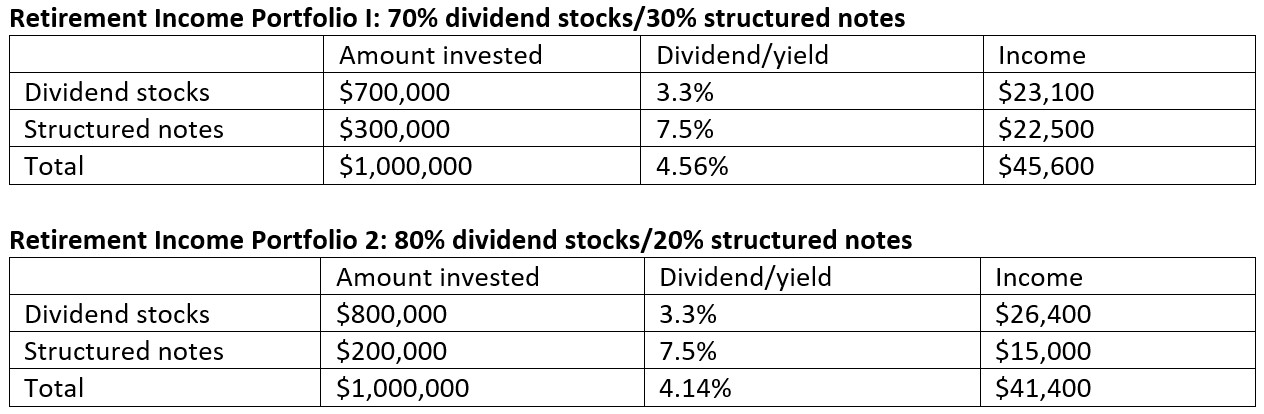

There are a variety of ways to construct the portfolio depending on your risk tolerance and how much you want to invest. Here are two examples:

Benefits and Risk Mitigation

There are many benefits to this approach. These include the ability to avoid selling stocks into a market decline to obtain income to fund your lifestyle. This advantage mitigates what is known as sequence of returns risk, which occurs when withdrawals during a down market further deplete your portfolio, leaving less principal to recover when the market rises again. This situation can leave you with even less principal to draw on in the future, meaning you’ll potentially need to cut back on your lifestyle.

Another point in favor of this type of portfolio is liquidity. In other words, you retain access to your savings, should you need them for other purposes or decide to reposition your portfolio.

A cash-flow-driven approach also helps you deal with market events such as bear markets and extremely volatile markets. That’s because you generate income from dividends and interest produced by your investments, rather than by selling those investments. This gives you time to recover from bear markets that could otherwise negatively impact your retirement.

If you’re preparing for retirement, but not yet retired, you can reinvest the dividends and interest produced by your investments or keep them in cash. When done strategically, such an approach could provide you with either additional investment principal for growth or one or two years of retirement income in cash. Should you decide to keep this income in cash, you could use those funds for your expenses when you initially retire, allowing your investments to continue to appreciate.

Dividends investing also offers a reliable and predictable income stream near and into retirement, solid investment returns and preferential tax treatment. Structured notes offer the opportunity to receive relatively high rates of interest with little risk.

In terms of disadvantages, dividend investing, like other types of stock investing, is subject to the risk that an individual dividend stock or stocks will underperform and that the market itself will decline. Dividend stocks may not perform as well as the rest of the market. In addition, the companies that offer the dividends that you invest in might change their dividend policies. Structured notes are more risky than conventional bonds. If the market declines more than you bet that it will, you could lose principal.

The Bottom Line

Dividend stocks tend to be less risky than non-dividend stocks overall, but in order to make the most of everything they have to offer, you should become familiar with both the pros and cons of dividend investing before attempting to put them to work as part of your investment portfolio strategy. Similarly, you should become familiar with structured notes and their advantages and disadvantages before investing in them.

This type of retirement income portfolio provides ample cash flow, creates plenty of liquidity and income all while mitigating sequence of returns risk and market risk.

Amy Buttell contributed to this article.

Investment advisory services offered by duly registered individuals through CreativeOne Wealth, LLC a Registered Investment Advisor. CreativeOne Wealth, LCC and MOKAN Wealth Management are unaffiliated entities.

This information has been provided by an Investment Adviser Representative and does not necessarily represent the views of the presenting adviser. The statements and opinions expressed are those of the author and are subject to change at any time. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individualized tax, legal, fiduciary, or investment advice. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Hammerschmidt is the founder and CEO of MOKAN Wealth Management, a firm dedicated to helping self-made 401(k) and IRA millionaires keep more and pay less in retirement through a plan-led approach. He developed The Five Seed System™, a framework that connects all key areas of retirement — income, taxes, investments, health care and legacy — into one coordinated plan.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.