Who Should Consider an Annuity (and Who Shouldn’t)

While annuities can be complicated, the decision about whether one is right for you doesn’t have to be. Some folks are clearly better candidates for annuities than others.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You can make your best effort for planning your retirement, but how much of what you are thinking or planning can you actually control?

You can’t control the market, how long you’re going to live, inflation, health care costs, your health care needs, tax law changes, pension or Social Security solvency, economic shifts, government intervention, the list goes on.

There is so much uncertainty in life. Besides a weather forecast, we don’t know what tomorrow brings for any of us (and even the weather forecast is not always reliable).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The reality of what could happen can hit you like a freight train when you begin to think about what you can and can’t control. All this uncertainty surrounding retirement is why annuities are so popular. They are a way to transfer risk over to an insurance company and provide some sense of safety for the future.

This concept is nothing new. We transfer risk to insurance companies for all sorts of things and rely on them to cover losses when things outside of our control occur. Retirement is no different. In fact, retirement income can be a much greater risk than any of these other things we deem worthy of insuring when you think of the amount of money that is at stake.

The risk of running out of money is a real concern for many retirees and is why there is an estimated $2.53 trillion of retirement assets are held inside of annuities, according to Statista.

What is an annuity?

Annuities are issued by insurance companies as a form of insurance, allowing retirees to transfer the risk of running out of money for retirement income or losing money in the stock market away from themselves and onto the insurance company.

There are essentially three types of annuities: variable, fixed index and fixed rate. The variable allows for stock market investing, the fixed rate has a set rate of interest and the index has a proprietary crediting method that is tied to an index.

The fixed rate and index have guarantees against loss of principal, while the variable has a degree of downside risk similar to any other investment. The index and variable have benefits that can be added for a fee that provide the annuity holder a guarantee for income in their retirement.

The income benefits vary from contract to contract and are typically associated with your age. The older you are, the higher the payout percentage can be and it is determined by the proprietary calculations of the insurance company.

One of the misconceptions about income benefits is that the use of this feature is an exchange of the principal for income. That is not true. The income benefits are separate from the account value. However, the income taken through the benefits and any fees applied to the account are deducted from the account value and can deplete the account over time. This is where the insurance kicks in and continues the income beyond the assets in the account. Of course, guarantees of an annuity are based on the financial strength and claims paying ability of the issuer.

Comparatively speaking, if you use the 4% rule as a distribution strategy from your investments, that assumption assumes that based on past performance that your money should last for 30 years. So, even while using an investment, you are still facing the risk of depleting your assets but without the insurance for income. I explain this more in a previous article, My 5-Minute Retirement Plan.

Often there is some confusion between what was just described and the fixed annuity version of this income benefit, called an annuitization. When an immediate fixed annuity is purchased, the amount deposited is essentially a purchase of a pension-like payment for a specified period. However, these two income benefits are not the same and shouldn’t be confused.

As you can see, annuities are complex, and it would take an entire book to outline and compare all of the annuity types. So, while I believe that annuities should be considered for certain situations, you want to make sure you know what you’re getting into and avoid being sold a program that you don’t understand. This shouldn’t be a problem if you work with a fiduciary financial adviser who doesn’t just sell annuities.

Is an Annuity Right for You? How to Tell

I am a strong believer that whether or not you should use an annuity depends on your situation. That is not a popular stance to have, since those who sells annuities suggest that everyone should own an annuity, while those who sell investments tend to badmouth annuities.

These are the fringe of opinions, and there rooted more in a business model than what is necessarily best for the client. My take on this is a little different and more geared toward what someone needs or wants.

Here is how I see it, when it comes to who may be a candidate for annuities:

- Consider saying yes to annuities: If you are someone approaching retirement who wants to grow and protect your retirement income or simply wants to keep some of your money out of the market, protected from downside risk, then look into annuities.

- Consider saying no to annuities: If you don’t fall into one of these two camps, then it is likely that an annuity isn’t the best option for you. There are a few other special uses but that is for another discussion.

Annuities vs. Investments

I believe the best way to accumulate wealth is through capital appreciation over time. The market has more upside potential than most other possibilities outside of owning a business or real estate, which makes it the best option for long-term growth.

As a diversification tool, using income-oriented investments specifically within private markets is a way to not only diversify asset classes but also investment types, which further spreads out your risk and also lessens correlation.

Another addition would be the use of specially designed life insurance contracts. Not only do these designs substitute and replace the need for bonds, they also build tax-free assets without the restrictions of a retirement account. I explain this in more detail in this article: What to Do with Cash in a Low Interest Rate Environment.

With all of this said, I feel insurance agents and investment advisers have not clearly communicated these facts and have confused people about whether buying an annuity is appropriate for them.

The fact is that annuities are not in competition with investments at all, since they are totally different products with different purposes. Both have a place at different times in someone’s life depending on their needs. It is never a one-size-fits all situation, and there are no absolutes one way or another.

Common Myths About Annuities

The four most common myths talked about from listeners to my podcast and followers of my writing about annuities are:

Annuities have lower growth potential. The truth is that some annuities can grow just as competitively as a regularly managed portfolio.

An income annuity will run out of money. The truth is that while, yes, an annuity can run out of money, an investment portfolio carries the same risk of running out of money … only without the insurance.

Annuities are too expensive. The truth is that some annuities can be pretty expensive when you add together all the rider options and contract fees, but what is often not mentioned is that some annuities have no fees at all.

The stock market has historically performed well enough that there is no need for the guarantees of an annuity. The truth is that we don’t know for sure what the future holds, but when people discuss historical performance, I find that their references are often too short-sighted to understand the reality over time. This is where sequence of return risk to a portfolio over a reasonable time frame can help provide perspective.

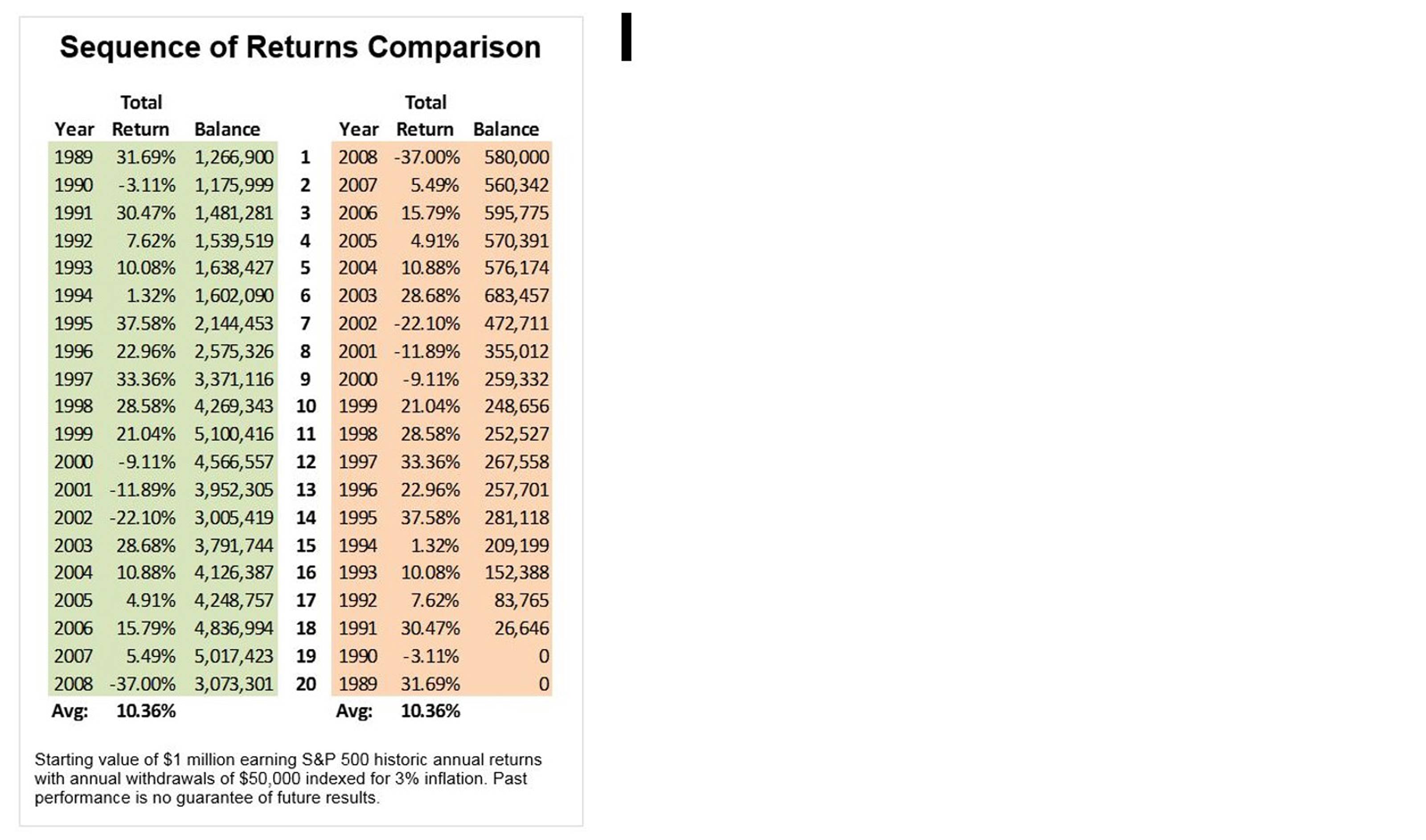

For example, if you were to retire in 1989 and enjoyed the bull run of the 1990s then experienced the reversal of good fortune in the 2000s, you would have seen the best and the worst of the market. It illustrates that markets will move with earnings and headlines, but economic and political cycles are the real drivers of the market and the long-tailed effects are what can propel you or sink you.

Above is an example of a 20-year time frame side by side with the returns reversed to illustrate the significance of what I am explaining. The example assumes a $1 million balance at the beginning with a $50,000 annual withdrawal rate and a 3% inflation factor.

As you can see, the left side grows while the right side runs out of money with the exact same average return. This is sequence of return risk, and it adds to the complexities of retirement income planning while relying on the stock market. It is not the returns that matter as much as the sequence of those returns.

If you consider that we are on the back side of what many experts believe is the end of a long bull run, the question to ask is whether you are on the left side or the right side of this chart?

My purpose behind writing this article is to shed light on the problem of relying on things outside of your control and basing that decision on bad information. Whether you use an annuity or not is less important than you understanding why you’re making the decision.

I will conclude by saying that just like anything you insure, no one loves insurance unless they find themselves using it to replace something valuable that they lost. At that point they are thankful they have it.

If you would like to evaluate the use of an annuity for your retirement planning, you can request a consultation at https://calendly.com/brianskrobonja/initialfuture. Just mention “Kiplinger Annuity Evaluation” for a free report when you schedule.

Securities offered through Kalos Capital Inc., Member FINRA/SIPC/MSRB and investment advisory services offered through Kalos Management Inc., an SEC registered Investment Advisor, both located at 11525 Park Wood Circle, Alpharetta, GA 30005. Kalos Capital Inc. and Kalos Management Inc. do not provide tax or legal advice. Skrobonja Financial Group LLC and Skrobonja Insurance Services LLC are not an affiliate or subsidiary of Kalos Capital Inc. or Kalos Management Inc.

Securities offered only by duly registered individuals through Madison Avenue Securities, LLC. (MAS), Member FINRA & SIPC. Advisory services offered only by duly registered individuals through AE Wealth Management (“AEWM”), a registered investment adviser. Skrobonja Financial Group, LLC, Skrobonja Insurance Services, LLC, AEWM and MAS are not affiliated entities. The article and opinions in this publication are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you consult your accountant, tax or legal adviser with regard to your individual situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Brian Skrobonja is a Chartered Financial Consultant (ChFC®) and Certified Private Wealth Advisor (CPWA®), as well as an author, blogger, podcaster and speaker. He is the founder and president of a St. Louis, Mo.-based wealth management firm. His goal is to help his audience discover the root of their beliefs about money and challenge them to think differently to reach their goals. Brian is the author of three books, and his Common Sense podcast was named one of the Top 10 podcasts by Forbes. In 2017, 2019, 2020, 2021 and 2022, Brian was awarded Best Wealth Manager. In 2021, he received Best in Business and the Future 50 in 2018 from St. Louis Small Business.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.