What to Do with Cash in a Low Interest Rate Environment

Safe places to stash cash are earning next to nothing, so what can you do? Dividend-paying whole life insurance may be one option to consider.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It is no secret that savers are having a difficult time knowing how and where to hold their cash in this low interest rate environment.

Storing money in traditionally “safe” places no longer makes sense and has pushed some into more risky alternatives — such as fixed income securities like bonds and, in some cases even the stock market — in search of yield.

However, while fixed income securities may offer a potentially higher yield than deposit accounts, they are not a “safe” alternative for storing cash since there is potential risk of losing principal due to longevity and interest rate risk.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So the question is, what do you do when traditional methods for storing money are no longer working? There is an answer, but you must first understand two things:

1. The future is looking to be much different than the past

Looking back, we find that interest rates climbed for 40 years (early 1940s – early 1980s) then changed direction and began a steady decline for the next 30 years (early 1980s – late 2000s), when interest rates ultimately hit zero and then flatlined. This declining interest rate environment made for an ideal fixed income bull run that has since faded into a stagnant corner of the market.

2. What worked in the past may not work in the future

Fixed income experienced satisfying returns during a time of declining interest rates. However, this is no longer the case. The fact is that interest rates have no room to the downside left without going negative, and since fixed income investments like bonds have an inverse relationship to interest rates, there is no remaining upside. We have to assume that when interest rates begin rising, fixed income will eventually be negatively impacted.

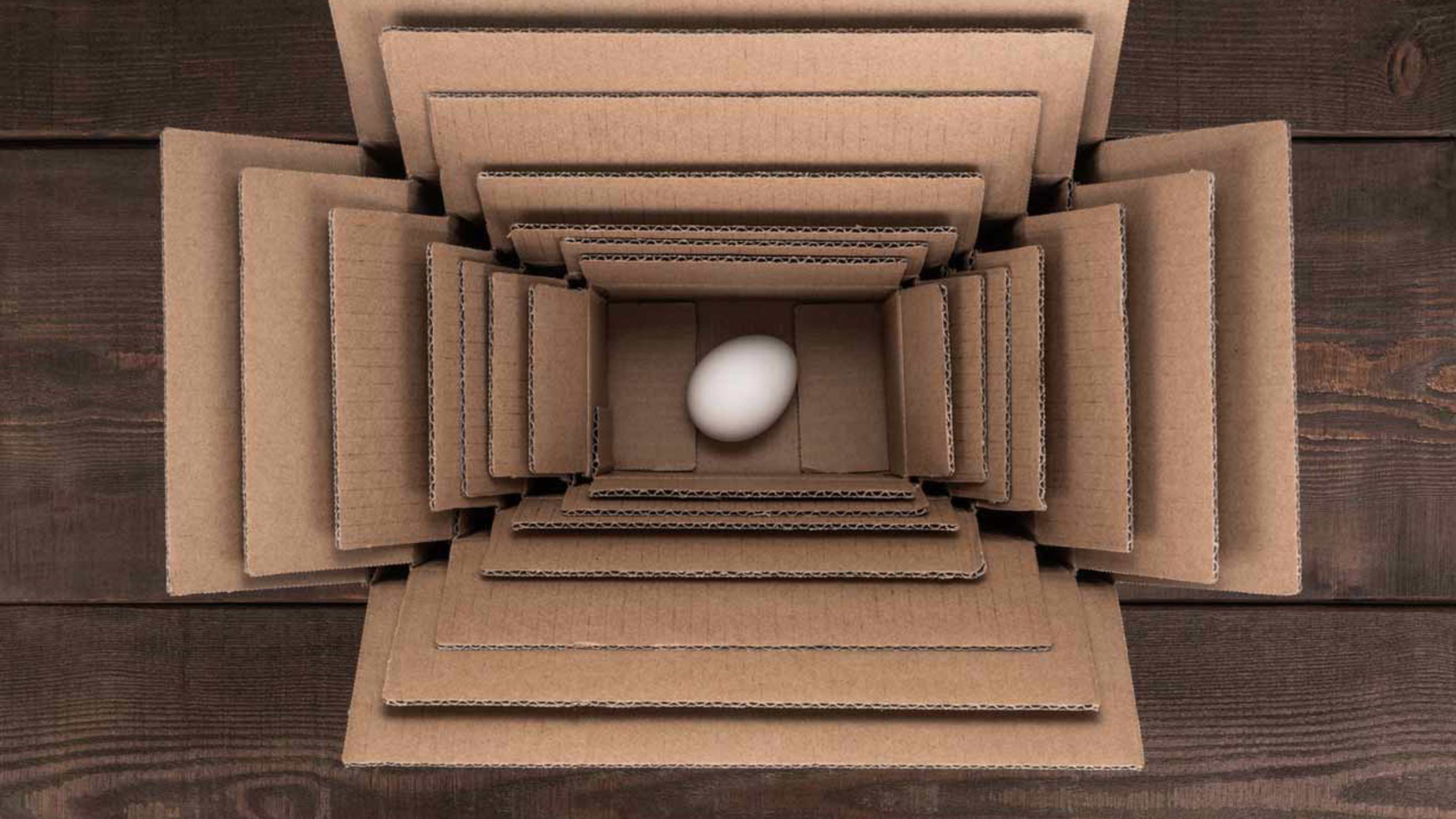

The truth is that it is difficult to see how this will all play out until it is actually happening, but savers need to accept the reality that things are not what they used to be. Savers need to think outside of the box to find ways to protect their cash, take advantage of the current interest rate environment and be positioned for what happens in the future.

What you find outside of the box may surprise you

A few years back a colleague of mine asked me what I thought about the idea of using dividend-paying whole life insurance as a way to get clients higher yields on “safe money” without the interest rate risk of fixed income and without tying money up long term.

At first I dismissed the idea — like some of you may be doing right now — but the gravity of the problem made me curious enough to investigate and test the hypothesis with anticipation of finding a viable solution. Here is what I learned through my research…

Not all policies are created equal

While whole life insurance is a broadly used term for a type of permanent insurance, there are in fact many variations to choose from, leading to much of the confusion that exists about how they work.

What makes a dividend-paying whole life insurance contract different than other forms of “permanent” life insurance is its consistent growth through contract guarantees and dividends and ultimate ownership of the death benefit.

Compare these features with other forms of ”permanent” insurance and you’ll discover that a dividend-paying whole life insurance policy is arguably the only form of insurance that has the characteristics to function as a bank or bond alternative. Hybrids, such as variable, indexed, universal life or even non-participating whole life (non-participating means there are no dividends paid) have design flaws that prevent them from functioning as a viable option, and here is why:

- Variable and index contracts rely on stock market performance in determining their returns. If markets are negative or flat, the contract fees and cost of insurance can cause negative returns, making the performance unpredictable.

- A dividend-paying whole life policy, on the other hand, does not rely on stock market performance. Company guarantees and dividend tables determine the contracts’ growth, both of which are interest rate positive, which means they react favorably to rising interest rates.

- Variable, index and universal life contracts have perpetual contract fees and insurance costs that are deducted from the cash value of the contract. These can erode your equity over time.

- Meanwhile, a whole life policy has a defined funding period (usually modified at seven years) that leads to having ownership of the policy with no future cost or premiums due.

Premiums, costs and fees are the wrong conversation

Some like to debate that the death benefit of a whole life policy is too expensive compared with other forms of life insurance, leading to this paradigm that whole life insurance is a bad deal.

But I want to clarify that this is not about debating whether the death benefit is too expensive … that is the wrong conversation to be having. We are not discussing death benefits and cheap rates for coverage. We are talking about having a place to put money that can generate 3% to 4% net of costs, fees and commissions in a low interest rate environment.

If you get mentally caught up in the insurance debate you will miss the benefit of what is being discussed.

There is no perfect investment or product

The truth is that whether you put money in a bank account, the stock market or an insurance policy, there will be certain things about each of them you do not like. Maybe there is too much risk, too many fees or low returns.

Regardless of the issue, there is no perfect investment — and whole life insurance is no different. These contracts have a couple drawbacks that should be considered:

- There are premium (deposit) requirements for 5-7 years depending on the design.

- Policies have some cash restrictions in the early years that decrease over time allowing more access each year that passes. (In year one, 65%-80% access to cash and increasing to 100% by years 8-10 years depending on the design.)

But knowing this to be true, we have to weigh the negatives with the positives and then consider the alternatives.

Here is a quick comparison of popular options for storing money to highlight the attributes of each of them side by side:

| Row 0 - Cell 0 | Whole Life Insurance | Fixed Income | Deposit Account |

| Consistent Growth | x | x | Row 1 - Cell 3 |

| No Market Risk | x | Row 2 - Cell 2 | x |

| Tax Free Access | x | Row 3 - Cell 2 | Row 3 - Cell 3 |

| Access to Cash | x | Row 4 - Cell 2 | x |

When you evaluate the three options, you find:

- A low interest deposit account paying close to zero.

- A fixed income option paying below 3% with volatility, tax liabilities and with interest rate risk.

- A dividend-paying whole life insurance contract with consistent growth of 3% to 4%, not subject to market risk, tax-free growth and access to cash.

Clearly not a unicorn, but when comparing the attributes of these contracts to deposit and fixed income accounts, whole life insurance does prove to be a “best” option.

Conclusion

I have been in the financial planning business for nearly three decades and have had my own personal roller coaster relationship with life insurance over the years. It wasn’t until I was challenged to set my personal biases and opinions aside to look at the facts that I able to see the possibilities of using specially designed life insurance.

The truth is that most of what you hear or read about whole life insurance are repeated thoughts and opinions from one person to another with little if any testing or vetting of the facts.

Knowing the facts and avoiding too much opinion when making decisions will help you navigate these decisions and lead you to the answer you are looking for.

For more, please see my podcasts: Life Insurance as a Bank Alternative and Life Insurance as an Asset Class.

Securities offered through Kalos Capital, Inc., Member FINRA/SIPC/MSRB and investment advisory services offered through Kalos Management, Inc., an SEC registered Investment Advisor, both located at11525 Park Wood Circle, Alpharetta, GA 30005. Kalos Capital, Inc. and Kalos Management, Inc. do not provide tax or legal advice. Skrobonja Financial Group, LLC and Skrobonja Insurance Services, LLC are not an affiliate or subsidiary of Kalos Capital, Inc. or Kalos Management, Inc.

BUILD Banking™ is a DBA of Skrobonja Insurance Services, LLC

Benefits and guarantees are based on the claims paying ability of the insurance company.

Results may vary. Any descriptions involving life insurance policies and its use as an alternative form of financing or risk management techniques are provided for illustration purposes only, will not apply in all situations, may not be fully indicative of any present or future investments, and may be changed at the discretion of the insurance carrier, General Partner and/or Manager and are not intended to reflect guarantees on securities performance. The term BUILD Banking™, private banking alternatives or specially designed life insurance contracts (SDLIC) are not meant to insinuate that the issuer is creating a real bank for its clients or communicating that life insurance companies are the same as traditional banking institutions. This material is educational in nature and should not be deemed as a solicitation of any specific product or service. BUILD Banking™ is offered by Skrobonja Insurance Services, LLC only and is not offered by Kalos Capital, Inc. nor Kalos Management.

Skrobonja Insurance Services, LLC does not provide tax or legal advice. The opinions and views expressed here are for informational purposes only. Please consult with your tax and/or legal advisor for such guidance.

Income and growth on accumulated cash values is generally taxable only upon withdrawal. Adverse tax consequences may result if withdrawals exceed premiums paid into the policy. Withdrawals or surrenders made during a surrender charge period may be subject to surrender charges and may reduce the ultimate death benefit and cash value. Surrender charges vary by product, issue age, sex, underwriting class and policy year.

Policy loans and withdrawals will reduce available cash values and death benefits and may cause the policy to lapse, or affect guarantees against lapse. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of unrecovered cost basis will be subject to ordinary income tax. Tax laws are subject to change and you should consult a tax professional. Policy loans are not usually subject to income tax unless the policy is classified as a modified endowment contract (MEC) under IRC Section 7702A. However, withdrawals or partial surrenders from a non-MEC policy are subject to income tax to the extent that the amount distributed exceeds the owner’s cost basis in the policy. Loans, withdrawals or partial surrenders from an MEC policy are subject to income tax to the extent of any gains in the policy, and if the payment occurs prior to age 59½, a 10 percent federal additional tax may apply.

A policy change may incur fees and costs, and may also require a medical examination.

Securities offered only by duly registered individuals through Madison Avenue Securities, LLC. (MAS), Member FINRA & SIPC. Advisory services offered only by duly registered individuals through AE Wealth Management (“AEWM”), a registered investment adviser. Skrobonja Financial Group, LLC, Skrobonja Insurance Services, LLC, AEWM and MAS are not affiliated entities. The article and opinions in this publication are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you consult your accountant, tax or legal adviser with regard to your individual situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Brian Skrobonja is a Chartered Financial Consultant (ChFC®) and Certified Private Wealth Advisor (CPWA®), as well as an author, blogger, podcaster and speaker. He is the founder and president of a St. Louis, Mo.-based wealth management firm. His goal is to help his audience discover the root of their beliefs about money and challenge them to think differently to reach their goals. Brian is the author of three books, and his Common Sense podcast was named one of the Top 10 podcasts by Forbes. In 2017, 2019, 2020, 2021 and 2022, Brian was awarded Best Wealth Manager. In 2021, he received Best in Business and the Future 50 in 2018 from St. Louis Small Business.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.