Three Charitable Giving Strategies for High-Net-Worth Individuals

If you have $1 million or more saved for retirement, these charitable giving strategies can help you give efficiently and save on taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When you’ve saved for the past 30 or 40 years, you get to the point where you may have enough money for retirement. The conversation is no longer about running out of money; instead, the discussion shifts to getting the most purpose out of your money. It’s time to start thinking bigger.

At the end of the day, there are only a few things you can do with your money: You can spend it all, leave it for your loved ones or give it to a charity or organization. This article isn’t to try to persuade you which option to choose — that’s your decision.

But I do urge you to start thinking about your plans now. If your goal is to spend every last dollar, then you’d better get to spending. And if you want to leave it to your family, it’s time to start having conversations so they know what to expect instead of being left in the dark.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For those who choose option three — giving money to a charitable organization — it’s also time to start planning how you want to make that happen.

Some giving strategies will allow you to put your money to use for a big purpose while also creating tax-saving opportunities while you’re alive and after you’re gone. Let’s look at three of those strategies.

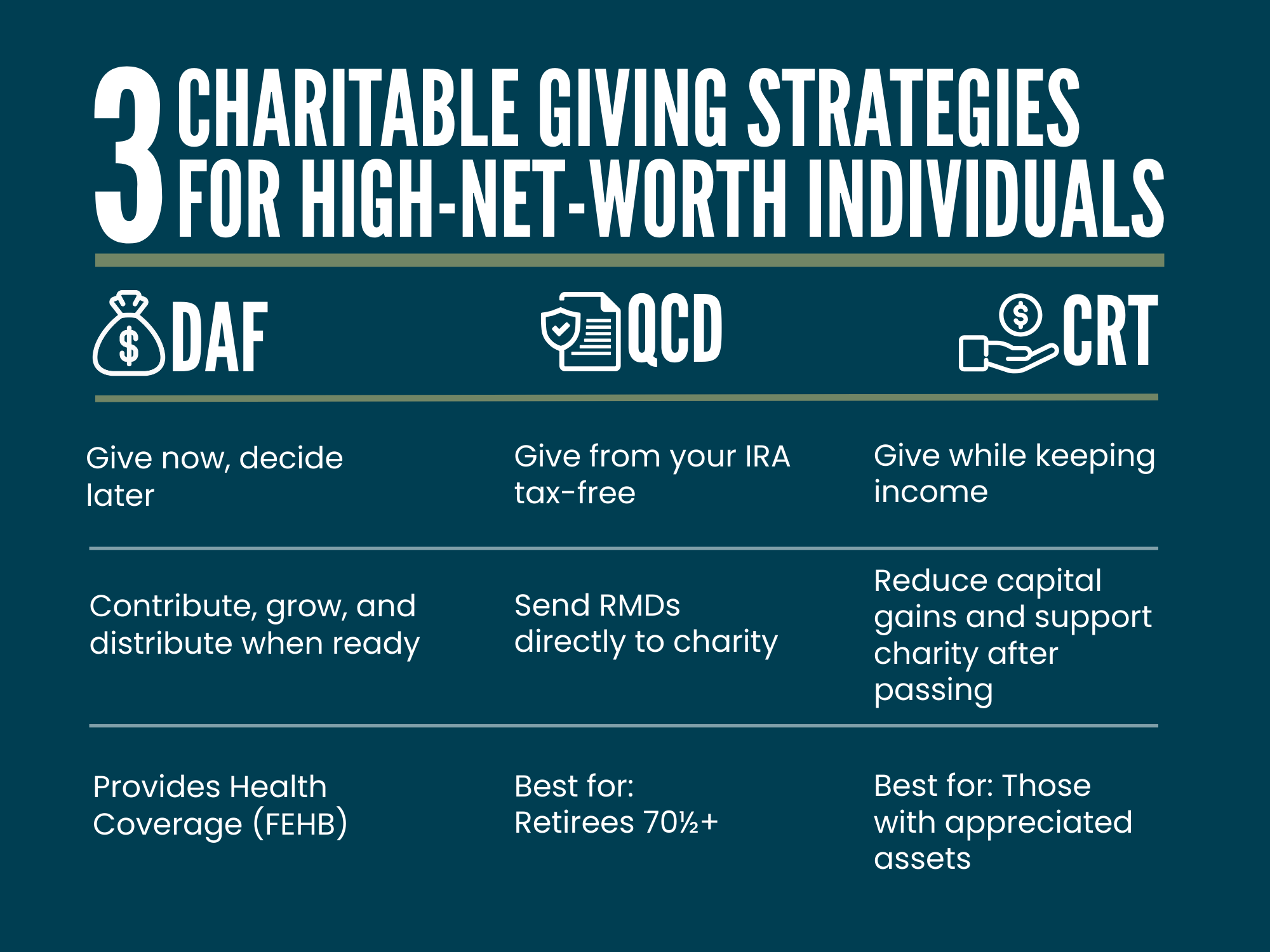

Strategy #1: Donor-advised funds

A donor-advised fund (DAF) allows you to give to charity while receiving tax benefits today. This strategy has risen in popularity over the past few years because of the higher standard deduction.

Nearly 90% of people take the standard deduction because they don’t have enough deductions to itemize, according to the Tax Policy Center.

With a DAF, you can “bunch” your donations into one year and maximize your charitable deductions, allowing you to potentially increase your tax savings.

Joe has built a comprehensive retirement planning company focused on helping clients grow and preserve their wealth. Under his leadership, a team of experienced financial advisers use tax-efficient strategies, investment management, income planning and proactive health care planning to help their clients feel confident in their financial future — and the legacy they leave behind.

Another benefit of this strategy is that the money doesn’t have to be distributed to a charitable organization in the year that the contribution is made. Instead, it can remain in the DAF, giving the assets time to grow. It also provides time for the donor to decide how to distribute the assets.

We use this strategy a lot with clients who are under the age of 70½ (I’ll discuss why that’s the magic age in the next section). For example, let’s say you’re 60 years old and you give $10,000 to charity every year. You may decide that this year you’re going to put 10 years’ worth of giving — $100,000 — into a DAF instead.

This would allow you to itemize your deductions vs. taking the standard deduction. In addition, your donation consists of appreciated stock. Now you can offset your capital gains, further reducing your tax bill for the year in which you made the donation.

One thing to note is that contributions to a DAF are irrevocable and you lose access to the assets once the contribution is made. But you have 100% control over how and to whom the assets are distributed.

Strategy #2: Qualified charitable distribution

The second strategy worth considering is called a qualified charitable distribution (QCD). Individuals who have reached age 70½ can send money from an IRA directly to a charity tax-free.

Why is this helpful? If you own an IRA, the IRS says you must start taking required minimum distributions (RMDs) from your account after you turn age 73 or 75, depending on your birth year.

RMDs are counted as taxable income, leading to a higher tax bill in the year they’re taken. Sending your RMDs directly to a charity reduces your taxable income while putting your money to work for a higher purpose.

If you’re counting on distributions from your IRA to cover your monthly expenses and maintain your lifestyle in retirement, this strategy won’t be for you. It works best for those who have enough income coming from other sources and want to find additional ways to potentially offset some of their taxable income.

Strategy #3: Charitable remainder trust

A charitable remainder trust (CRT) might be a good fit for those who have highly appreciated assets and wish to reduce their tax bill today but leave their remaining assets to a charity after they pass. The appreciated assets might include a business, real estate, stock or other property that has grown significantly over the years.

This is a complicated strategy and requires assistance from an estate planning attorney. I recommend working with a financial planning professional who offers comprehensive financial planning, including estate planning.

They typically partner with an experienced estate planning attorney to make sure the trust is set up correctly and that nothing gets missed.

If you are charitably minded and a diligent saver, there are several giving strategies that might be the right fit for you. I recommend working with someone who shares your giving values and understands your unique situation. One of the credentials I have is the Certified Kingdom Advisor® (CKA®).

With this credential, I can give financial advice from a biblical worldview and follow principles to make an impact for the kingdom of God. I believe generosity doesn’t just help others, but it can also make us feel more fulfilled and help us find our sense of purpose. Happy giving!

Related Content

- Do You Have the Five Pillars of Retirement Planning in Place?

- Estate Planning: Who Needs a Trust and Who Doesn’t?

- Will You Pay Higher Taxes in Retirement?

- Do You Have at Least $1 Million in Tax-Deferred Investments?

- Five Financial Strategies for High-Net-Worth Individuals

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

The Best Short-Term CD for Your Cash in 2026

The Best Short-Term CD for Your Cash in 2026This strategy can help you earn thousands in months.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.