Estate Planning: Who Needs a Trust and Who Doesn’t?

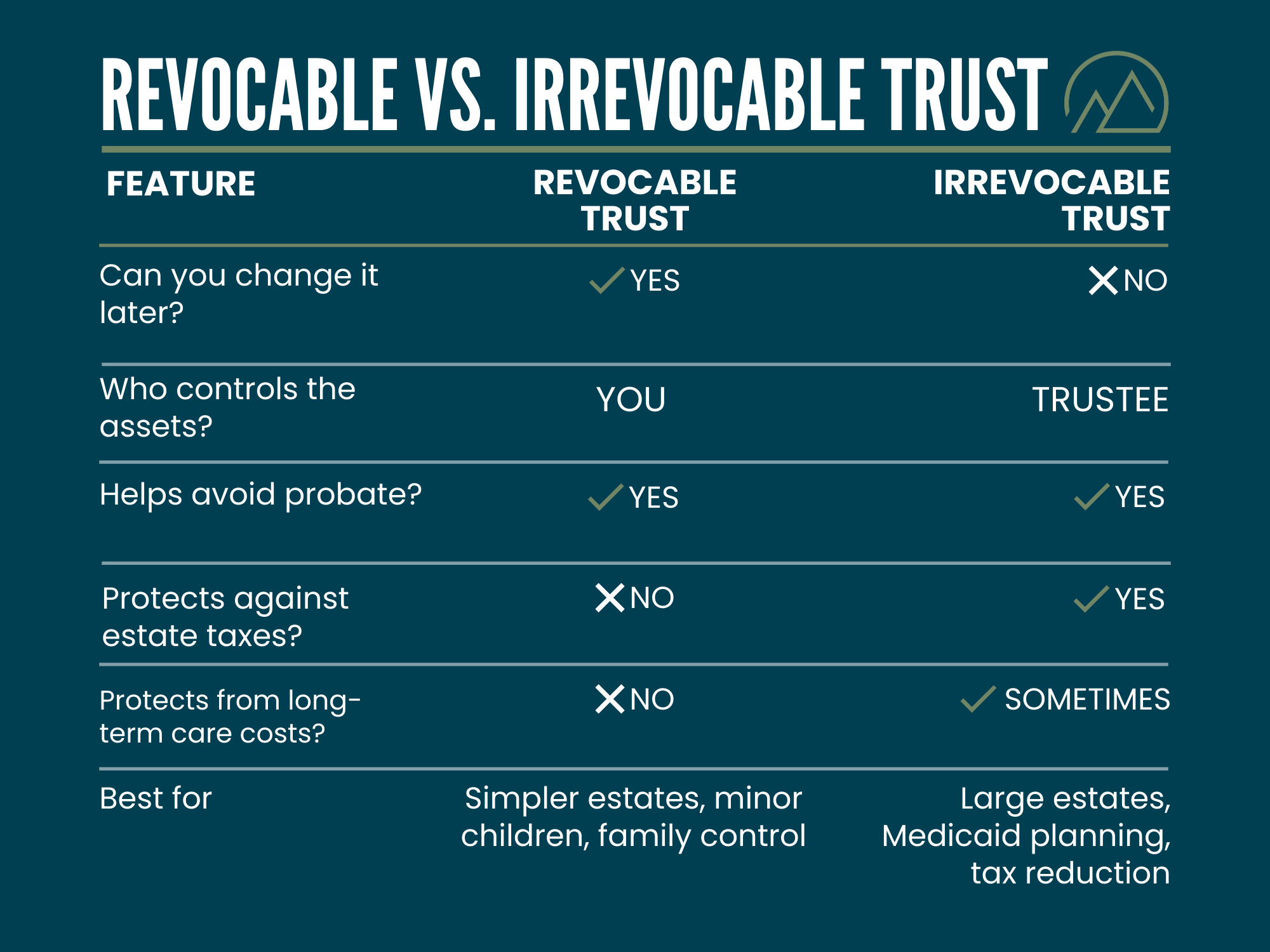

Knowing the differences between a revocable trust and an irrevocable trust can help you decide if you need one and, if you do, which kind.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Why is there so much confusion around trusts? In my opinion, it is because they are often used the wrong way and not used for the right reasons.

We had some clients whose attorney tried to get them to do a trust they did not need. Fortunately for them, our client had a reliable guide to step in and tell them they did not need to spend the money to get a trust. So how do you know if you need a trust? Let's dive in.

There are two types of trusts:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Revocable trust

This is the simpler of the two types of trusts. There are some great uses for it, but we see this type of trust misused often because most people do not need it (especially our clients who are in or near retirement).

Most of the time, if they do not have a complex situation, basic estate planning documents will suffice, and in turn be more affordable than establishing a trust.

This type of trust could be good in certain circumstances, such as when you:

- Don't trust your kids. Some may laugh at this, but there are certainly times when this can be the case. With this trust, you can limit how much your children are able to spend each year. We had a client who allowed her kids to take out only $20,000 per year from her estate. We also had a client take a more extreme approach and didn’t allow her children to touch the money until they were 60. At least they will have a great retirement!

- Want to keep your money in your bloodline in case, for example, a divorce happens.

- Have minor children (under 18). In this case, a trust can be important to ensure they have detailed plans for using the funds.

2. Irrevocable trust

You should consider using this type of trust if you are looking to protect against long-term care costs and estate taxes. But understand, just like the revocable trust, not every client needs this.

Who does not need this trust? Someone who has:

- A large net worth and can self-insure against long-term care expenses.

- No legacy goals of leaving behind assets to kids or a beneficiary.

- The majority of their wealth in IRAs.

Who might benefit from this trust?

- Those who may need long-term care protection may need to consider this type of trust. We commonly see irrevocable trusts used in times of Medicaid planning, which is a way to shield your assets from being accessed if you were to need them for long-term care events. The idea is that if you move the assets out of your estate, then they are safe. Keep in mind that you must have moved the assets out for a period of time in order for them not to be counted for Medicaid purposes. Here in Ohio, that is five years, but it could be different depending on the state you are in.

- This type of trust is also used for estate planning. This is not a concern for many people right now, considering that estate taxes don’t kick in until the value reaches almost $13 million. However, even if you do not have that much wealth, I would still encourage you to start considering planning for estate taxes. Why? Because the estate tax limit will get cut in half in 2026 when the Tax Cuts and Jobs Act expires. The estate tax has been well under $1 million in the past. And remember, our country is more than $30 trillion in debt. Do you think they will find ways to get hardworking and smart people to pay more taxes? The way estate taxes work is that any money you have over the limit could be taxed at a 37% tax rate, leaving almost as much money to Uncle Sam as your beneficiaries. The good news? You can find ways to avoid having Uncle Sam as a beneficiary when it comes to estate taxes. This could involve using a tool like an irrevocable trust.

Remember that most irrevocable trusts do not allow you to retain ownership of the assets you put into it. However, if you structure it the right way, then you could still be able to access it and benefit from using it.

Pro tip: Be aware of listing your trust as an IRA beneficiary.

If you pass away and leave your IRA to a trust, then you would pay "trust rates," which could be as much as 37%. Instead, if you leave your IRA to a person rather than a trust, your beneficiary would pay only federal income tax rates, which for most is 12% to 24%.

In the end, we would advise working with a retirement planning team who works closely with an attorney. Together, they can make sure you get what you need and get it done the right way so that you do not have to pay more taxes and fees than you need to.

Related Content

- To Avoid Probate, Use Trusts for Estate Planning

- Eight Types of Trusts for Owners of High-Net-Worth Estates

- Four Reasons Retirees Need a (Revocable) Trust

- Four Reasons You Don’t Need a (Revocable) Trust

- Do You Have the Five Pillars of Retirement Planning in Place?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.