Use the 'Newton Rule' to Grow Your 401(k) Retirement Savings

Harnessing Sir Isaac Newton's rule in retirement can boost your 401(k) savings while you chill.

Ellen B. Kennedy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

You don't need to be a physicist to know that Sir Isaac Newton's first law of motion is: "Objects at rest tend to stay at rest unless acted upon."

This is Newton's description of inertia — and it's also a law referenced recently at the Center for Retirement Research, by research fellow, Geoffrey T. Sanzenbacher, who is also a professor of economics at Boston College. Sanzenbacher unpacked recent research on how inertia can affect retirement savings efforts.

Ultimately, he found that inertia can both help and hurt your efforts in saving for your future — it all depends on the way you're managing your accounts.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The 'Newton rule' shows that inertia can help you save for retirement

As the Center for Retirement Research explains, inertia can either work for you or against you. Because people tend to stick to the status quo, employers are trying to help workers by automating best practices, detailed below.

| Header Cell - Column 0 | For You (Best Practices) | Against You |

|---|---|---|

Scenario 1 | Your employer auto-enrolls new workers in company 401(k) plans. | You're not auto-enrolled in a 401(k), and you don't make the effort to enroll. |

Scenario 2 | Your plan automatically increases contributions over time. | You're auto-enrolled in a 401(k) with a low contribution level, and you don't make changes. |

Scenario 3 | Your employer automatically enrolls plan participants in target date funds so their asset allocation adjusts appropriately over time. | You're auto-enrolled in a 401(k) with the wrong investments or you don't choose target date funds. |

The key is for the default, or the easy option, to be the one that sets people up for success in retirement, rather than leaving them to fail.

If your employer has followed these best practices, you can probably sit back and relax. If not, read on, because maybe it's in your interest to stay on the couch.

Inertia might help you avoid investing mistakes

The Center for Retirement Research identified another way that inertia can help bolster your retirement savings. It saves people from their instinct to become overly conservative in their investments as they age and approach retirement.

Becoming more risk-averse as you get nearer to your retirement years can be a good thing. You don't want to have your entire portfolio in stocks (or equities) when you need to start making withdrawals in a year or two. That kind of asset allocation could backfire in the event of a market crash, forcing you to withdraw money at a bad time and lock in losses — a retirement fumble known as the sequence of returns risk.

However, research into how older savers view equity investing and whether they act on their beliefs revealed that retirement savers often failed to properly gauge market risk. In a survey of U.S. adults ages 48 to 78 with $100,000 or more in investable assets, researchers found that these individuals were often overly pessimistic about the stock market. They would choose a far more conservative portfolio than they should.

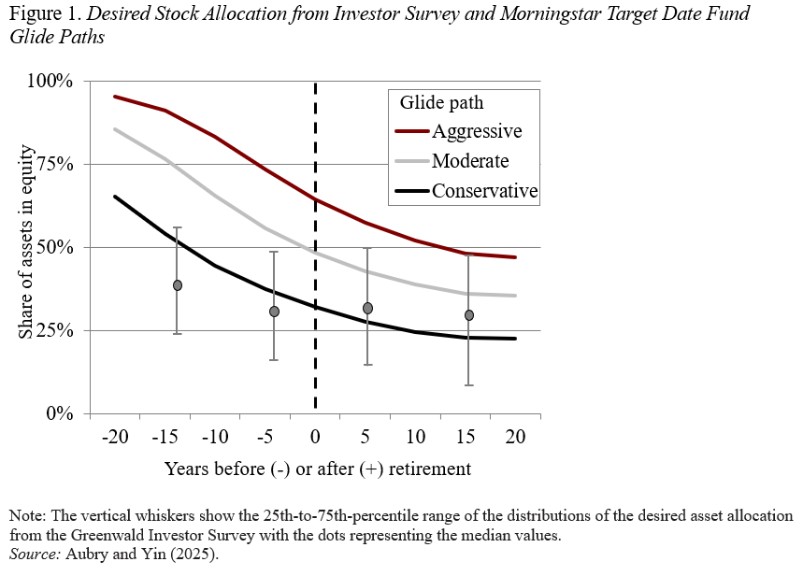

The chart below shows three commonly recommended glide paths for target date funds for the 20 years before and after retirement: aggressive, moderate and conservative.

"Glide paths" are set formulas for how a portfolio will gradually reduce the percentage of investments in stocks and increase the percentage of safer investments over time. Vertical lines show that people want to invest in a lower percentage of stocks than the glide paths recommend, especially early in their careers.

As Sanzenbacher pointed out, if older investors followed their desired investment asset allocation plan based on their level of risk aversion, their investment mix would be below the most conservative recommended glide path. This is true even among pre-retirees who are relatively aggressive in their preferred investment strategy compared with older investors.

Sanzenbacher said that "If these savers acted like they said that they would like to, their pessimism would be causing them to give up valuable returns."

The good news, however, is that most people don't adjust their asset allocation to reflect their risk tolerance. In fact, while participants on the whole said they wanted 37% of their retirement assets in equities, the average they actually had invested was higher and was much closer to the recommended moderate glide path.

Pre-retirees, in other words, benefited by not adjusting their portfolios to their preferred asset allocation — and that's most likely because of inertia. Since many of the plan participants were invested in target date funds, they stayed in those funds with the appropriate investment mix instead of switching to the more conservative investments they claimed they preferred.

A lack of action saved these investors from their own fear of the market and allowed them to remain appropriately invested.

Can — and should — you make inertia work for you?

Doing nothing can be helpful in many ways in retirement investing.

If you set up large automatic 401(k) contributions early and make auto-increases the default, you'll be more likely to hit your investment goals.

You're also less likely to panic sell if the market starts to decline. Since investing for the long-term is one of the best and most proven strategies for growing wealth, you're probably more likely than very active investors to win in the market.

At the same time, a target date fund does come with higher fees than many other investments and isn't necessarily as effective in helping you to achieve your retirement targets as a personalized plan would be.

Ultimately, it comes down to how confident you are that you can make the right moves, rather than acting based on fear, emotion or short-term thinking.

If you're working with a financial planner or investment adviser to refine your goals, optimize your finances, and select the right investments, being more active in growing your retirement savings could leave you better off. If you're acting on your own and making choices based on emotion, then inertia or inaction could serve you better.

Before you decide whether to act upon your retirement savings, carefully consider whether the moves you're making are better than no moves at all.

Read More Retirement Rules

- The 'Me First' Rule of Retirement Spending

- The Rule of the Shrinking Dollar in Retirement

- The '120 Minus You Rule' of Retirement

- The Retirement Rule of $1 More

- The 'First Year of Retirement' Rule

- The Y Rule of Retirement: Why Men Need to Plan Differently

- The Rule of 240 Paychecks in Retirement

- The 'Die With Zero' Rule of Retirement

- The '8-Year Rule of Social Security' — A Retirement Rule

- The Kevin Bacon Rule of Retirement

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.When your heart says "yes" but your wallet says "no," there is still a way forward. Here's what financial pros say.

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.