Is Inflation Crimping Your Holiday Travel? Join the Crowd

Bankrate survey says 83% of holiday travelers are changing their plans due to inflation. Here's how to save.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Flight delays, grumpy kids and harsh weather can buzzkill the holidays. Add inflation to the travel equation, and most of us find new ways to visit family or travel abroad, at least according to a new Bankrate survey. More than four in five travelers, or 83%, are changing their holiday travel plans this year to save money, according to the survey. And almost a quarter of respondents are racking up travel expenses on credit cards or through a buy now pay later service.

“Although inflation has come down significantly, it continues to strain holiday travelers in a big way,” says Ted Rossman, Bankrate Senior Industry Analyst. “The cumulative effect is the problem. Multiple years of paying more for everything from housing to food, gas and discretionary items has eroded savings and increased debt. And prices are still rising; they’re just rising more slowly.”

But you don't have to embrace your inner Grinch or risk getting into a debt trap, as there are measures you can take to cut costs and still travel.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Holiday travel strategies

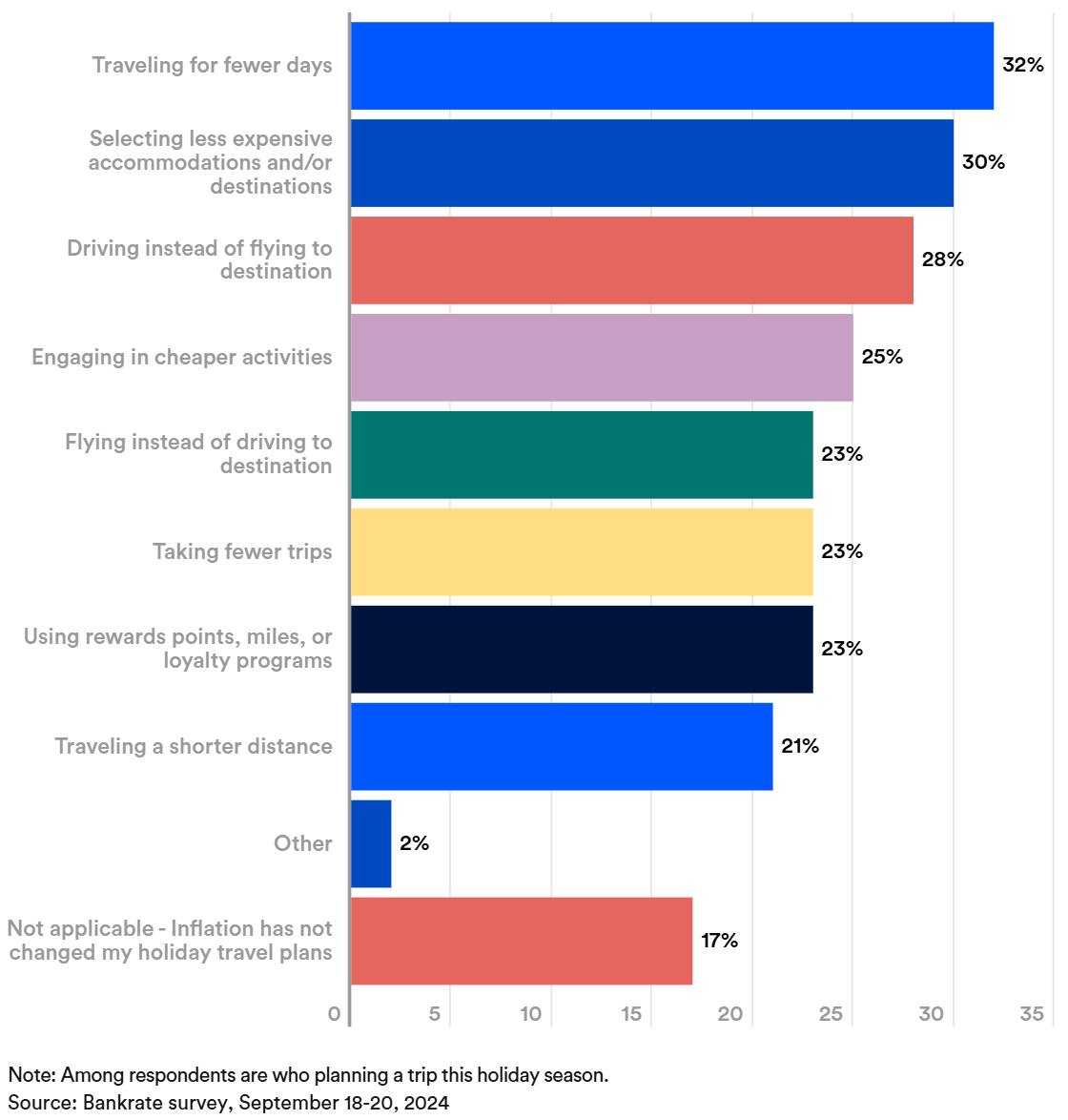

The survey showed Americans are employing several strategies to save money on holiday travel. Some are traveling a shorter distance, for a shorter time or choosing lower-cost accommodations and activities. More than a quarter are driving instead of flying. Meanwhile, 17% of lucky holiday travelers say inflation hasn’t changed their travel plans.

Here's how the respondents answered when Bankrate asked: Which, if any, of the following changes are you making to your holiday travel plans due to inflation/rising prices?

Inflation comes even for the wealthy

Among households earning less than $100,000 annually, 86% are changing their holiday travel plans due to inflation. Surprisingly, 77% of respondents with annual incomes above $100,000 also seek ways to save money.

“Many travelers are cutting corners by spending fewer days away from home, selecting cheaper accommodations, and driving instead of flying,” Rossman observed. “They don’t want to skip the trip entirely but are willing to make adjustments that lower the cost.”

Baby boomers are the least likely to change their travel plans due to inflation (72%). This could be because older generations may have more income, fewer travel obligations, no kids to bring along, or a combination of factors. By contrast, millennials (86%) are most likely to have their travel plans affected by inflation. Gen Zers and Gen Xers follow closely behind at 84% and 83%, respectively.

How much will holiday travel cost?

Holiday travelers face sticker shock when booking their trips. Those who plan to travel for Thanksgiving expect to pay an average of $925 for airfare and $825 for accommodations, according to the study. The costs go up for December travel when people expect to pay an average of $1,165 for airfare and $950 for hotel or short-term rentals.

More than one in four holiday travelers will take on debt

Unfortunately, traveling this holiday season can really deplete your holiday budget. Credit cards are expected to be the most popular payment method for holiday travel (59%). That includes 37% of holiday travelers who plan to pay off the balance in full and 22% who plan to carry a credit card balance.

Almost half of holiday travelers plan to use a debit card or cash, while 24% plan to use points or miles from rewards credit cards. Overall, the survey showed that 29% plan to take on debt over the holidays.

A few ways to stretch your holiday dollars

No matter your travel plans or how you plan to pay, here are a few tips to make sure there’s some leftover money to spread the joy of the holidays.

- Airline travel. When searching for airline flights over the holidays, consider booking on the cheapest day — Sunday — and traveling on a weekday. Set up price alerts from Hopper and Google Flights’ tracker to ensure you find the best prices. Do a quick inventory of your travel credit card points or miles to see if you have enough saved for your trip. Remember that you can usually earn extra rewards for travel purchases made through a travel card issuer’s portal or with transfer partners.

- Driving. If you plan to drive rather than fly, pack your own snacks and meals. Stay with a friend or family member instead of at an expensive hotel. A credit card that earns cash back on gas or EV charging can also be an excellent addition to your wallet.

- Accommodations. If staying with friends and family is out of the question, using one of the most lucrative hotel rewards credit cards to pay for your stay can get you points toward future stays and include hotel perks like free nights, elite status, complimentary breakfast and late checkouts.

- Paying with plastic. If you’re among the 22% of holiday travelers who plan to use credit card debt to pay for your trip, remember that the average interest rate on most credit cards still tops 20%. So plan to pay off your travel expenses or at least how you’ll pay them down over time.

Rossman adds, “Despite economic worries, people are still traveling. They’re traveling differently, though. They don’t want to skip the trip entirely but are willing to make adjustments that lower the cost.”

Bottom line

Holidays are for making merry, but high costs and inflation can have you singing the blues instead. If you're one of the 83% who are changing your holiday travel plans this year to save money, you can still have a festive season without starting the New Year in debt, much less a world of regret. Learning to be frugal over the holidays takes a little effort, and expectations may need to be adjusted to keep your spending in check. Even so, instead of buying into the idea that you have to overspend, it is possible to celebrate the holidays on a budget. With the money you save, you may even have a bit left over to pad your gift-giving budget.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.