Home Values to Rise 6.5% Over Next Year, Zillow Report Says

Home values have bottomed out, says Zillow, and home sales will decrease amid a tight market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

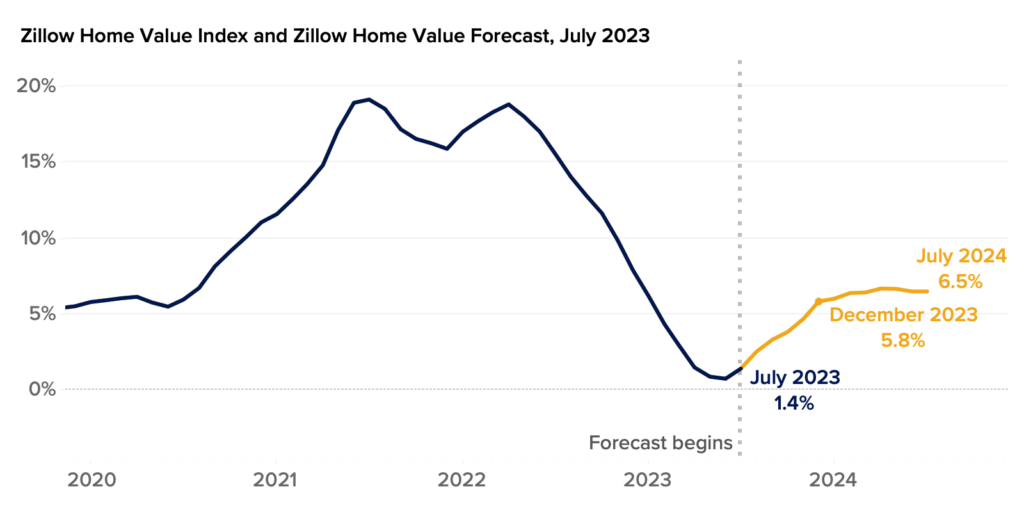

Just when U.S. home values seem impossibly unaffordable, Zillow revised its forecast to reflect even higher prices to come. The company predicted that its national Zillow Home Value Index (ZHVI) will jump 6.5% from July 2023 through July 2024.

Home values surge in a tight market

Zillow credits several factors for driving home price growth over the next year. First, rising mortgage rates increase monthly payments for would-be homeowners in a market that has adapted to low mortgage rates. The average 30-year fixed rate mortgage reached 7.23% last week, the highest rate since the year 2000, according to data from Freddie Mac. The Federal Reserve Board meets again on September 20, and mortgage rates could hold steady or decline slightly if the Fed decides against another rate hike. Fed Chairman Jerome Powell, however, has indicated that he is prepared to raise rates if needed. The central bank raised the fed funds rate, a key overnight bank lending rate, by a quarter-percentage point, to a range of 5.25% to 5.50% as of the last Fed meeting in July.

It’s no secret that tight inventory is also driving up home values. Zillow forecasts that 2023 home sales will hit 4.2 million, representing a 17% decline from 2022. And when compared to pre-pandemic inventory, the picture looks even more discouraging for home buyers. This lack of available housing translates into faster sales; homes for sale in July 2023 went under contract in only 12 days, compared to about 22 days in 2019.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Forecasts can be wrong, of course. In fact, Kiplinger’s economic forecasting team is more bearish than Zillow, predicting that high mortgage rates will drive housing price declines over the next few months.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How to Budget as a Couple Without Fighting About Money

How to Budget as a Couple Without Fighting About MoneyThese tips will help you get on the same page to achieve your financial goals, with minimal drama.

-

Is the Housing Market's 'Lock-In Effect' Finally Starting to Ease?

Is the Housing Market's 'Lock-In Effect' Finally Starting to Ease?As mortgage rates stabilize and fewer owners hold ultra-low loans, the lock-in effect may be losing its grip.

-

Mortgage Protection Insurance: What It Covers and When It Makes Sense

Mortgage Protection Insurance: What It Covers and When It Makes SenseHow mortgage protection insurance works, what it costs, and when it’s actually useful in a financial plan.

-

What to Watch for When Refinancing Your Home Mortgage

What to Watch for When Refinancing Your Home MortgageA smart refinance can save you thousands, but only if you know how to avoid costly pitfalls, calculate true savings and choose the right loan for your goals.

-

Builders Are Offering Big Mortgage Incentives — What Homebuyers Should Watch For

Builders Are Offering Big Mortgage Incentives — What Homebuyers Should Watch ForBuilder credits and below-market mortgage rates can ease affordability pressures, but the savings often come with trade-offs buyers should understand before signing.

-

Trump Signals Plan to Ban Institutional Investors From Buying Single-Family Homes

Trump Signals Plan to Ban Institutional Investors From Buying Single-Family HomesThe president says the move could improve housing affordability. Here’s what the data show about investor ownership, recent buying trends and what it could mean for homebuyers.

-

How Much Income You Really Need to Afford a $500,000 Home

How Much Income You Really Need to Afford a $500,000 HomeAs home prices increase, the income needed for a house is also climbing. We break down what you need to earn to afford a $500,000 home.

-

How Much Would a $50,000 HELOC Cost Per Month?

How Much Would a $50,000 HELOC Cost Per Month?Thinking about tapping your home’s equity? Here’s what a $50,000 HELOC might cost you each month based on current rates.